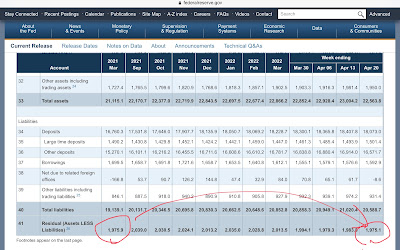

Fed interest rate policy reducing prices of banking system HQLA to a new 1 year low… hence bank capital (A-L) is being degraded as liabilities remain constant…. equity index prices back to same levels in consonance as the sum of all asset values are regulated as a fixed multiple of bank capital …Fed rate policy is working to reduce prices of bonds and equities and other financial assets…

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

Fed interest rate policy reducing prices of banking system HQLA to a new 1 year low… hence bank capital (A-L) is being degraded as liabilities remain constant…. equity index prices back to same levels in consonance as the sum of all asset values are regulated as a fixed multiple of bank capital …

Fed rate policy is working to reduce prices of bonds and equities and other financial assets…