Fed rate increases crushing NPV of system regulatory capital:They are doing the same thing they did in September 2008 ie putting their own Depositories and Dealers into violation of their own regulatory capital requirements… system is again getting close to failure mode:Bank of America, $BAC, is worried about bond market volatility and says risk of a 'crash' is rising, per CNBC.— unusual_whales (@unusual_whales) October 14, 2022 Why is the Swiss National Bank drawing BILLION USD (last two days) from the swap line with the U.S. FED?! #CreditSuisse @SNB_BNS #Trouble— ??Kyle Bass?? (@Jkylebass) October 14, 2022 Treasury might have to intervene directly again:THE US TREASURY HAS ASKED MAJOR BANKS WHETHER IT SHOULD BUY BACK SOME US GOVERNMENT BONDS IN ORDER TO IMPROVE MARKET LIQUIDITY.—

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

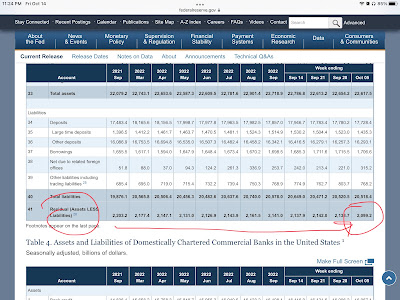

Fed rate increases crushing NPV of system regulatory capital:

They are doing the same thing they did in September 2008 ie putting their own Depositories and Dealers into violation of their own regulatory capital requirements… system is again getting close to failure mode:

Bank of America, $BAC, is worried about bond market volatility and says risk of a 'crash' is rising, per CNBC.

— unusual_whales (@unusual_whales) October 14, 2022

Why is the Swiss National Bank drawing $10 BILLION USD (last two days) from the swap line with the U.S. FED?! #CreditSuisse @SNB_BNS #Trouble

— ??Kyle Bass?? (@Jkylebass) October 14, 2022

Treasury might have to intervene directly again:

THE US TREASURY HAS ASKED MAJOR BANKS WHETHER IT SHOULD BUY BACK SOME US GOVERNMENT BONDS IN ORDER TO IMPROVE MARKET LIQUIDITY.

— Breaking Market News ⚡️ (@financialjuice) October 14, 2022