You knew this guy was going to have to change his view…#Zoltan pic.twitter.com/Izos8J7Wit— Randy Woodward (@TheBondFreak) January 12, 2022 This part here:RRP % has to be at or ABOVE any alternative to avoid a catastrophic flow of reserve balances into Depositories…. That’s why access to it had to be expanded in the first place…Fed gets a ? (so far)…But he says they are doing it to provide “structural support” (figurative language) to Money Market funds… they are doing it to avoid creating a financial incentive for current RRP .5T of system reserve balances to flow into Depository asset accounts which would crash the whole thing again… like they did in September 2008 and March 2020…Accordingly it would be best if Fed were to as quickly as possible reduce system reserve balances to a

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

You knew this guy was going to have to change his view…

#Zoltan pic.twitter.com/Izos8J7Wit

— Randy Woodward (@TheBondFreak) January 12, 2022

This part here:

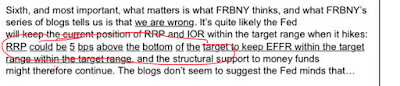

RRP % has to be at or ABOVE any alternative to avoid a catastrophic flow of reserve balances into Depositories…. That’s why access to it had to be expanded in the first place…

Fed gets a ? (so far)…

But he says they are doing it to provide “structural support” (figurative language) to Money Market funds… they are doing it to avoid creating a financial incentive for current RRP $1.5T of system reserve balances to flow into Depository asset accounts which would crash the whole thing again… like they did in September 2008 and March 2020…

Accordingly it would be best if Fed were to as quickly as possible reduce system reserve balances to a point where this Rube Goldberg RRP account goes to zero… they need to get on with “QT” (to them) as quickly as possible… the monetarist inflationista dummies should applaud this…