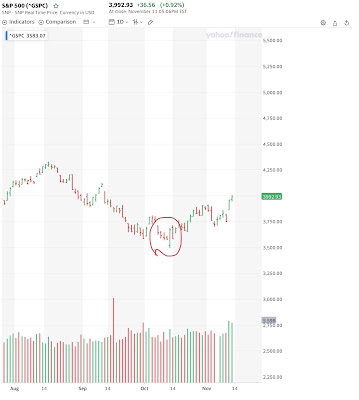

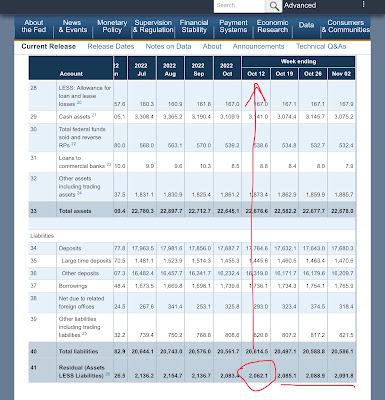

This bottom on October 12th might be where the increase in government interest income overcame the reduction in NPVs due to the risk free rate increase itself… This corresponds with the recent bottom in Depository system Residual (Assets - Liabilities ie implied Capital) here:Just depends on the first derivative of Fed policy rate increases… if they maintain current plan of reducing the magnitude of periodic increases then this bottom will probably stand and we’re in the clear from these morons…

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

This bottom on October 12th might be where the increase in government interest income overcame the reduction in NPVs due to the risk free rate increase itself…

This corresponds with the recent bottom in Depository system Residual (Assets - Liabilities ie implied Capital) here:

Just depends on the first derivative of Fed policy rate increases… if they maintain current plan of reducing the magnitude of periodic increases then this bottom will probably stand and we’re in the clear from these morons…