Many investors short term bearish on a reduction of their figure of speech “liquidity!”…Druckenmiller is 100% spot on here ? pic.twitter.com/1LGMs9FXqM— Financelot (@FinanceLancelot) June 10, 2023 What could neuter a new bull market? A recession that knocks down earnings would be a big one, of course. But the more immediate concern is liquidity.With the debt ceiling finally passed, the Treasury is expected to issue at least .2 trillion in T-Bills, with half of that… pic.twitter.com/lwGmjNjw3w— Jurrien Timmer (@TimmerFidelity) June 9, 2023 If USD reserve balances are simply transferred from the RRP account to the TGA account there won’t be any adverse regulatory effect… But if instead the USD reserve balances are transferred from the Depository account to the TGA account then system

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

Many investors short term bearish on a reduction of their figure of speech “liquidity!”…

Druckenmiller is 100% spot on here ? pic.twitter.com/1LGMs9FXqM

— Financelot (@FinanceLancelot) June 10, 2023

What could neuter a new bull market? A recession that knocks down earnings would be a big one, of course. But the more immediate concern is liquidity.

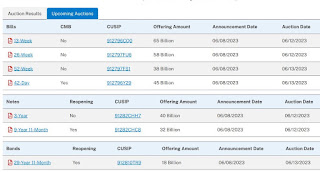

With the debt ceiling finally passed, the Treasury is expected to issue at least $1.2 trillion in T-Bills, with half of that… pic.twitter.com/lwGmjNjw3w

— Jurrien Timmer (@TimmerFidelity) June 9, 2023

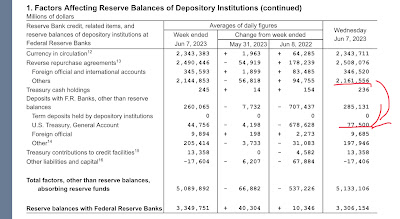

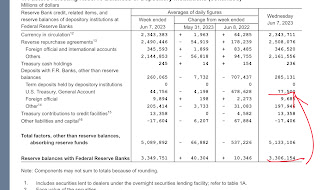

If USD reserve balances are simply transferred from the RRP account to the TGA account there won’t be any adverse regulatory effect…

But if instead the USD reserve balances are transferred from the Depository account to the TGA account then system regulatory leverage ratio will increase allowing Depository system to apply HIGHER prices (NOT lower prices ) to remaining non-USD Reserve assets while maintaining an equivalent leverage ratio…

Though may cause more chaos in small banks that have a dearth of Reserve assets… but that would be their problem…

$400b of new Bills being issued Monday and Tuesday and will settle a few days after that… have to watch what the regulatory effect of TGA refunding is… it may be very favorable to Depositories…