Total System reserves took a nice 50b drop last week but it does no good if Tsy runs TGA down by almost 200b at same time.. TGA account balance supposed to be 0b…. TGA reduction increases bank deposits while banks capital still under pressure from the Fed rate increasing psychos…TGA:TGA topped at around 550b coming up out of debt ceiling and rolled over taking financial asset prices with it since late July… I think TGA should be back up to mid 400s as of yesterday’s Treasury operations… These morons who can’t apply 8th grade Algebra caused another mini March “bank crisis!” here (Citi shares back to March lows) but hopefully it’s over this week if TGA bottomed and being adjusted back up over 550b…

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

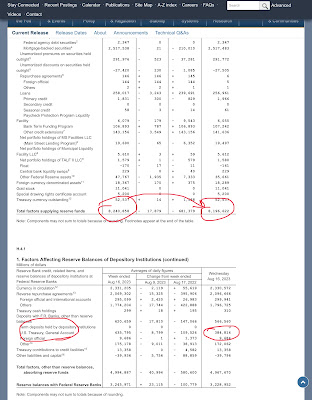

Total System reserves took a nice 50b drop last week but it does no good if Tsy runs TGA down by almost 200b at same time.. TGA account balance supposed to be $650b…. TGA reduction increases bank deposits while banks capital still under pressure from the Fed rate increasing psychos…

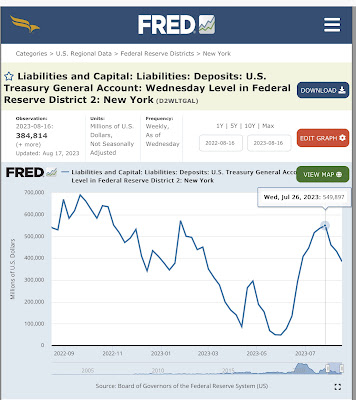

TGA:

TGA topped at around 550b coming up out of debt ceiling and rolled over taking financial asset prices with it since late July… I think TGA should be back up to mid 400s as of yesterday’s Treasury operations…

These morons who can’t apply 8th grade Algebra caused another mini March “bank crisis!” here (Citi shares back to March lows) but hopefully it’s over this week if TGA bottomed and being adjusted back up over 550b…