Blue chip consensus dropping quickly now, and today won’t help any:Remember a year ago when they said the oil price drop would be an unambiguous positive for the trade balance?;) Anyway, this is weak dollar stuff, vs the euro area current account surplus, which is strong euro stuff: Current AccountHighlightsThe nation’s current account deficit widened sharply in the third quarter, to 4.1 billion from a revised 1.1 billion in the second quarter. This is the widest gap of the recovery, since the troubles of fourth-quarter 2008. A greater deficit in goods trade, at %excerpt%.8 billion in the quarter, is the smallest factor in the widening. A narrowing in the surplus for primary income, at .6 billion, and a widening in the gap for secondary income, at .8 billion, are the main factors behind the quarter’s deficit. The gap relative to GDP rose 1 tenth in the third quarter to a still manageable 2.7 percent. Bad. Fed rate hike already have an effect…;) Philadelphia Fed Business Outlook SurveyHighlightsThe negative headline, below Econoday’s low-end estimate, isn’t even half of story for the December Philly Fed report which is pointing to another rough month for the nation’s factory sector. The headline index came in at minus 5.9 for its third negative reading in four months. New orders have been in the negative column for the last three months, at a steep minus 9.

Topics:

WARREN MOSLER considers the following as important: FED, GDP, trade

This could be interesting, too:

Angry Bear writes GDP Grows 2.3 Percent

NewDealdemocrat writes Real GDP for Q3 nicely positive, but long leading components mediocre to negative for the second quarter in a row

Mike Norman writes Atlanta Fed reduces Q2 GDP forecast once again, as I said they would

Frances Coppola writes Why the Tories’ “put people to work” growth strategy has failed

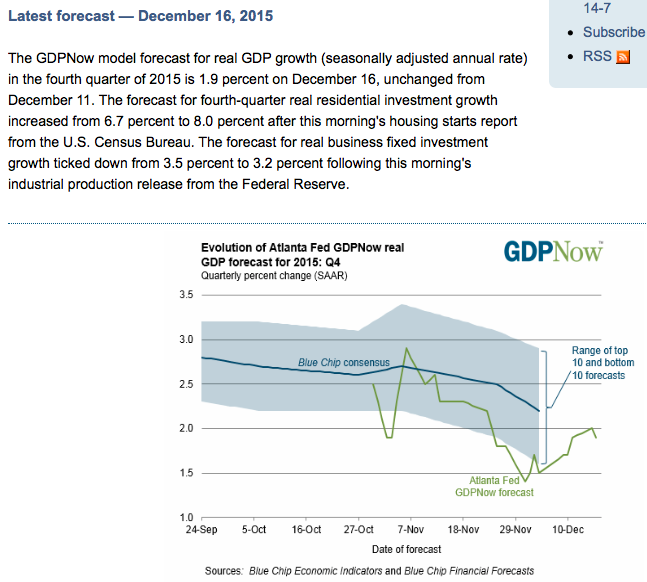

Blue chip consensus dropping quickly now, and today won’t help any:

Remember a year ago when they said the oil price drop would be an unambiguous positive for the trade balance?

;)

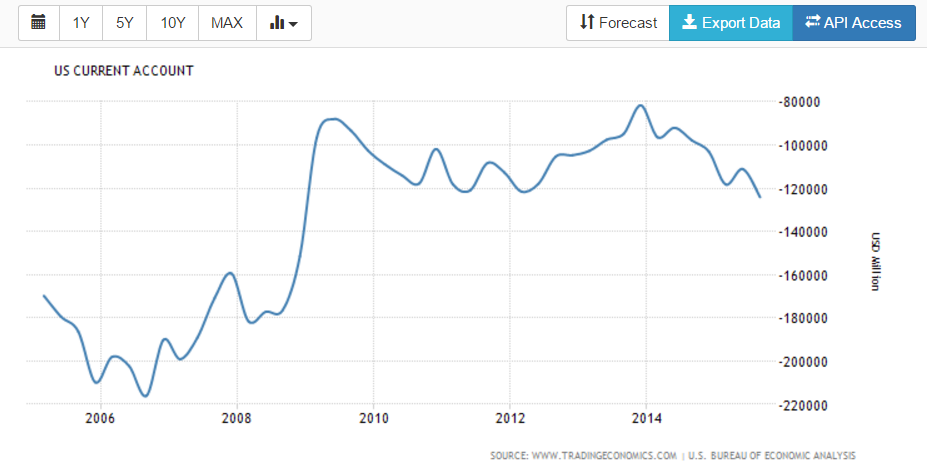

Anyway, this is weak dollar stuff, vs the euro area current account surplus, which is strong euro stuff:

Current Account

Highlights

The nation’s current account deficit widened sharply in the third quarter, to $124.1 billion from a revised $111.1 billion in the second quarter. This is the widest gap of the recovery, since the troubles of fourth-quarter 2008. A greater deficit in goods trade, at $0.8 billion in the quarter, is the smallest factor in the widening. A narrowing in the surplus for primary income, at $6.6 billion, and a widening in the gap for secondary income, at $5.8 billion, are the main factors behind the quarter’s deficit. The gap relative to GDP rose 1 tenth in the third quarter to a still manageable 2.7 percent.

Bad. Fed rate hike already have an effect…

;)

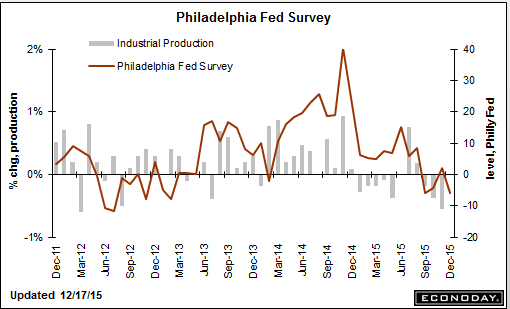

Philadelphia Fed Business Outlook Survey

Highlights

The negative headline, below Econoday’s low-end estimate, isn’t even half of story for the December Philly Fed report which is pointing to another rough month for the nation’s factory sector. The headline index came in at minus 5.9 for its third negative reading in four months. New orders have been in the negative column for the last three months, at a steep minus 9.5 in today’s report. Unfilled orders, which popped up slightly in November, are back in the minus column and deeply in the minus column at 17.7.Manufacturers in the Philly Fed’s sample worked down their backlogs to keep up shipments which came in on the plus side at 3.7. But without new orders coming in, shipments are bound to fall. Employment, likewise, is bound to fall though it did hold in the plus column for a second month in a row at 4.1 in December. Ominously, price data are beginning to turn deeply negative, at minus 9.8 for inputs and minus 8.7 for final goods — the latter an indication of weakening demand.

Another ominous detail in the report is a breakdown in the 6-month outlook, down more than 20 points to 23.0 which is low for this reading. Expectations for future orders are especially weak. Today’s report falls in line with Tuesday’s Empire State report and are both reminders that weak global demand, together with the breakdown in the energy and commodity sectors, are pulling down the nation’s factory sector.