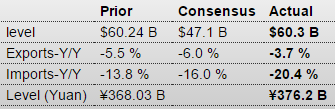

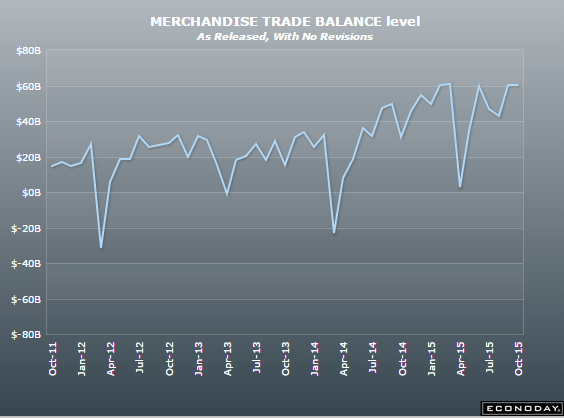

Total trade is down, but the surplus is still high and holding, which ultimately supports the currency: China : Merchandise Trade Balance Highlights Every month China’s trade data are reported in both the renminbi and U.S. dollars by the National Bureau of Statistics. The renminbi report comes out first, followed about an hour later by the more closely-watched U.S. dollar report. Since the August 11 devaluation of the renminbi there is a wider discrepancy between the two sets of data and it has taken on added significance. September imports, in renminbi terms, fell 17.7 percent from a year ago after dropping 14.3 percent in August. This is the 11th consecutive decline and the worst pace since May. But, exports fell just 1.1 percent, holding up much better than expected. This is third straight decline and points to some stabilization. As a result of weakening imports but improving exports, the trade surplus surged to a record high. The surplus was Rmb376 billion. That was almost 30 percent higher than the August surplus. Low commodity prices, compounded by deteriorating domestic demand, are cutting the import bill. Exports have performed comparatively better but are also weak and are falling in year-on-year terms. The trade surplus in U.S. dollar terms was .3 billion. On the year, exports were down a less than anticipated 3.7 percent while imports plunged 20.4 percent.

Topics:

WARREN MOSLER considers the following as important: China, deficit, GDP, trade

This could be interesting, too:

Angry Bear writes GDP Grows 2.3 Percent

Dean Baker writes Donald Trump is badly nonfused # 67,218: The story of supply and demand

Merijn T. Knibbe writes Peak babies has been. Young men are not expendable, anymore.

Robert Skidelsky writes In Memory of David P. Calleo – Bologna Conference

Total trade is down, but the surplus is still high and holding, which ultimately supports the currency:

China : Merchandise Trade Balance

Highlights

Every month China’s trade data are reported in both the renminbi and U.S. dollars by the National Bureau of Statistics. The renminbi report comes out first, followed about an hour later by the more closely-watched U.S. dollar report. Since the August 11 devaluation of the renminbi there is a wider discrepancy between the two sets of data and it has taken on added significance.

September imports, in renminbi terms, fell 17.7 percent from a year ago after dropping 14.3 percent in August. This is the 11th consecutive decline and the worst pace since May. But, exports fell just 1.1 percent, holding up much better than expected. This is third straight decline and points to some stabilization. As a result of weakening imports but improving exports, the trade surplus surged to a record high. The surplus was Rmb376 billion. That was almost 30 percent higher than the August surplus.

Low commodity prices, compounded by deteriorating domestic demand, are cutting the import bill. Exports have performed comparatively better but are also weak and are falling in year-on-year terms.

The trade surplus in U.S. dollar terms was $60.3 billion. On the year, exports were down a less than anticipated 3.7 percent while imports plunged 20.4 percent.

Short interview on recession possibility:

The post China trade, WRKO interview appeared first on The Center of the Universe.