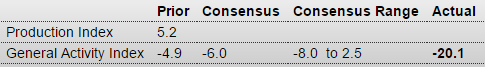

From bad to worse: Dallas Fed Mfg SurveyHighlightsTexas factory activity increased for a third month in a row in December. The production index, a key measure of state manufacturing conditions, rose from 5.2 to 13.4, indicating stronger growth in output. Some other indexes of current manufacturing activity also reflected growth in December, but the survey’s demand measures showed continued weakness.New orders, an indicator of incoming demand, declined at a faster pace. The index has been below zero for five months and fell to minus 8.9 in December. The growth rate of orders index has been negative for more than a year and dipped 7 points to minus 14.3 this month. Meanwhile, the capacity utilization and shipments indexes posted their fourth positive readings in a row and inched up to 7.8 and 7.6, respectively.Perceptions of broader business conditions weakened markedly in December. The general business activity index has been negative throughout 2015 and plunged to minus 20.1 this month. After pushing just above zero last month, the company outlook index fell 10 points in December to minus 9.7, its lowest level since August.The survey’s price measures pushed further negative in December. The raw materials prices index declined to minus 8.6, suggesting a slightly steeper drop in input costs than last month.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

From bad to worse:

Dallas Fed Mfg Survey

Highlights

Texas factory activity increased for a third month in a row in December. The production index, a key measure of state manufacturing conditions, rose from 5.2 to 13.4, indicating stronger growth in output. Some other indexes of current manufacturing activity also reflected growth in December, but the survey’s demand measures showed continued weakness.New orders, an indicator of incoming demand, declined at a faster pace. The index has been below zero for five months and fell to minus 8.9 in December. The growth rate of orders index has been negative for more than a year and dipped 7 points to minus 14.3 this month. Meanwhile, the capacity utilization and shipments indexes posted their fourth positive readings in a row and inched up to 7.8 and 7.6, respectively.

Perceptions of broader business conditions weakened markedly in December. The general business activity index has been negative throughout 2015 and plunged to minus 20.1 this month. After pushing just above zero last month, the company outlook index fell 10 points in December to minus 9.7, its lowest level since August.

The survey’s price measures pushed further negative in December. The raw materials prices index declined to minus 8.6, suggesting a slightly steeper drop in input costs than last month. The finished goods prices index was negative all year and moved down to minus 15.9. Meanwhile, the wages and benefits index moved up to plus 20.4, indicating stronger wage growth.

Expectations regarding future business conditions were mixed in December. The index of future general business activity fell 9 points to minus 1.4, while the index measuring future company outlook fell but remained positive at 6.6. Indexes for future manufacturing activity declined but remained strongly positive.

Japan restarting a nuke, this will move trade towards surplus and eventually add support for the yen:

Japan court rules to restart Takahama nuclear reactors