Exports down but so are imports, indicating a weak global economy and continued euro support from trade net flows: Germany : Merchandise Trade German exports plunge at fastest pace since global financial crisis Oct 8 (Reuters) — German exports plunged in August. Data from the Federal Statistics Office showed seasonally-adjusted exports sliding by 5.2 percent to 97.7 billion euros month-on-month, the steepest drop since January 2009. Imports tumbled by 3.1 percent to 78.2 billion euros, the biggest one-month decline since November 2012. Germany’s trade surplus narrowed to 19.6 billion euros. Germany’s auto industry accounts for roughly one in five jobs. It accounted for 17.9 percent of Germany’s 1.1 trillion euros (.25 trillion) in exported goods last year. Out of the frying pan and into the fire: Japan : Machine Orders Highlights Core machine orders retreated for a third month in August. Core machine orders sank 5.7 percent on the month – expectations were for an increase of 3.2 percent. The monthly decline followed drops of 3.6 percent in July and 7.9 percent in June. On the year, orders were 5.2 percent lower. Total orders plunged 14.6 percent. Manufacturing orders slid 3.2 percent while nonmanufacturing orders dropped 6.1 percent on the month. In an indication of weak international trade, overseas orders plummeted 26.1 percent on the month.

Topics:

WARREN MOSLER considers the following as important: German Trade, Germany, inflation, Japan, trade

This could be interesting, too:

Matias Vernengo writes Serrano, Summa and Marins on Inflation, and Monetary Policy

Angry Bear writes Voters Blame Biden and Harris for Inflation

Lars Pålsson Syll writes How inequality causes financial crises

Matias Vernengo writes Inflation, real wages, and the election results

Exports down but so are imports, indicating a weak global economy and continued euro support from trade net flows:

German exports plunge at fastest pace since global financial crisis

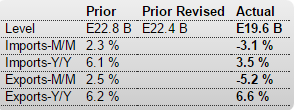

Oct 8 (Reuters) — German exports plunged in August. Data from the Federal Statistics Office showed seasonally-adjusted exports sliding by 5.2 percent to 97.7 billion euros month-on-month, the steepest drop since January 2009. Imports tumbled by 3.1 percent to 78.2 billion euros, the biggest one-month decline since November 2012. Germany’s trade surplus narrowed to 19.6 billion euros. Germany’s auto industry accounts for roughly one in five jobs. It accounted for 17.9 percent of Germany’s 1.1 trillion euros ($1.25 trillion) in exported goods last year.

Out of the frying pan and into the fire:

Japan : Machine Orders

Highlights

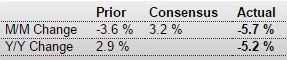

Core machine orders retreated for a third month in August. Core machine orders sank 5.7 percent on the month – expectations were for an increase of 3.2 percent. The monthly decline followed drops of 3.6 percent in July and 7.9 percent in June. On the year, orders were 5.2 percent lower. Total orders plunged 14.6 percent.

Manufacturing orders slid 3.2 percent while nonmanufacturing orders dropped 6.1 percent on the month. In an indication of weak international trade, overseas orders plummeted 26.1 percent on the month.

Needless to say, the government downgraded its view – said orders are marking time. Core machine orders are considered a proxy for private capital expenditures.

Japan out of deflation, Kuroda says

Oct 8 (Nikkei) — Japan has exited deflation and the overall inflation trend has risen steadily, Bank of Japan Gov. Haruhiko Kuroda said Wednesday. Kuroda emphasized price hikes, arguing that daily and weekly price indexes show a significant change from last year. Growth in the UTokyo Daily Price Index, which tracks changes in supermarket prices using data from Nikkei Inc., is hovering near 1.5%. Companies are passing higher labor and other costs on to customers, who are accepting the resulting price increases. Kuroda hinted that even a cut to inflation projections caused by the slump in crude oil would not be enough to merit more stimulus.

Japan’s August core machinery orders down 5.7% on month

Oct 8 (Kyodo) — Japan’s core private sector machinery orders fell a seasonally adjusted 5.7 percent in August from the previous month to 759.4 billion yen ($6.33 billion). The government cut its basic assessment, saying core machinery orders are “at a standstill.” Orders from the manufacturing sector dropped 3.2 percent to 347.9 billion yen in August, down for the third straight month, while those from the nonmanufacturing sector slid 6.1 percent to 422.1 billion yen for the second straight monthly fall. Overseas demand for Japanese machinery, an indicator of future exports, plunged 26.1 percent to 872.3 billion yen.

Japan service sector sentiment worsens in September

Oct 8 (Economic Times) — Japan’s service sector sentiment index fell to 47.5 in September, a Cabinet Office survey showed on Thursday. The survey of workers such as taxi drivers, hotel workers and restaurant staff – called “economy watchers” for their proximity to consumer and retail trends – showed their confidence about current economic conditions slipped from 49.3 in August. The outlook index, indicating the level of confidence in future conditions, rose to 49.1 in September from 48.2 the previous month. The Cabinet Office started compiling the data in comparative form in August 2001.

The post German Trade, Japan appeared first on The Center of the Universe.