[embedded content] This is the full round table on Inflation and Monetary Policy organized by the Bucknell Institute for Public Policy (BIPP), with Franklin Serrano, Ricardo Summa and Nathalie Marins.

Read More »Voters Blame Biden and Harris for Inflation

[unable to retrieve full-text content]The 2024 election was, to some extent, a referendum on inflation. Voters were mad about higher prices, and they vented their wrath on the Democrats. Was that fair? USA TODAY asked economists to ascribe blame for the historic run of inflation, which reached a 40-year peak in mid-2022. Inflation has cooled since then, to an annual rate of […] The post Voters Blame Biden and Harris for Inflation appeared first on Angry...

Read More »How inequality causes financial crises

from Lars Syll One way that inequality precipitates debt bubbles begins with “relative deprivation.” This concept concerns the discontent people feel when they compare their socio-economic status, measured by income, wealth, consumption, or other indicators of perceived economic welfare, with that of their richer counterparts. Economists have suggested several ways that this discontent may translate into indebtedness. One theory holds that people of a given income level may try to...

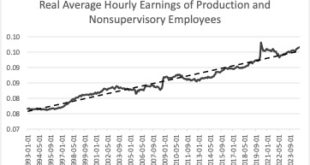

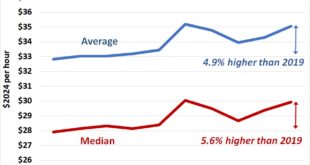

Read More »Inflation, real wages, and the election results

Almost everybody these days accepts at face value that the result of the election was heavily determined by negative perceptions about Bidenomics, and that, in turn, resulted from inflation. Inflation was high (it wasn't, at least not that much), and people were pissed off. This is not just Larry Summers, who had argued (incorrectly in my view) that inflation was caused the large fiscal packages of an excessive generous government.In the heterodox camp, many have suggested that more should...

Read More »´Extra Unordinarily Persistent Large Otput Gaps´ (EU-PLOGs)

A PLOG is a ´Persistent Large Output Gap´. Read: a long period of high unemployment. Literature about PLOGs tries to mitigate one of the ideas of economic orthodoxy, especially the unsubstantiated idea that lowering high post-economic crisis unemployment will fuel inflation. According to this literature, which is quite empirical, it doesn´t. However, this somewhat older literature does not yet consider the post-2009 Euro Area experience. Here, I will propose an updated definition of...

Read More »Interrogating the ‘Vibecession’

There are encouraging signs that Canada’s economy and labour market are improving after a period of stagnation brought about by the Bank of Canada’s aggressive interest rate hikes in 2022 and 2023. Newly released data for the third quarter of 2024 (July-September) shows the economy has continued to grow, albeit slowly. Consumer spending was the brightest light in the third quarter data: growing at an annualized rate of 3.5% (in real, inflation-adjusted terms), and constituting the...

Read More »More ´Natural rate of unemployment´ busting, bad measurement edition.

The ´natural rate of unemployment´, also called ´Non-Accelerating Inflation Rate of Unemployment´ (NAIRU) or ´Non-Accelerating Wage Rate of Unemployment´ (NAWRU), is as, on this blog, Lars Syll states (here and here), a dangerous tool. According to NAIRU/NAWRU theory, a) When unemployment falls below a certain threshold, an inexorable increase in inflation will start. This is simply not true, considering the facts. b) As NAIRU/NAWRU theory is untrue, it can´t be measured by...

Read More »Busting the ‘natural rate of unemployment’ myth

from Lars Syll Sixty years ago Milton Friedman wrote an (in)famous article arguing that (1) the natural rate of unemployment was independent of monetary policy and that (2) trying to keep the unemployment rate below the natural rate would only give rise to higher and higher inflation. The hypothesis has always been controversial, and much theoretical and empirical work has questioned the real-world relevance of the idea that unemployment really is independent of monetary policy and that...

Read More »Elon Musk (& Vivek Ramaswamy) on hardship, because he knows so much about it

I noted (here on the blog and also here) that I didn't think predictions about inflation acceleration and a recession as a result of a a second Trump presidency seemed probable. Yes, he would cut social spending, but would likely expand defense spending, and the tariffs would have a level effect on prices, but not a persistent one on the rate of change (inflation). This was before the rant by Elon Musk on spending cuts and the need for real hardship. Elon suggested cuts of 2 trillion dollars...

Read More »NAIRU — a harmful fairy tale

from Lars Syll The NAIRU story has always had a very clear policy implication — attempts to promote full employment are doomed to fail since governments and central banks can’t push unemployment below the critical NAIRU threshold without causing harmful runaway inflation. Although a lot of mainstream economists and politicians have a touching faith in the NAIRU fairy tale, it doesn’t hold water when scrutinized. One of the main problems with NAIRU is that it is essentially a timeless...

Read More » Heterodox

Heterodox