More deflation news here: PPI-FD Nothing good here, and of course sales = income, so lower sales = lower incomes. Also, the boost to prior months from car sales looks like it’s fading: Retail SalesHighlightsRetail sales slowed in October but fundamentally remain solid. Sales rose only 0.1 percent, 2 tenths under the Econoday consensus. But when excluding vehicles, which slipped back after surging in prior months, and when also excluding gasoline stations, where sales once again fell on price weakness, core sales rose a respectable 0.3 percent which hits the consensus.And there are solid gains including for housing-related components of furniture & home furnishings and building materials & garden equipment. Nonstore retailers also show a strong gain as do restaurants.Aside from vehicles and gas, other areas that declined are electronics & appliance stores, grocery stores, and the big category of general merchandise sales. Declines in the latter may be related to import-price effects which are deflating sales. A positive, however, is a gain for department stores which are a subset of general merchandise. Apparel sales, which are definitely being held down by import prices, were unchanged following two small declines.Year-on-year rates really tell the story especially a respectable plus 4.1 percent rate for sales excluding gasoline stations, a component that is down 20.

Topics:

WARREN MOSLER considers the following as important: GDP, inflation

This could be interesting, too:

Matias Vernengo writes Serrano, Summa and Marins on Inflation, and Monetary Policy

Angry Bear writes Voters Blame Biden and Harris for Inflation

Angry Bear writes GDP Grows 2.3 Percent

Lars Pålsson Syll writes How inequality causes financial crises

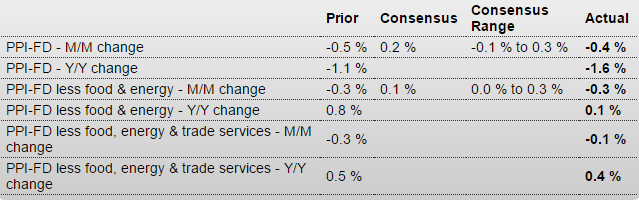

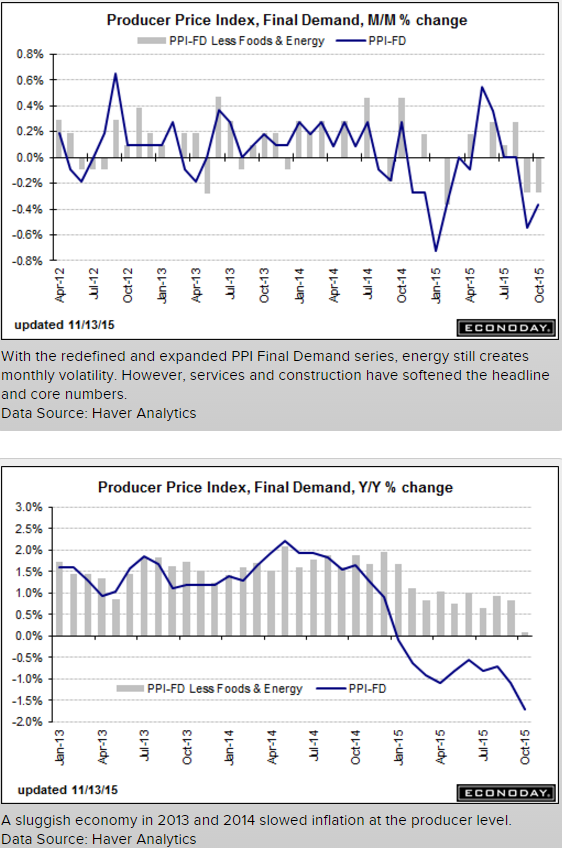

More deflation news here:

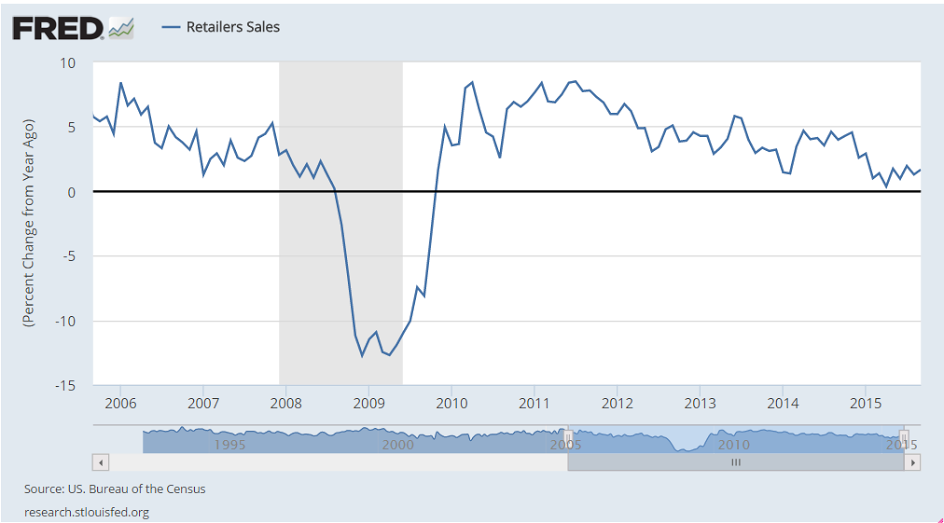

Nothing good here, and of course sales = income, so lower sales = lower incomes.

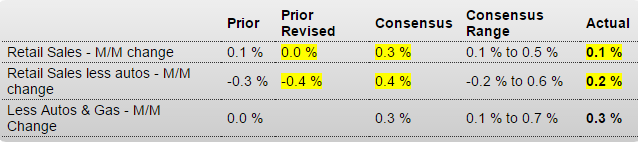

Also, the boost to prior months from car sales looks like it’s fading:

Retail Sales

Highlights

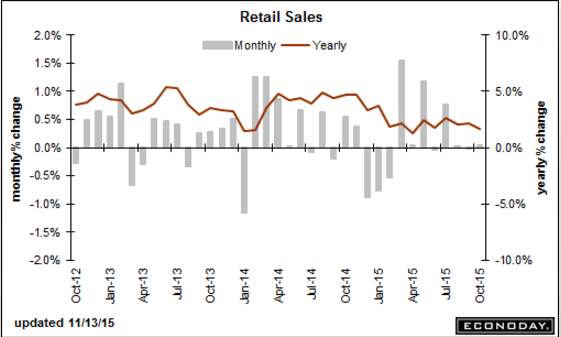

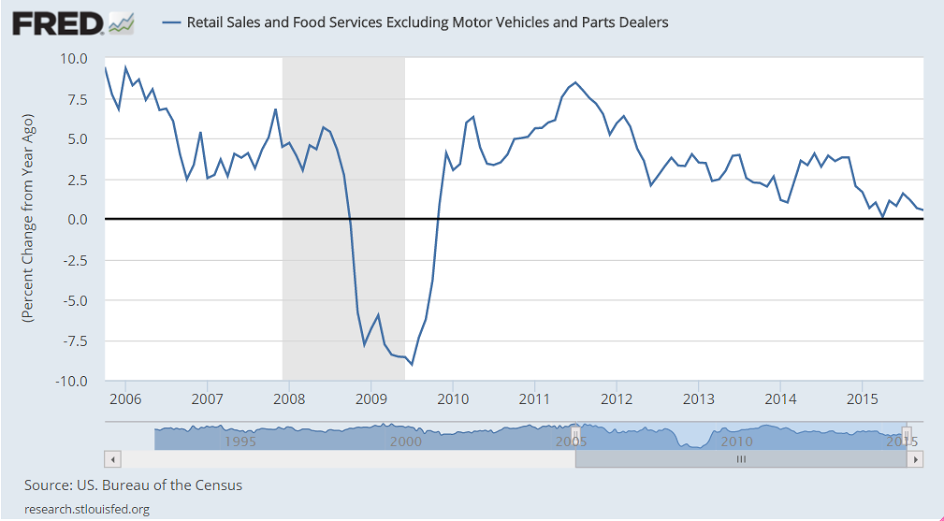

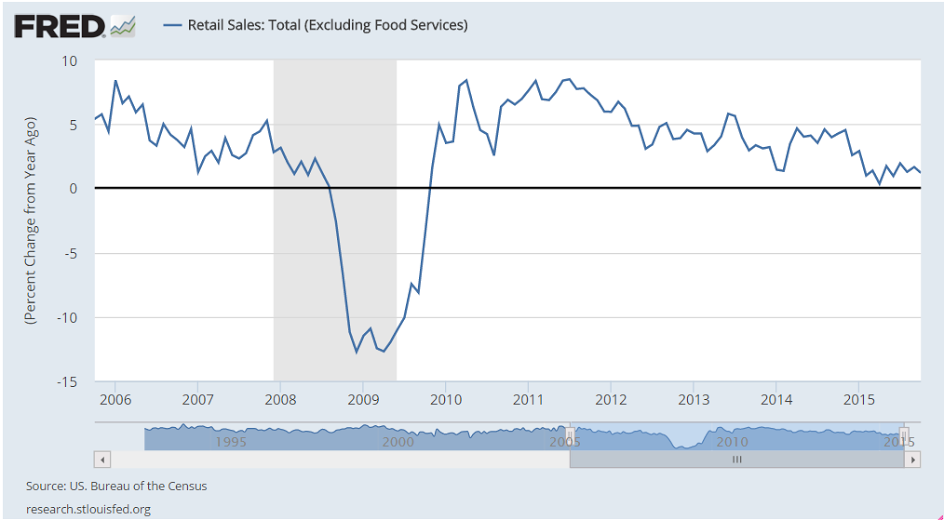

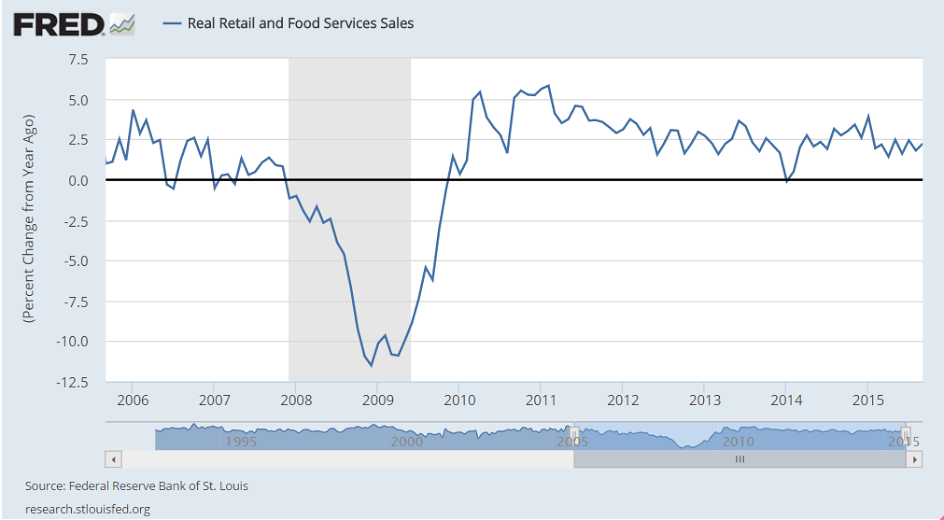

Retail sales slowed in October but fundamentally remain solid. Sales rose only 0.1 percent, 2 tenths under the Econoday consensus. But when excluding vehicles, which slipped back after surging in prior months, and when also excluding gasoline stations, where sales once again fell on price weakness, core sales rose a respectable 0.3 percent which hits the consensus.And there are solid gains including for housing-related components of furniture & home furnishings and building materials & garden equipment. Nonstore retailers also show a strong gain as do restaurants.

Aside from vehicles and gas, other areas that declined are electronics & appliance stores, grocery stores, and the big category of general merchandise sales. Declines in the latter may be related to import-price effects which are deflating sales. A positive, however, is a gain for department stores which are a subset of general merchandise. Apparel sales, which are definitely being held down by import prices, were unchanged following two small declines.

Year-on-year rates really tell the story especially a respectable plus 4.1 percent rate for sales excluding gasoline stations, a component that is down 20.1 percent and has been badly skewing total sales all year. Total sales are up only 1.7 percent.

The headline is weak and year-on-year rates did ease off, including for core ex-auto ex-gas to plus 3.5 from 3.8 percent, but this report is better than it looks, showing underlying strength that shouldn’t scale down expectations for a December FOMC rate hike.

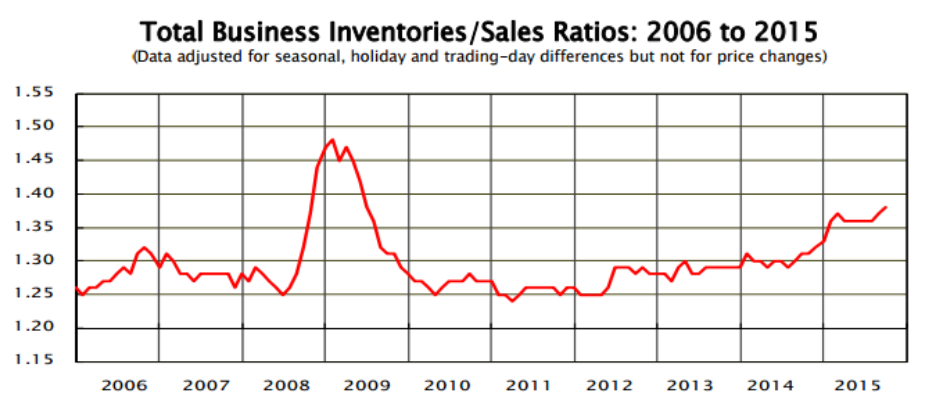

Looks to me like the excess inventory situation has gone from bad to worse, as sales continue to lag output:

MANUFACTURING AND TRADE INVENTORIES AND SALES September 2015 Sales.

The U.S. Census Bureau announced today that the combined value of distributive trade sales and manufacturers’ shipments for September, adjusted for seasonal and trading-day differences but not for price changes, was estimated at $1,320.3 billion, virtually unchanged (±0.2%)* from August 2015, but was down 2.8 percent (±0.4%) from September 2014.

Inventories.

Manufacturers’ and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,817.5 billion, up 0.3 percent (±0.1%) from August 2015 and were up 2.5 percent (±0.5%) from September 2014. Inventories/Sales Ratio.

The total business inventories/sales ratio based on seasonally adjusted data at the end of September was 1.38. The September 2014 ratio was 1.31.