Interesting, with no discount borrowings, the regional Federal Reserve Bank presidents want a discount rate hike? Nine Fed banks called for discount rate hike: minutes Nov 24 (Reuters) — The number of regional Federal Reserve banks pushing for a hike in what commercial banks are charged for emergency loans rose to nine in October, minutes from its discount rate meeting showed. Eight Fed banks had voted to raise the discount rate at the prior meeting in September, a jump from five in July and August. The nine regional banks that requested a hike want to normalize the spread between the discount rate governing Fed lending to banks and the overnight federal funds rate, which is the central bank’s primary economic lever. Falling Corporate Profits Blur U.S. Growth Outlook Nov 24 (WSJ) — A comprehensive measure of companies’ profits across the U.S.—earnings adjusted for inventory and depreciation—dropped to .1 trillion in the third quarter, down 1.1% from the second quarter. Compared with a year earlier, profits fell 4.7%. Profits as a share of overall economic output have shrunk to 11.4% in the third quarter from a recent peak of 12.5% in 2012. Domestic profits rose .3 billion in the third quarter, or 0.4%. Domestic profits were down 2.8% from the third quarter of 2014. Meanwhile, foreign profits fell by billion, a 7.4% decline from the second quarter and 12.

Topics:

WARREN MOSLER considers the following as important: GDP

This could be interesting, too:

Angry Bear writes GDP Grows 2.3 Percent

NewDealdemocrat writes Real GDP for Q3 nicely positive, but long leading components mediocre to negative for the second quarter in a row

Mike Norman writes Atlanta Fed reduces Q2 GDP forecast once again, as I said they would

Frances Coppola writes Why the Tories’ “put people to work” growth strategy has failed

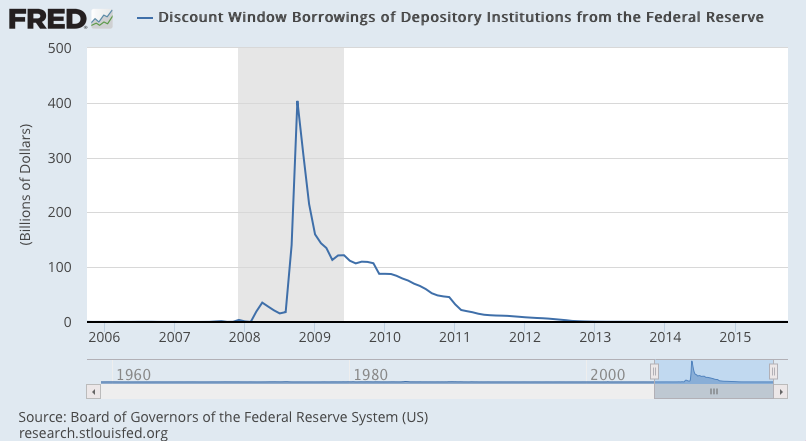

Interesting, with no discount borrowings, the regional Federal Reserve Bank presidents want a discount rate hike?

Nine Fed banks called for discount rate hike: minutes

Nov 24 (Reuters) — The number of regional Federal Reserve banks pushing for a hike in what commercial banks are charged for emergency loans rose to nine in October, minutes from its discount rate meeting showed. Eight Fed banks had voted to raise the discount rate at the prior meeting in September, a jump from five in July and August. The nine regional banks that requested a hike want to normalize the spread between the discount rate governing Fed lending to banks and the overnight federal funds rate, which is the central bank’s primary economic lever.

Falling Corporate Profits Blur U.S. Growth Outlook

Nov 24 (WSJ) — A comprehensive measure of companies’ profits across the U.S.—earnings adjusted for inventory and depreciation—dropped to $2.1 trillion in the third quarter, down 1.1% from the second quarter. Compared with a year earlier, profits fell 4.7%. Profits as a share of overall economic output have shrunk to 11.4% in the third quarter from a recent peak of 12.5% in 2012. Domestic profits rose $7.3 billion in the third quarter, or 0.4%. Domestic profits were down 2.8% from the third quarter of 2014. Meanwhile, foreign profits fell by $30 billion, a 7.4% decline from the second quarter and 12.2% drop from a year earlier.

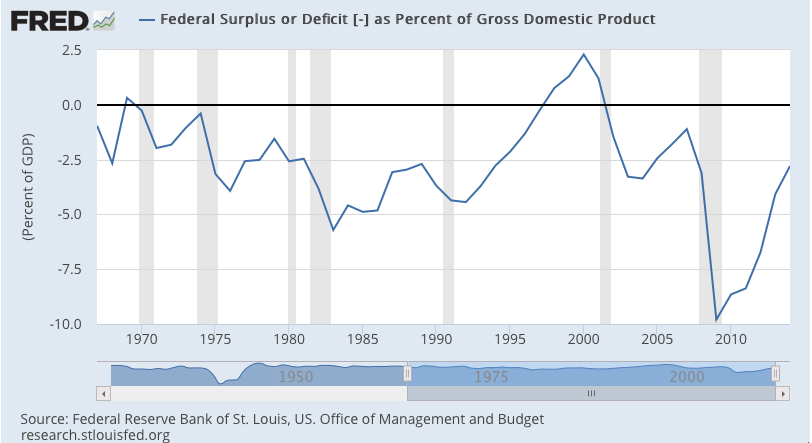

As previously discussed, if agents spending more than their incomes weren’t sufficient to offset agents spending less than their incomes the output didn’t get sold, and inventories build. This leads to reduced production, reduced employment, and reduced income, in a downward spiral that only reverses via agents spending that much more than their incomes. With the private sector largely pro cyclical, the reversal most often requires govt spending that much more than its income, either by reducing taxes or increasing spending. This can be done proactively, or the ugly way- via reduced tax collection due to the slow down and rising unemployment benefits, as most often is the case, at least initially. With the currency itself a (simple) public monopoly, and in this case the currency monopolist is restricting the supply of net $US financial assets, and a necessarily pro cyclical private sector, the idea of markets clearing on their own to restore output and employment is entirely inapplicable once the down turn is in progress:

U.S. GDP growth raised for third quarter

Nov 25 (Reuters) — US GDP grew at a 2.1 percent annual pace, not the 1.5 percent rate it reported last month. Wages and salaries increased $109.3 billion, $61.6 billion more than initially estimated. In the third quarter, businesses accumulated $90.2 billion worth of inventories, instead of the $56.8 billion reported last month. That followed more than $100 billion worth of inventories accumulated in each of the prior two quarters. Business spending on equipment was revised up to a 9.5 percent rate from a 5.3 percent pace.

Consumer Confidence Index Declines Again

Nov 24 (Conference Board) — The Consumer Confidence Index declined to 90.4 in November, down from 99.1 in October. The Present Situation Index decreased from 114.6 last month to 108.1 in November, while the Expectations Index declined to 78.6 from 88.7 in October. Those stating jobs are “plentiful” decreased from 22.7 percent to 19.9 percent, while those claiming jobs are “hard to get” increased to 26.2 percent from 24.6 percent. Those anticipating more jobs in the months ahead fell from 14.4 percent to 11.6 percent, while those anticipating fewer jobs increased from 16.6 percent to 18.7 percent.

As recession hits, deficit spending is what always leads the subsequent recovery: