Looks like a bit of oversupply from new construction, and it didn’t take much of that, either, as construction has been well below prior cycles: “Apartment markets remain strong, but the surge of new apartment construction is starting to shift the supply-demand balance, particularly in the market for upscale apartments,” said Mark Obrinsky, NMHC’s Senior Vice President of Research and Chief Economist. “Given that most new supply is class A, we’re not seeing the same shift in class B and C apartments. In addition, some weakness in the Market Tightness Index may be just seasonality.” Read more at http://www.calculatedriskblog.com/#LSMKAUerapUOBGK4.99 May be an indication of investors being ‘underweight’ euro: And foreigners going ‘overweight’ dollars: Seems the UK deficit has gotten too small to support the credit structure, particularly in the context of Brexit uncertainty: Union Pacific Profit Falls 19% as Demand Remains Under Pressure By Imani Moise and Tess Stynes July 21 (WSJ) — For the three months ended June 30, Union Pacific’s total freight volume fell 11% as a 2% increase in shipments of agricultural products was offset by declines in volume for other commodities. Coal volume slumped 21% and industrial products volume dropped 11%. Volume in its intermodal business, which moves freight using a combination of trains and trucks, fell 14%.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

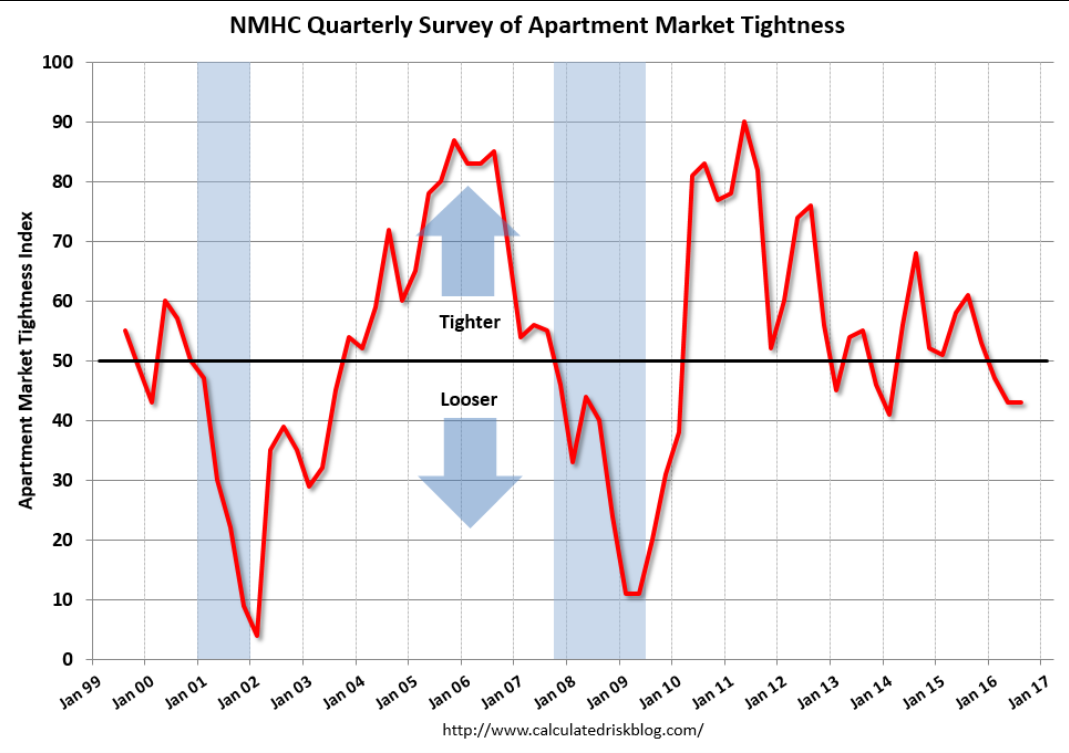

Looks like a bit of oversupply from new construction, and it didn’t take much of that, either, as construction has been well below prior cycles:

“Apartment markets remain strong, but the surge of new apartment construction is starting to shift the supply-demand balance, particularly in the market for upscale apartments,” said Mark Obrinsky, NMHC’s Senior Vice President of Research and Chief Economist. “Given that most new supply is class A, we’re not seeing the same shift in class B and C apartments. In addition, some weakness in the Market Tightness Index may be just seasonality.”

Read more at http://www.calculatedriskblog.com/#LSMKAUerapUOBGK4.99

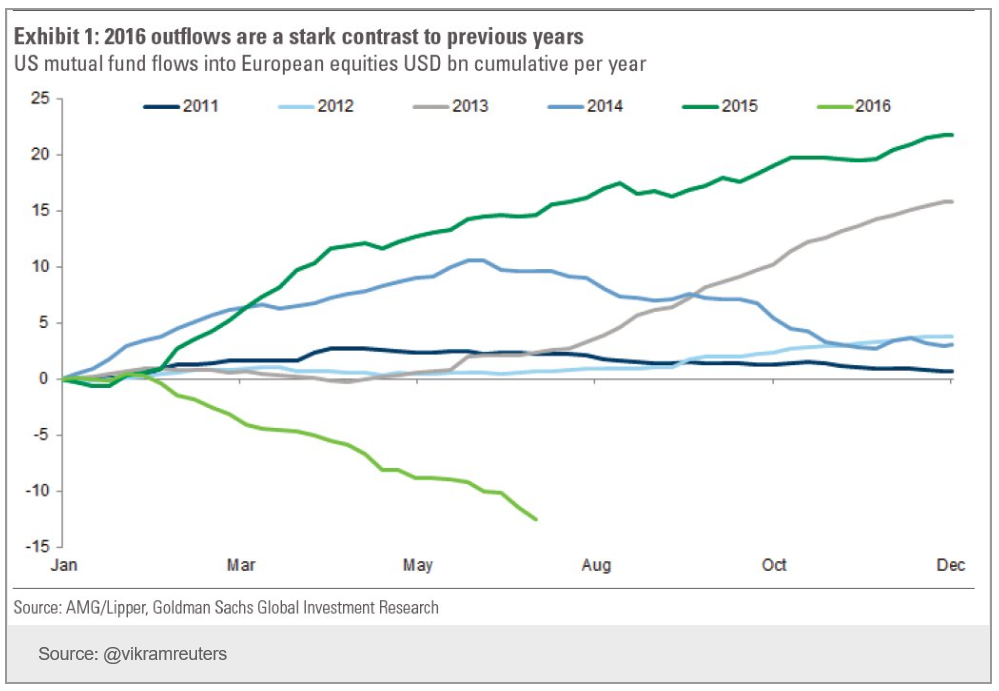

May be an indication of investors being ‘underweight’ euro:

And foreigners going ‘overweight’ dollars:

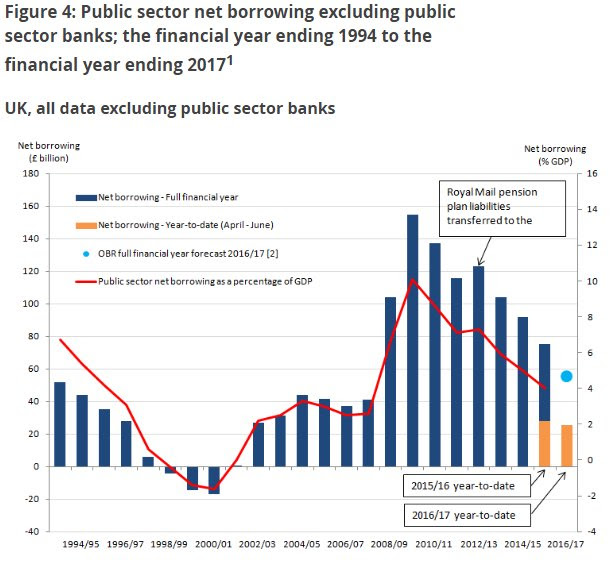

Seems the UK deficit has gotten too small to support the credit structure, particularly in the context of Brexit uncertainty:

Union Pacific Profit Falls 19% as Demand Remains Under Pressure

By Imani Moise and Tess Stynes

July 21 (WSJ) — For the three months ended June 30, Union Pacific’s total freight volume fell 11% as a 2% increase in shipments of agricultural products was offset by declines in volume for other commodities. Coal volume slumped 21% and industrial products volume dropped 11%. Volume in its intermodal business, which moves freight using a combination of trains and trucks, fell 14%. Union Pacific reported an overall profit of $979 million, or $1.17 a share, down from $1.2 billion, or $1.38 a share, a year earlier. Revenue decreased 12% to $4.77 billion.