As previously discussed- sales are slowing and inventory is too high: U.S. Car Makers Idle Plants Amid Oversupply Concerns By Mike Colias Adrienne Roberts and Christina Rogers Dec 21 (WSJ) — Detroit auto makers are pulling back on first-quarter production in response to a cooling in retail demand and a shift in consumer tastes, a speed bump for an industry that has laid the foundation for U.S. economic expansion in recent years. All three domestic car companies this week said they have scheduled down time at some of their factories for as much as three weeks in January. Auto makers typically idle assembly plants for a week or two around the holidays—but shutting factories for multiple weeks in January is unusual. Auto makers produced 3.6% more vehicles in North America last month than November 2015, according to researcher WardsAuto.com. Bad: Highlights Defense came to the rescue of November’s durable goods report though core capital goods orders are another positive. Durable goods fell 4.6 percent in November but were down an even sharper 6.6 percent excluding defense. When including defense and excluding transportation (commercial aircraft and vehicles), orders rose a better-than-expected 0.5 percent. Orders for core capital goods (nondefense ex-aicraft) rose a very solid 0.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

As previously discussed- sales are slowing and inventory is too high:

U.S. Car Makers Idle Plants Amid Oversupply Concerns

By Mike Colias Adrienne Roberts and Christina Rogers

Dec 21 (WSJ) — Detroit auto makers are pulling back on first-quarter production in response to a cooling in retail demand and a shift in consumer tastes, a speed bump for an industry that has laid the foundation for U.S. economic expansion in recent years.

All three domestic car companies this week said they have scheduled down time at some of their factories for as much as three weeks in January. Auto makers typically idle assembly plants for a week or two around the holidays—but shutting factories for multiple weeks in January is unusual. Auto makers produced 3.6% more vehicles in North America last month than November 2015, according to researcher WardsAuto.com.

Bad:

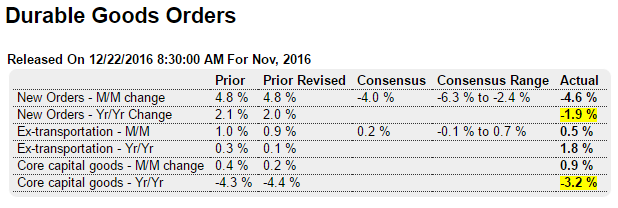

Highlights

Defense came to the rescue of November’s durable goods report though core capital goods orders are another positive. Durable goods fell 4.6 percent in November but were down an even sharper 6.6 percent excluding defense. When including defense and excluding transportation (commercial aircraft and vehicles), orders rose a better-than-expected 0.5 percent.

Orders for core capital goods (nondefense ex-aicraft) rose a very solid 0.9 percent though the gain is offset slightly by a 2 tenths downward revision to October where the gain is now only 0.2 percent. Shipments of core capital goods, reflecting prior weakness in orders, show only modest life, also at 0.2 percent.

Turning back to defense, orders for defense aircraft doubled in the month, up 103 percent. Orders for defense capital goods, which include aircraft, rose 29 percent. But outside of defense, non-aircraft components show strength including communications equipment (up 6.7 percent), primary metals (up 2.3 percent), machinery (up 1.3 percent), and vehicles (up 0.8 percent).

Total shipments inched 0.1 percent forward in November with inventories also up 0.1 percent to keep the inventory-to-shipments ratio stable at 1.64. A negative in the report is a 0.2 percent dip in unfilled orders following a 0.8 percent rise in October which looks very much like an outlier.

This report is known for its volatility which for November is highlighted by aircraft, both defense and commercial for opposite reasons. In sum, year-end momentum for the factory sector appears to be in place, suggesting a better finish to what has been a flat year.

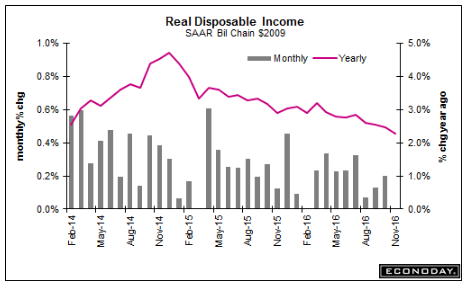

Even not adjusted for inflation at best it’s gone flat:

As the chart shows, the decline in real disposable personal income continues uninterrupted:

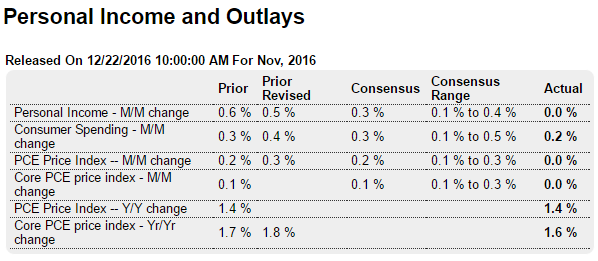

Highlights

November may have been a cycle high for confidence but it actually proved a weak month for the consumer. Personal income was unchanged in November as the wages & salaries component dipped into the negative column at minus 0.1 percent. Consumer spending rose 0.2 percent and reflected specific weakness in vehicles. Not helped by the weakness in income, the consumer had to dip into savings during the month where the rate fell 2 tenths to 5.5 percent.

Price data are very flat, unchanged for both the PCE and PCE core (less food & energy) with the year-on-year rate at 1.4 percent for the PCE and at 1.6 percent for the core. And in a comparison that doesn’t point to accelerating inflation pressures, the year-on-year rate for the core fell 2 tenths to 1.6 percent..

Two months into the fourth quarter, consumer spending is running at a plus 2.0 percent annualized pace, well down from the 3.0 percent rate of the third-quarter (see GDP report earlier this morning).

But to put the report in context, the wages & salaries component had been showing outsized strength in recent months as had vehicle sales. So one month of weakness shouldn’t be a surprise. But the inflation readings are clearly a concern for Fed policy makers who want to see pressures building.

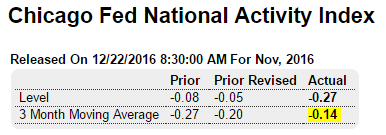

Highlights

Business and consumer confidence may have jumped but November proved to be a weak month for the economy based on the national activity index which fell to minus 0.27 from a revised minus 0.05 in October. The industrial sector proved weak, falling to minus 0.20 from October’s minus 0.01. Part of this decline reflects warm weather and less utility output but also reflects slippage in manufacturing production. Personal consumption & housing were also weak, at minus 0.10 vs minus 0.03 and reflecting weakness in retail spending and dips for housing starts & permits. Employment was a small positive in the month, at plus 0.2 vs October’s 0.1, with sales/orders/inventories at plus 0.01 vs minus 0.02.