This was the component of GDP that was touted as a sign of underlying consumer strength, as per the last quarter over quarter move up: However, the same data looked as year over year change- call it a 12 month moving average- shows that looking past the data’s ‘volatility’ there was a move up during the last phase of the burst of oil related capital expenditures chasing 0 oil followed by a continuous deceleration that began when the oil related capital expenditures collapsed: Excess inventory in the service sector is largely about employees. When sales growth slows faster than headcount, it can be said that firms are building (human) inventory. Productivity is output per employee, which can be an indicator of excess capacity as well. And at some point firms make the adjustment to lower sales growth and cut headcount, either directly or through attrition: Layoffs increased a bit with the oil capex collapse, then moderated. with the adjustment coming from the reduced pace of hiring. However with hiring still growing faster than real GDP growth would dictate, looks to me like the US economy remains ‘over staffed’: Familiar pattern here- employment growth increased as the shale boom started and reversed when it collapsed.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

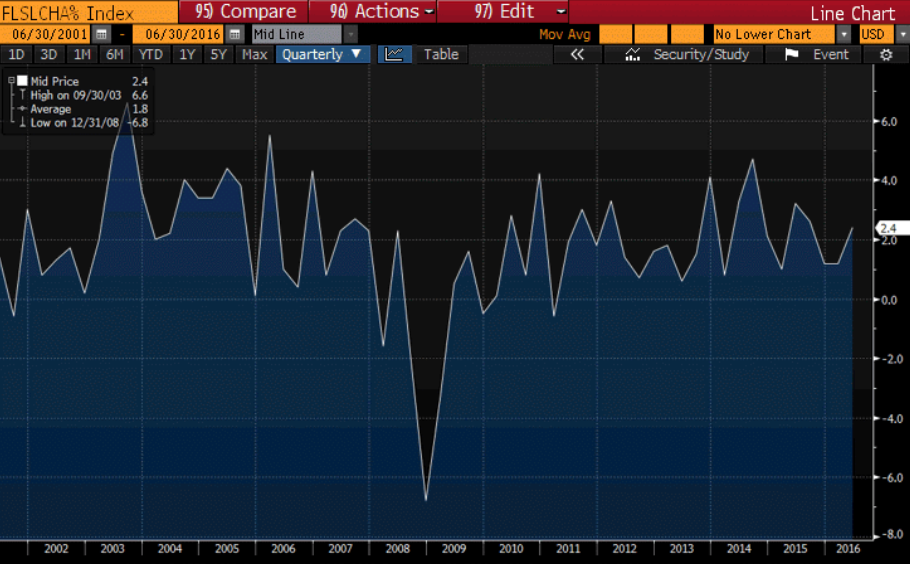

This was the component of GDP that was touted as a sign of underlying consumer strength, as per the last quarter over quarter move up:

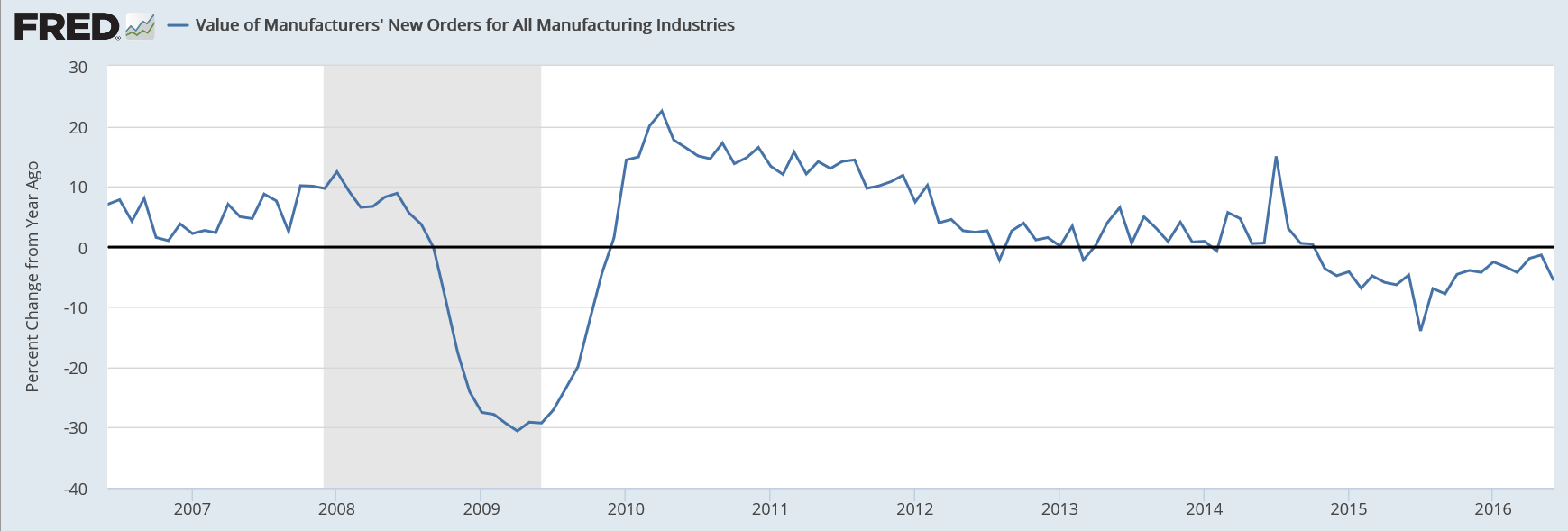

However, the same data looked as year over year change- call it a 12 month moving average- shows that looking past the data’s ‘volatility’ there was a move up during the last phase of the burst of oil related capital expenditures chasing $100 oil followed by a continuous deceleration that began when the oil related capital expenditures collapsed:

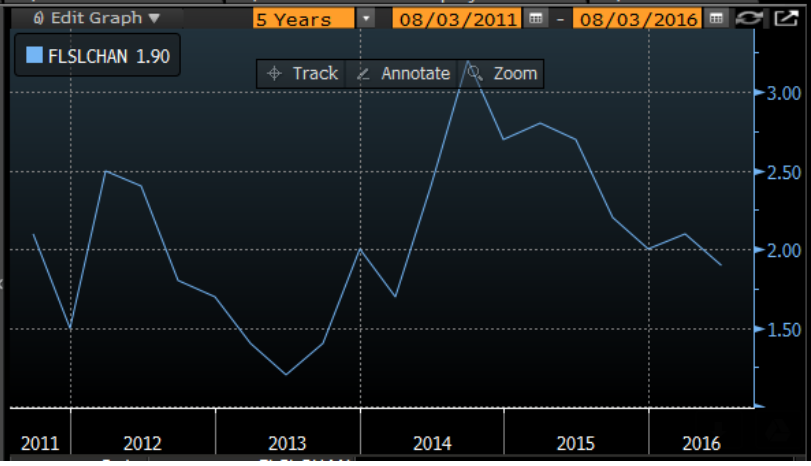

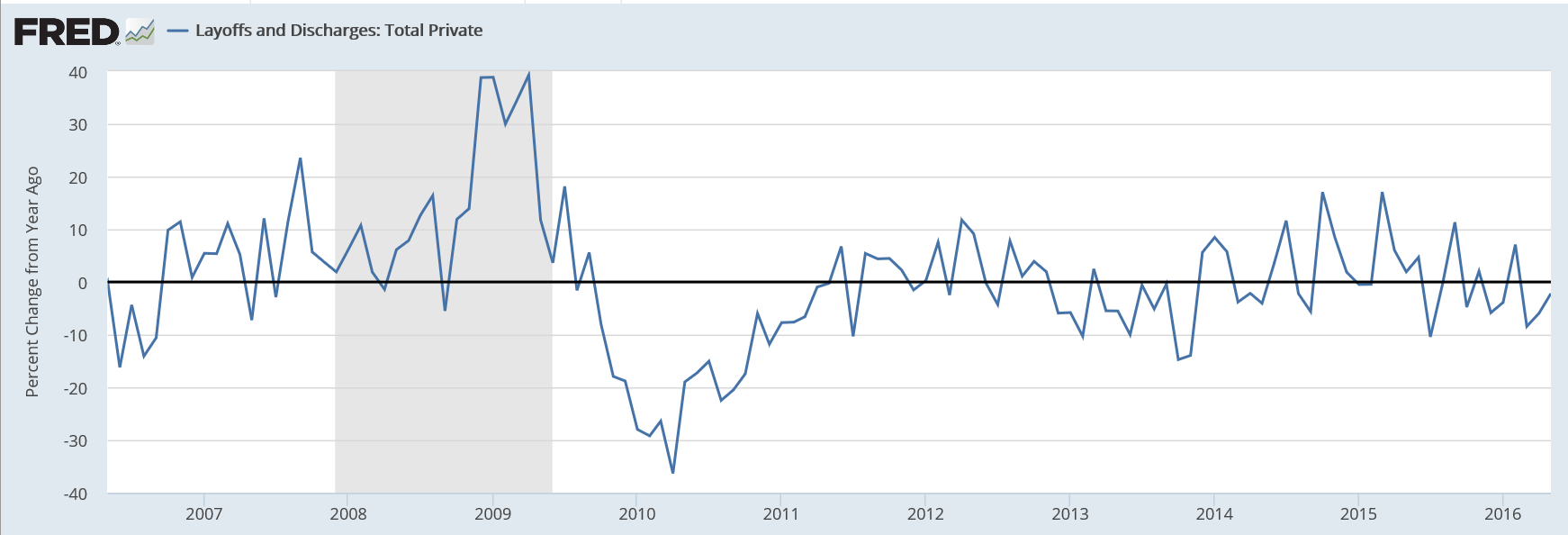

Excess inventory in the service sector is largely about employees. When sales growth slows faster than headcount, it can be said that firms are building (human) inventory. Productivity is output per employee, which can be an indicator of excess capacity as well. And at some point firms make the adjustment to lower sales growth and cut headcount, either directly or through attrition:

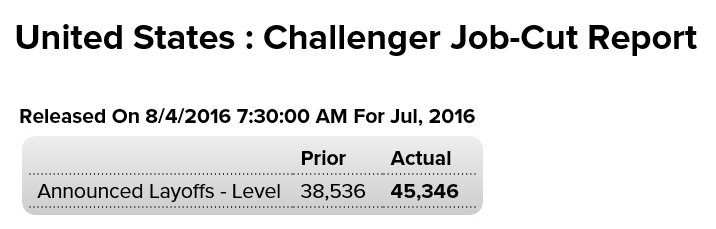

Layoffs increased a bit with the oil capex collapse, then moderated. with the adjustment coming from the reduced pace of hiring. However with hiring still growing faster than real GDP growth would dictate, looks to me like the US economy remains ‘over staffed’:

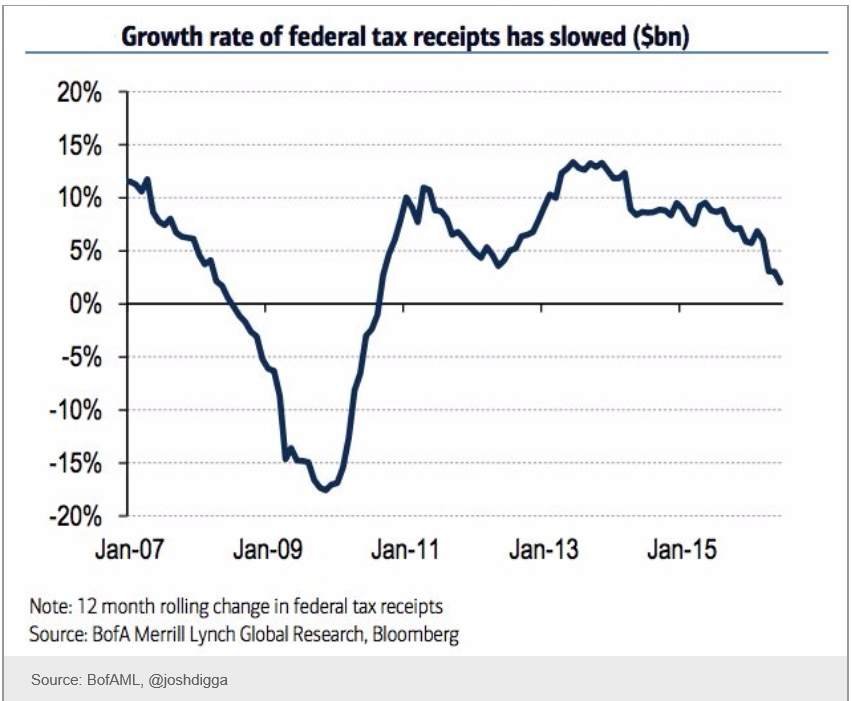

Familiar pattern here- employment growth increased as the shale boom started and reversed when it collapsed. Without some new credit driven boom seems to me the deceleration continues:

Same pattern here:

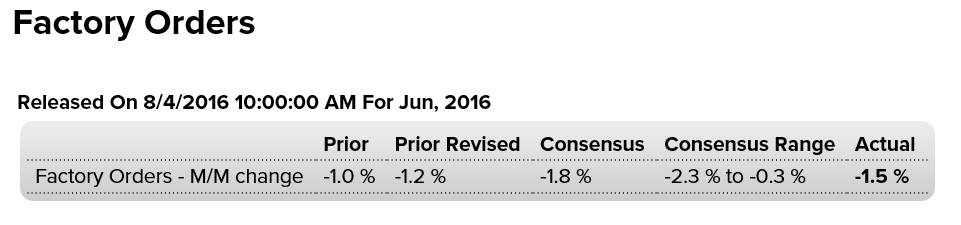

A bit better than expected but prior month revised down:

Highlights

Anecdotal reports on the factory sector have shown isolated strength that actual government data have yet to show. Factory orders fell a sizable 1.5 percent in June following a downward revised 1.2 percent decline in May. Core capital goods (nondefense ex-aircraft) have been especially weak though orders did rise 0.4 percent in June. Shipments for this category, however, slipped 0.2 percent following a downward revised 0.7 percent decline in June in readings that will not boost revision estimates for second-quarter GDP.Orders for nondurable goods were a plus in June, rising 1.0 percent but reflect price effects tied to energy products. Durable goods fell 3.9 percent in the month which is one 1 tenth lower than last week’s advance report for this component. Orders for computers & electronics were especially weak in the month as were orders for transportation equipment with civilian aircraft, which is always volatile month to month but nevertheless has been weakening on trend, falling 59 percent. Vehicles are a plus in the report, with orders up 3.2 percent.

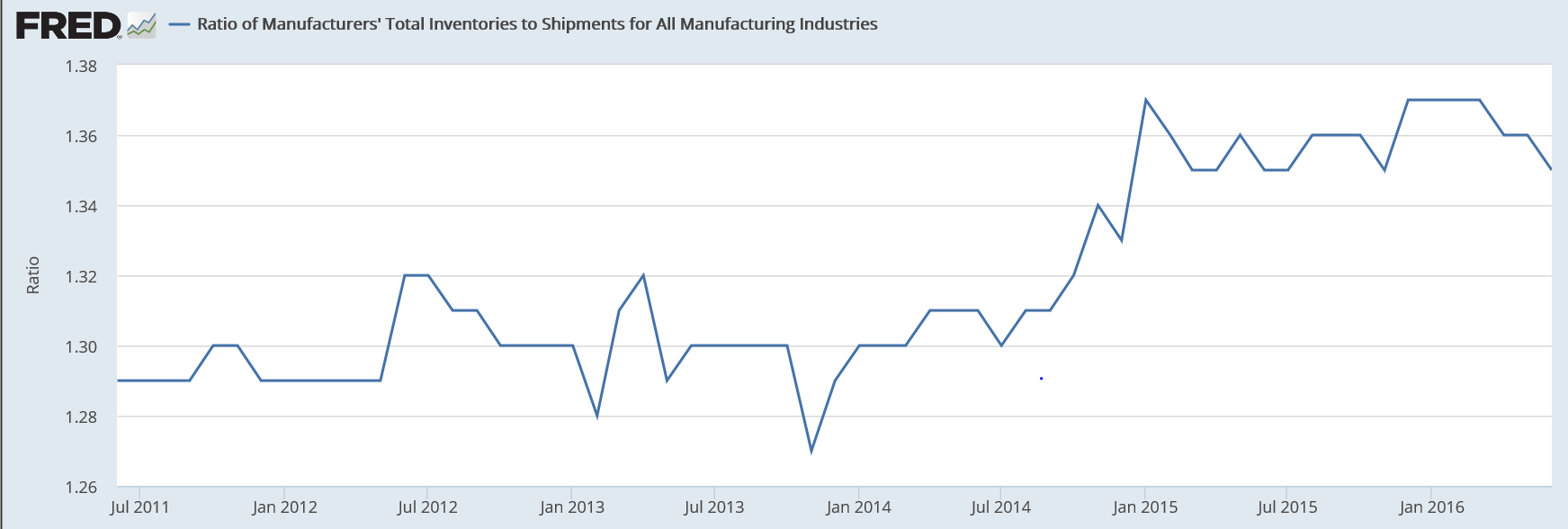

A major negative in the report is a 0.8 percent drop in total unfilled orders where contraction is a negative for factory employment. Total shipments are a positive, up 0.7 percent in a gain that may not be repeated should orders stay weak. A plus is that inventories edged lower, pulling down the inventory-to-shipment ratio to 1.35 from 1.36.

The factory sector, held down by weak exports and weak business investment centered in energy, has shown isolated signs of life but has yet to pull its weight so far this year.

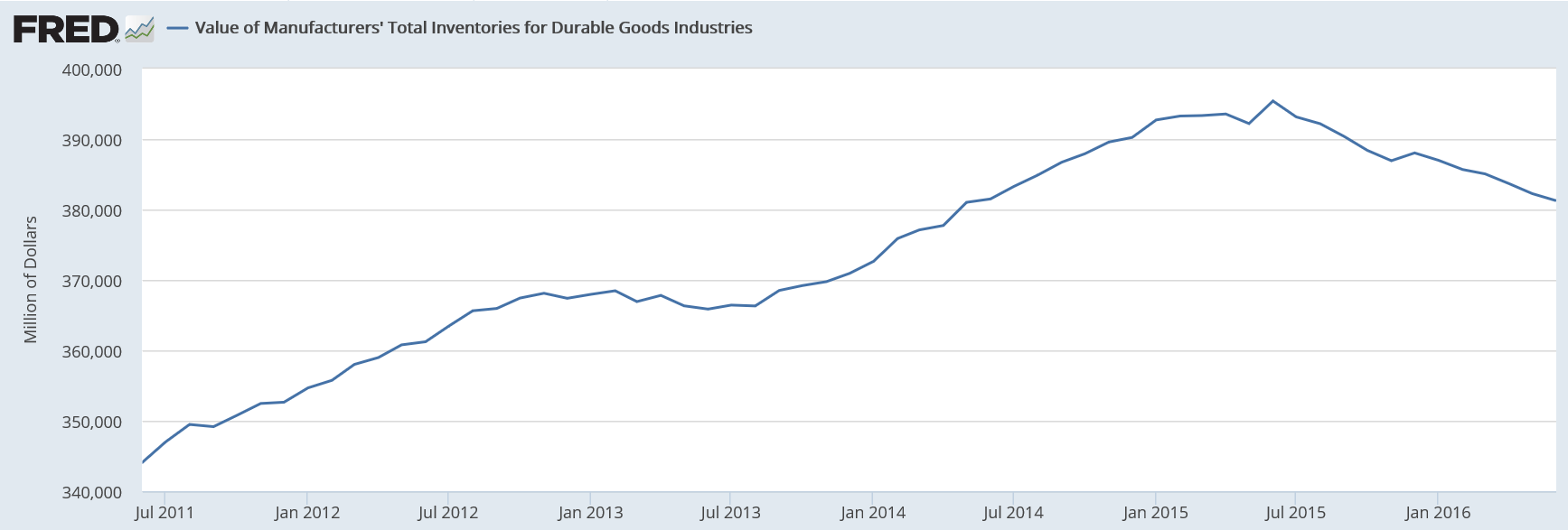

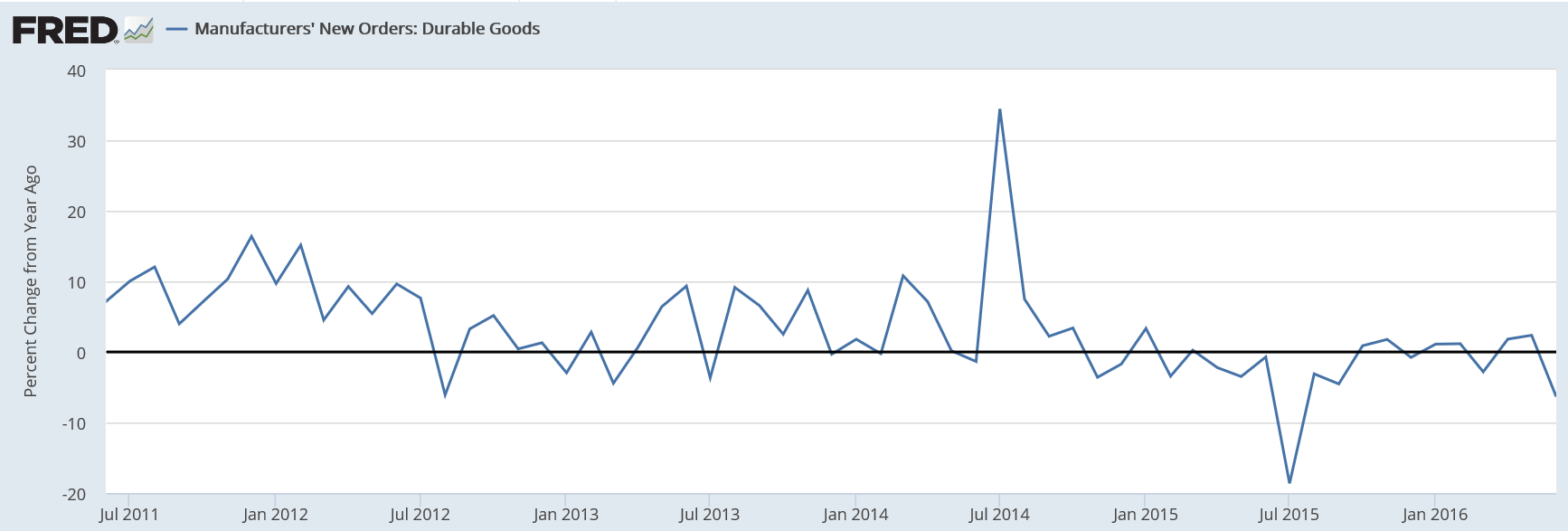

Inventories still way too high relative to shipments:

Inventories coming down but not fast enough to overtake declines in shipments: