Also tracing the weakness back to the oil capex collapse: Econintersect’s Economic Index declined and is barely positive – and still remains at the lowest value since the end of the Great Recession. The tracked sectors of the economy which showed growth were mostly offset by the sectors in contraction. Our economic index remains in a long term decline since late 2014. The Fed got this highlighted first part right: Information received since the Federal Open Market Committee met in OctoberDecember suggests that labor market conditions improved further even as growth slowed late last year. No growth here: Pending Home Sales IndexHighlightsSales of existing homes popped higher in December but a further gain for January is uncertain given only a 0.1 percent rise in pending home sales which follows a downward revised 1.1 percent decline in November. It usually takes one to two months for contract signings to close with greater delays possible given new mortgage documentation rules that were implemented in November. Also raising doubts whether January will prove to be a solid month is this report’s narrow breakdown with the Northeast, the smallest of the housing regions, the only one in the positive column in the month, at 6.1 percent. The other three regions show declines with the sharpest in the West at minus 2.1 percent.

Topics:

WARREN MOSLER considers the following as important: FED, GDP

This could be interesting, too:

Angry Bear writes GDP Grows 2.3 Percent

NewDealdemocrat writes Real GDP for Q3 nicely positive, but long leading components mediocre to negative for the second quarter in a row

Mike Norman writes Atlanta Fed reduces Q2 GDP forecast once again, as I said they would

Frances Coppola writes Why the Tories’ “put people to work” growth strategy has failed

Also tracing the weakness back to the oil capex collapse:

Econintersect’s Economic Index declined and is barely positive – and still remains at the lowest value since the end of the Great Recession. The tracked sectors of the economy which showed growth were mostly offset by the sectors in contraction. Our economic index remains in a long term decline since late 2014.

The Fed got this highlighted first part right:

Information received since the Federal Open Market Committee met in OctoberDecember suggests that labor market conditions improved further even as growth slowed late last year.

No growth here:

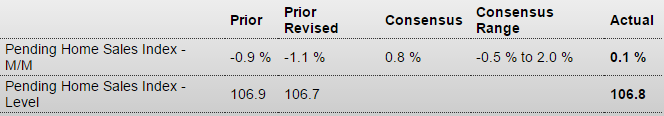

Pending Home Sales Index

Highlights

Sales of existing homes popped higher in December but a further gain for January is uncertain given only a 0.1 percent rise in pending home sales which follows a downward revised 1.1 percent decline in November. It usually takes one to two months for contract signings to close with greater delays possible given new mortgage documentation rules that were implemented in November. Also raising doubts whether January will prove to be a solid month is this report’s narrow breakdown with the Northeast, the smallest of the housing regions, the only one in the positive column in the month, at 6.1 percent. The other three regions show declines with the sharpest in the West at minus 2.1 percent. Despite this report, recent news on the housing sector has been positive including gains for sales and also respectable appreciation for prices.

Negative and decelerating:

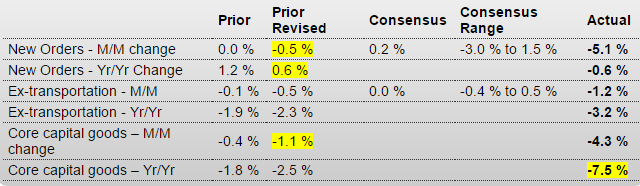

Durable Goods Orders

Highlights

The factory sector ended 2015 with a giant thud. Durable goods orders fell 5.1 percent in December vs expectations for a 0.2 percent gain and a low-end estimate of minus 3.0 percent. Aircraft orders didn’t help but they weren’t the whole cause of the problem as ex-transportation orders fell 1.2 percent vs expectations for no change and a low-end estimate of minus 0.4 percent. Core capital goods, which exclude defense equipment and also aircraft, are especially weak, down 4.3 percent following a 1.1 percent decline in November. Shipments for core capital goods, which are an input into GDP, slipped 0.2 percent following a downward revised 1.1 percent decline in November (initially minus 0.4 percent).Orders for civilian aircraft lead the dismal list, down 29 percent in December. The other main subcomponent for transportation, motor vehicles, also fell, down 0.4 percent in a reminder that vehicle sales were slowing at year end. Capital goods industries show deep declines: machinery down 5.6 percent, computers down 8.7 percent, communications equipment down 21 percent, and fabricated metals down 0.5 percent.

Other readings include a surprising 2.2 percent monthly drop in total shipments and a 0.5 percent drop in total unfilled orders. All this weakness isn’t a plus for inventories which rose 0.5 percent to lift the inventory-to-shipments ratio sharply, to 1.69 from 1.64. The rise in inventories poses a headwind to the sector and will dampen future shipments as well as employment and is a reminder of the inventory warning in yesterday’s FOMC statement.

There’s been trouble brewing in the factory sector, recently indicated by the Empire State and Dallas Fed reports and also by the ISM index which has fallen below breakeven 50. Weak export markets, made weaker for U.S. manufacturers by the strength of the dollar, together with contraction in the energy sector may now be pushing the factory into an accelerated breakdown, at least that’s the concern.