The chart shows the year over year and ongoing deceleration that in general began when oil capex collapsed. Nor will there be a reversal until after deficit spending increases- public or private- and I see no evidence of that happening: Employment SituationHighlightsAdd employment to those reports showing weakness, at least moderate weakness as nonfarm payrolls rose a lower-than-expected 160,000 in April. Revisions are minor, down a combined 19,000 in the two prior months with March now at 208,000. Government is a weak spot in April, down 11,000, with retail also showing weakness, down 3,000 after a series of outsized gains.The unemployment rate is unchanged at 5.0 percent but the size of the labor force did fall in this reading. And the participation rate, which had been jumping, slipped 2 tenths to 62.8 percent.Earnings are a positive, up 0.3 percent in the month with the year-on-year rate back on the climb at 2.5 percent for a 2 tenths gain. The workweek is also a positive up 1 tenth to 34.5 hours.Turning back to industry sectors, mining extended its long trail of contraction with a 7,000 decline. But there is definitely strength especially for the closely watched professional & business services reading, up a very strong 65,000 and pointing to the need for additional permanent hiring in the months ahead.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

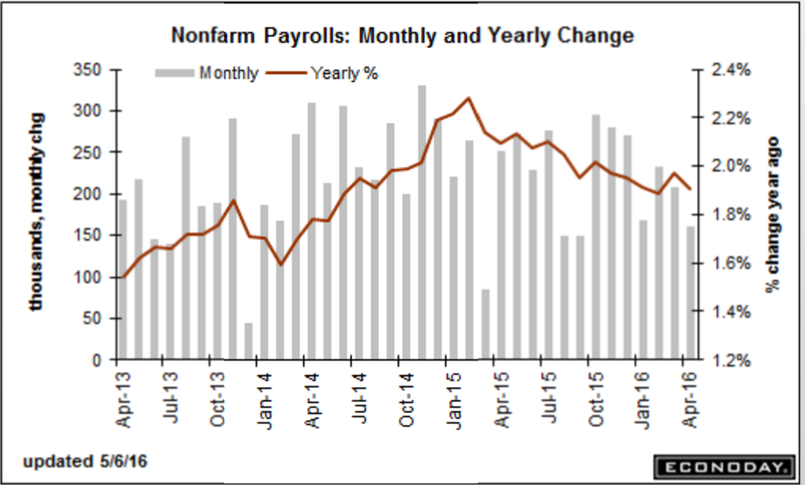

The chart shows the year over year and ongoing deceleration that in general began when oil capex collapsed.

Nor will there be a reversal until after deficit spending increases- public or private- and I see no evidence of that happening:

Employment Situation

Highlights

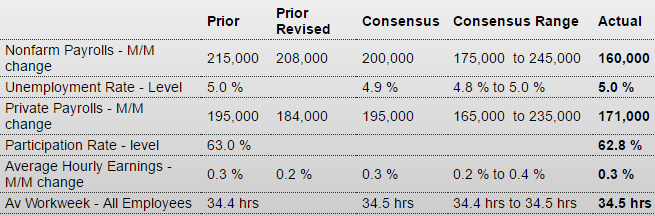

Add employment to those reports showing weakness, at least moderate weakness as nonfarm payrolls rose a lower-than-expected 160,000 in April. Revisions are minor, down a combined 19,000 in the two prior months with March now at 208,000. Government is a weak spot in April, down 11,000, with retail also showing weakness, down 3,000 after a series of outsized gains.The unemployment rate is unchanged at 5.0 percent but the size of the labor force did fall in this reading. And the participation rate, which had been jumping, slipped 2 tenths to 62.8 percent.

Earnings are a positive, up 0.3 percent in the month with the year-on-year rate back on the climb at 2.5 percent for a 2 tenths gain. The workweek is also a positive up 1 tenth to 34.5 hours.

Turning back to industry sectors, mining extended its long trail of contraction with a 7,000 decline. But there is definitely strength especially for the closely watched professional & business services reading, up a very strong 65,000 and pointing to the need for additional permanent hiring in the months ahead. The temporary help services subcomponent of this reading is up 9,000 for a second month. Financial activities also show strength, up a very solid 20,000 with manufacturing back in the plus column but not by much with a 4,000 gain and reflecting a snap-back for the auto industry.

There’s give and take in the April data especially for labor participation which, however, is still trending higher, at least modestly. Employment is still the central strength of the economy but less so in what is less than a gangbuster opening to the second quarter. Though there’s still one more employment report to go ahead of the June FOMC, today’s report lowers whatever chances there are for a rate hike. Note that the ongoing strike by 40,000 Verizon workers do not appear to have affected April’s data.

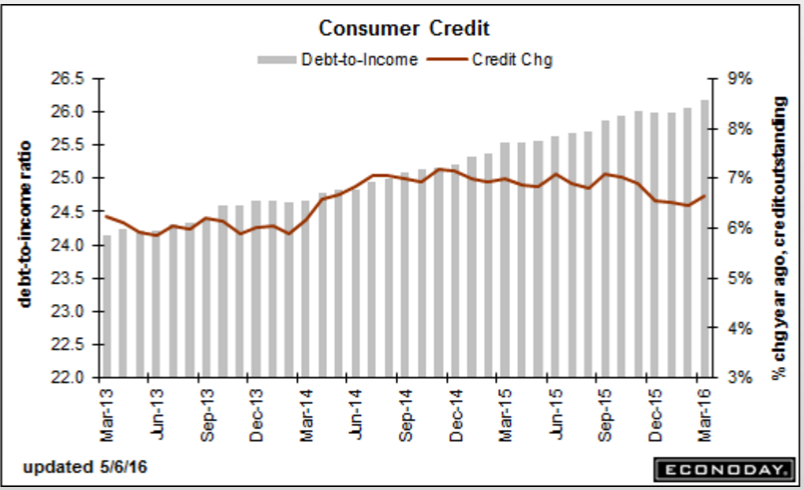

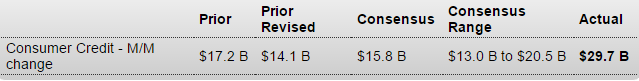

Up more than expected for the month, but the year over year didn’t move much. And note last month was revised down, so in any case best to withhold judgement regarding this series for at least a month. And a jump in borrowing can also indicate a fall off in income, particularly with retail sales growth as low as it is, with consumers borrowing to make ends meet. And check out how the debt to income level, also shown on the chart, continues to rise:

Consumer Credit

Highlights

The consumer may be showing limited enthusiasm for spending but certainly was borrowing in March. Consumer credit rose $29.7 billion in a surge that makes up for several months of prior weakness and includes a very strong $11.1 billion gain for revolving credit, indicating less reluctance to run up credit cards. Non-revolving credit rose $18.6 billion and once again reflects student loans and vehicle financing. The monthly headline is the strongest since a break in this series 5 years ago while the gain for the revolving component is the strongest since a prior break 10 years ago. The willingness to borrow hints at improved consumer confidence in the general outlook and reflects the strength of the labor market.