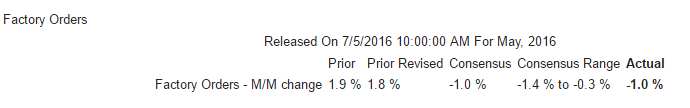

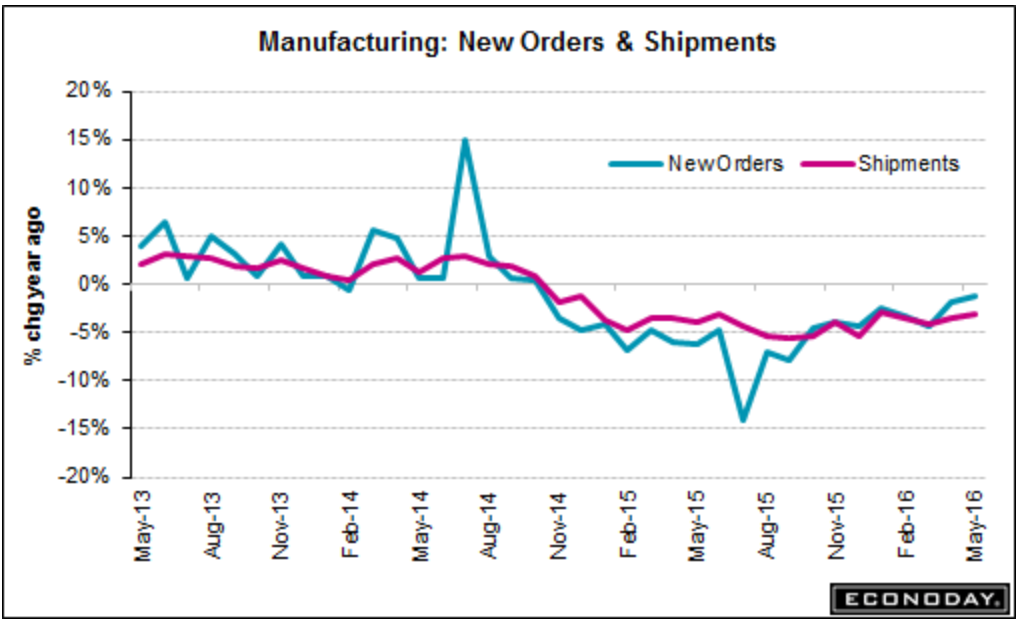

Worse than expected as another April gain reverts in May: US Factory Orders Fall More Than Expected New orders for manufactured goods shrank 1% mom in May, compared to a downwardly revised 1.8% gain in April. Figures came slightly worse than market expectations of a 0.9% drop. Meanwhile, orders for non-defense capital goods excluding aircraft fell 0.4%, lower than a 0.7% drop in April and excluding transportation, factory orders edged up 0.1%.HighlightsMay was a weak month for the factory sector as new orders fell 1.0 percent and show specific weakness in capital goods. New orders for core capital goods (nondefense ex-aircraft) fell 0.4 percent following a 0.9 percent drop in April while shipments fell 0.5 percent to nearly reverse April’s 0.6 percent gain. Commercial aircraft orders, which have been soft, improved on the month with vehicle orders, where growth has been respectable, also showing a bounce. Monthly weakness in transportation came from defense aircraft and ships & boats, two smaller components that show large double-digit declines. Excluding transportation, factory orders inched up 0.1 percent on the month. This report would be weaker were it not for price-related gains in oil-related subcomponents, specifically on the non-durables side where orders rose 0.3 percent. Durables orders fell 2.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Worse than expected as another April gain reverts in May:

US Factory Orders Fall More Than Expected

New orders for manufactured goods shrank 1% mom in May, compared to a downwardly revised 1.8% gain in April. Figures came slightly worse than market expectations of a 0.9% drop. Meanwhile, orders for non-defense capital goods excluding aircraft fell 0.4%, lower than a 0.7% drop in April and excluding transportation, factory orders edged up 0.1%.

Highlights

May was a weak month for the factory sector as new orders fell 1.0 percent and show specific weakness in capital goods. New orders for core capital goods (nondefense ex-aircraft) fell 0.4 percent following a 0.9 percent drop in April while shipments fell 0.5 percent to nearly reverse April’s 0.6 percent gain.Commercial aircraft orders, which have been soft, improved on the month with vehicle orders, where growth has been respectable, also showing a bounce. Monthly weakness in transportation came from defense aircraft and ships & boats, two smaller components that show large double-digit declines. Excluding transportation, factory orders inched up 0.1 percent on the month.

This report would be weaker were it not for price-related gains in oil-related subcomponents, specifically on the non-durables side where orders rose 0.3 percent. Durables orders fell 2.3 percent on the month, 1 tenth deeper than last week’s advance report for this component.

Weakness in capital goods means weakness in business investment and reflects weakness in business expectations. And expectations aren’t getting any lift from Brexit. Weakness in capital goods also means extended trouble for the nonresidential investment component of the GDP report, here trouble for the second quarter.

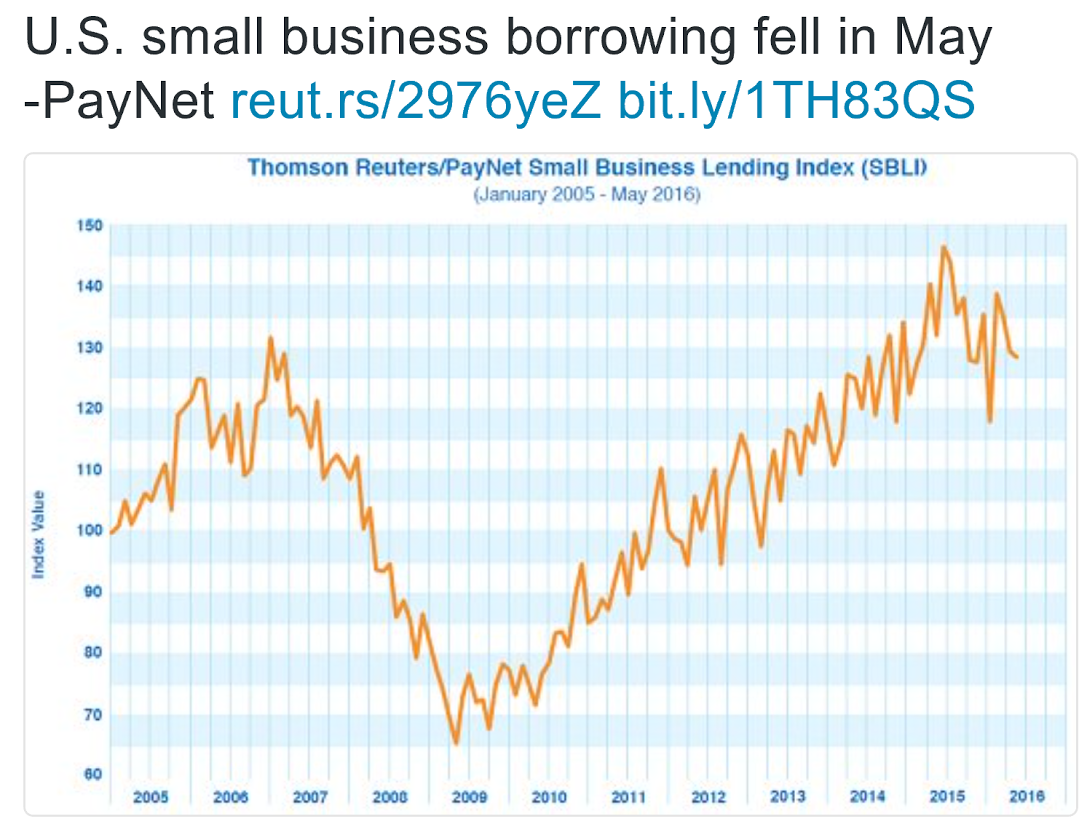

Still no sign of an expansion of private sector credit growth needed to support GDP growth:

U.S. small business borrowing fell in May -PayNet

By Ann Saphir

June 30 (Reuters) — U.S. small business borrowing fell for the third straight month in May, data released on Thursday showed, a pullback that suggests economic growth prospects were already dimming before Britain’s shock vote last week rocked global financial markets.

Loans more than 30 days past due rose in May to 1.54 percent, the highest in more than a year, separate data from PayNet showed.

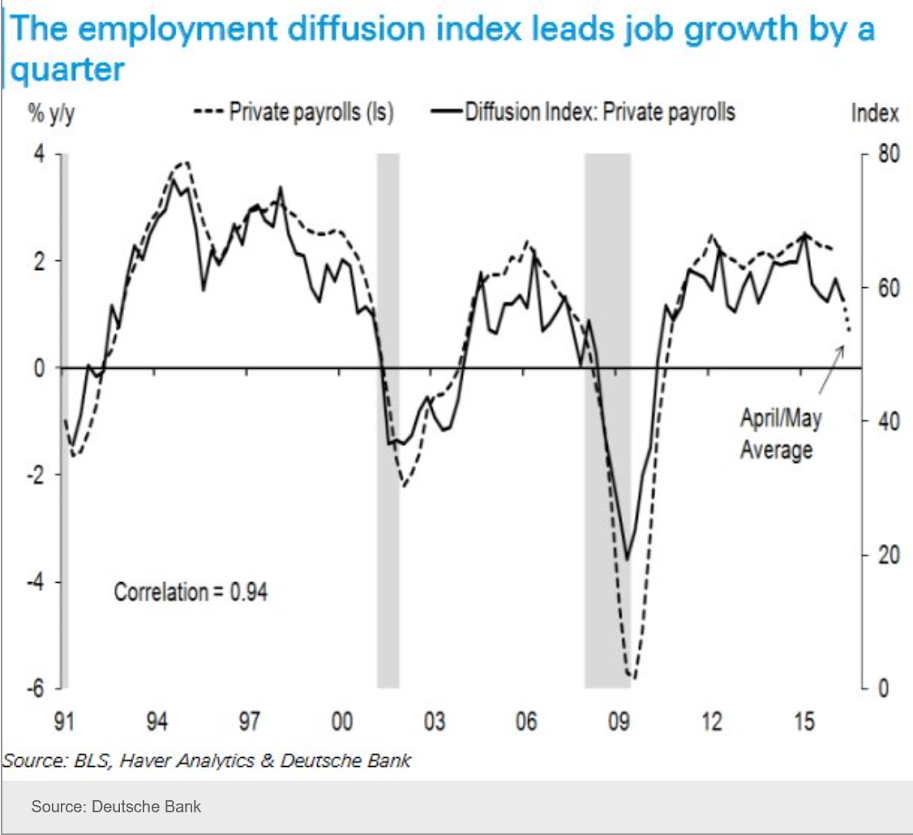

Jobs index:

United States ISM New York Index 1993-2016

The ISM NY Current Business Conditions Index came in at 45.4 in June of 2016 compared to 37.2 in May. Yet, business activity in New York City contracted in back-to back months for the first time since the Great Recession, as employment (35.9 from 44.6 in May) and quantity of purchases (46.7 from 37.5) continued to fall and current (55.6 from 60) and expected revenues (57.1 from 68) grew less. In contrast, prices paid recovered (55 from 45.7) and the 6-month outlook increased to 59.5, the highest in three months. Ism New York Index in the United States averaged 55.65 percent from 1993 until 2016, reaching an all time high of 88.80 percent in December of 2003 and a record low of 23.40 percent in October of 2001. Ism New York Index in the United States is reported by the Institute for Supply Management.

Slowdown in Shadow Lending Tightens Credit on Main Street

By Serena Ng

July 4 (WSJ) — America’s shadow banking system slowed sharply through the end of June, with the value of bonds backed by personal, corporate and real-estate loans falling $98 billion from the first half of 2015. That drop, which excludes bonds from state-backed issuers like Fannie Mae, represents a 37% decline from a year earlier, according to industry newsletter Asset-Backed Alert. At $31 billion so far this year, CMBS issuance is down nearly 44% from the same period in 2015. Through mid-June, some $4.5 billion in CMBS loans were transferred to special servicers that specialize in debt workouts, according to Fitch Ratings.