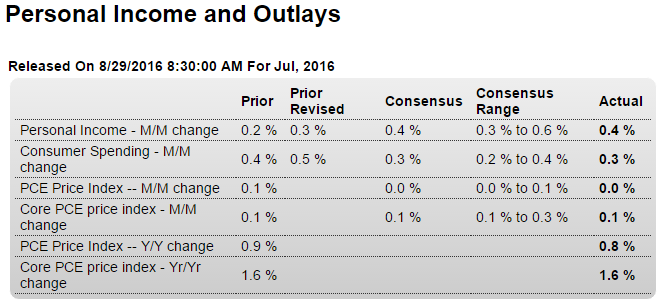

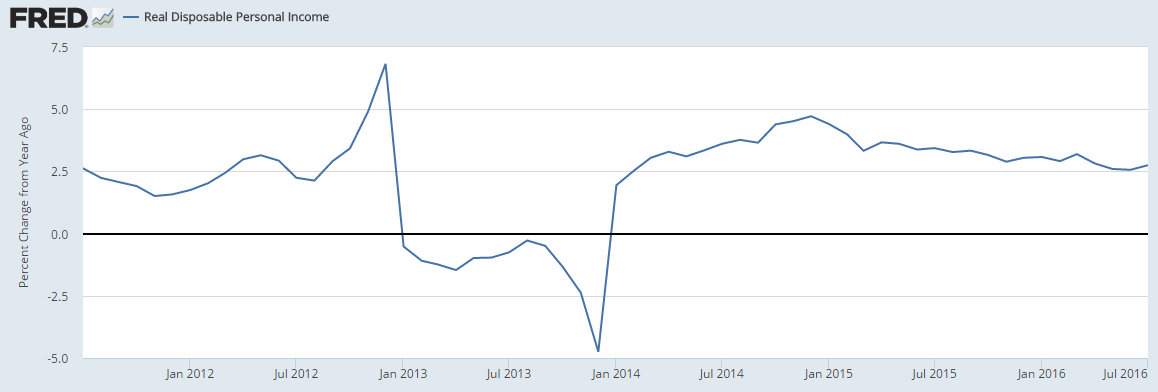

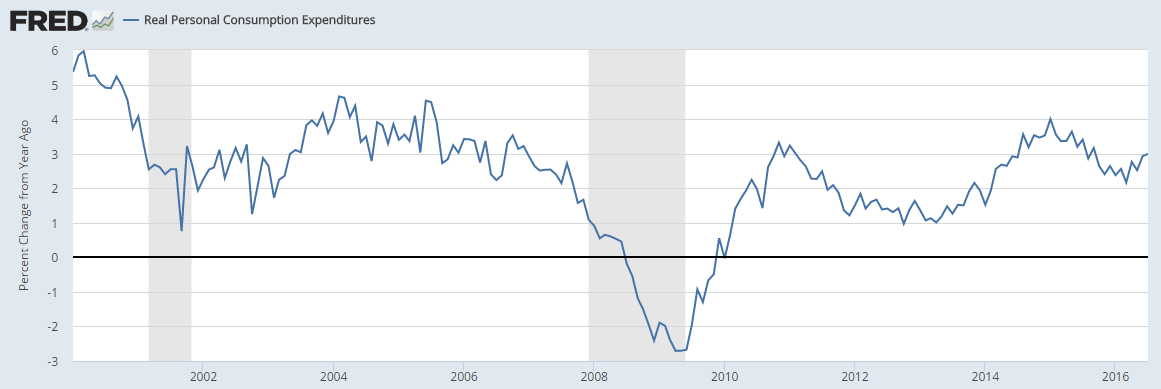

In line with expectations as real disposable income growth remains at or below ‘stall speed’, as per the charts. And the total growth of that measure of income since the 2008 peak remains very low. On the consumption side, the mini jump in auto sales provided the (small) boost for the month, though down year over year, and auto sales forecasts for August are all pointing to a resumption of weakness: Highlights Income picked up slightly in July and consumption slowed slightly in what was another constructive month for the consumer. Personal income rose 0.4 percent in the month with June revised 1 tenth higher to plus 0.3 percent. Income got another solid boost from wages & salaries which rose 0.5 percent for a second straight month. The consumer put some of this money into the bank with the savings rate rising 2 tenths to 5.7 percent. Consumer spending rose 0.3 percent in the month following 0.4 percent gains in the prior two months. Spending on durables got a big boost from the month’s strong auto sales while non-durables were pulled down by price effects for energy. Service spending was solid but down slightly from prior months. Price data are not showing any pressure, unchanged in the month for the overall PCE price index and up only 0.1 percent for the core index (ex-food ex-energy).

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

In line with expectations as real disposable income growth remains at or below ‘stall speed’, as per the charts. And the total growth of that measure of income since the 2008 peak remains very low. On the consumption side, the mini jump in auto sales provided the (small) boost for the month, though down year over year, and auto sales forecasts for August are all pointing to a resumption of weakness:

Highlights

Income picked up slightly in July and consumption slowed slightly in what was another constructive month for the consumer.

Personal income rose 0.4 percent in the month with June revised 1 tenth higher to plus 0.3 percent. Income got another solid boost from wages & salaries which rose 0.5 percent for a second straight month. The consumer put some of this money into the bank with the savings rate rising 2 tenths to 5.7 percent.

Consumer spending rose 0.3 percent in the month following 0.4 percent gains in the prior two months. Spending on durables got a big boost from the month’s strong auto sales while non-durables were pulled down by price effects for energy. Service spending was solid but down slightly from prior months.

Price data are not showing any pressure, unchanged in the month for the overall PCE price index and up only 0.1 percent for the core index (ex-food ex-energy). The year-on-year rate for the core PCE, which is the Fed’s central price gauge, is unchanged to extend a long string, stuck at 1.6 percent.

The respectable showings for income and spending are no surprise given the strong employment report for July, strength that is the underpinning of the consumer. The outlook for August will unfold this week, with vehicle sales on Thursday and the employment report on Friday.

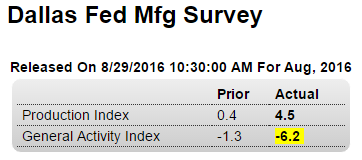

Production up a bit but General Activity Index down:

Highlights

There’s as many positives as negatives in the August manufacturing report from the Dallas Fed, which is a plus since negatives usually dominate this report. The production index rose more than 4 points to 4.5 while the new orders index jumped more than 13 points and is in positive ground at a modest but still respectable 5.3. Another positive is the future assessment of general activity, in positive ground for three months in a row and at 7.0 in August.

But there are negatives including the current assessment of general activity, falling nearly 4 points to minus 6.2 for the 20th straight negative result. Employment is at minus 5.0 and hours worked edged lower. Price data show pressure for inputs but continued declines for selling prices, all at the same time that wages & benefits continue to rise.

This along with the Kansas City Fed report have been depressed the past 2 years due to the drop in energy prices. But today’s report, though no better than mixed, does show signs of improvement, in a reminder of last week’s solid strength in the durable goods report.

United States Dallas Fed Manufacturing Index

The Federal Reserve Bank of Dallas’ general business activity index for manufacturing in Texas came in at -6.2 in August of 2016 from -1.3 in July, worse than market expectations of -3.9. Production (4.5 from 0.4 in July); new orders (5.3 from -8) and shipments (9.9 from 0.1) improved while job creation (-5 from -2.6) and hours worked (-4.5 from -0.2) worsened. The index of general business activity for the next six months fell to 7 from 18.4.