As previously discussed, jobless claims are down largely because they are a lot harder to get:https://www.bloomberg.com/view/articles/2016-11-02/the-good-news-on-jobs-isn-t-all-that-good And now they are going up a bit, though still very low historically: Highlights Jobless claims are holding at or near record lows, with initial claims up only 7,000 in the October 29 week and continuing claims down 14,000 in the October 22 week. The 4-week average for initial claims, now at 257,750, has trended for the last two months in the 255,000 area. Continuing claims have likewise been trending lower, at a new record low of 2.026 million. There are no special factors in today’s report where trends are pointing to strength in the labor market and suggest that employers are holding tightly onto their employees. This is the new one that tends to overstate: Highlights Growth in the nation’s service sector accelerated sharply in October based on Markit Economics’ U.S. sample where the final composite score is 54.8, unchanged from mid-month and up sharply from September’s 52.3. Strength in consumer spending is what respondents reported as well as a rise in both input costs and selling prices. New orders are at an 11-month high as is business activity while year-ahead expectations are at their best level in a year-and-a-half. Backlogs are also piling up.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

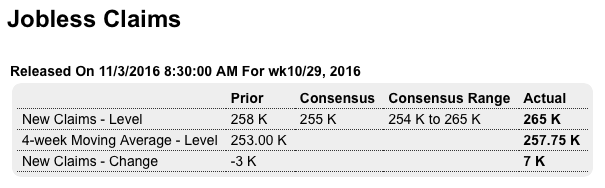

As previously discussed, jobless claims are down largely because they are a lot harder to get:

https://www.bloomberg.com/view/articles/2016-11-02/the-good-news-on-jobs-isn-t-all-that-good

And now they are going up a bit, though still very low historically:

Highlights

Jobless claims are holding at or near record lows, with initial claims up only 7,000 in the October 29 week and continuing claims down 14,000 in the October 22 week. The 4-week average for initial claims, now at 257,750, has trended for the last two months in the 255,000 area. Continuing claims have likewise been trending lower, at a new record low of 2.026 million. There are no special factors in today’s report where trends are pointing to strength in the labor market and suggest that employers are holding tightly onto their employees.

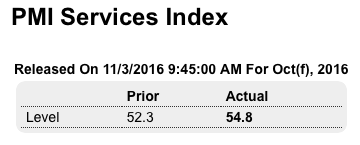

This is the new one that tends to overstate:

Highlights

Growth in the nation’s service sector accelerated sharply in October based on Markit Economics’ U.S. sample where the final composite score is 54.8, unchanged from mid-month and up sharply from September’s 52.3. Strength in consumer spending is what respondents reported as well as a rise in both input costs and selling prices. New orders are at an 11-month high as is business activity while year-ahead expectations are at their best level in a year-and-a-half. Backlogs are also piling up. This report points to a very solid fourth-quarter start for the bulk of the economy. Coming up next this morning will be ISM non-manufacturing which last month reported a very solid ending for the third-quarter.

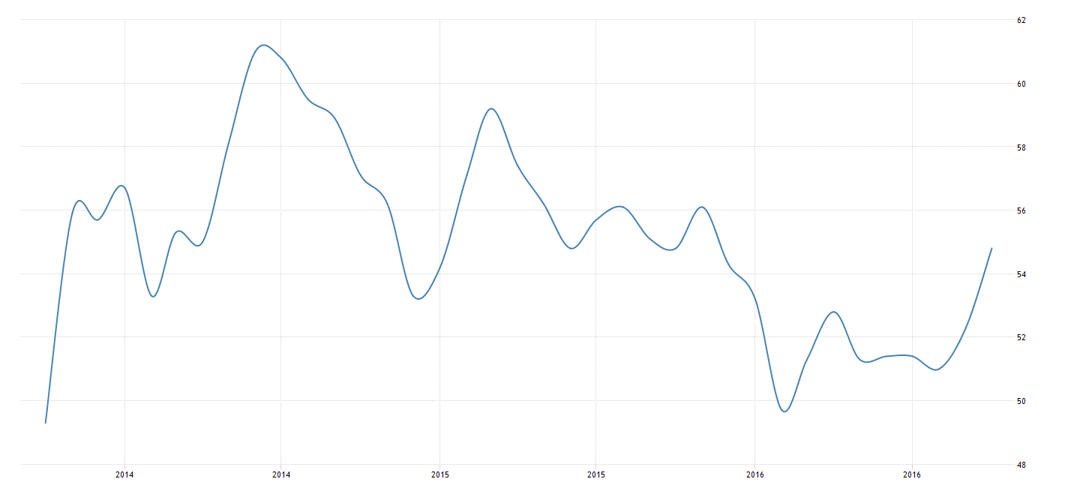

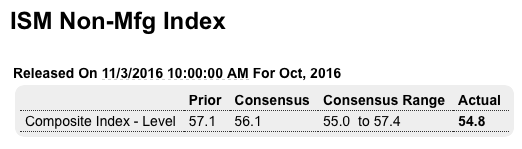

This is the older, more respected series:

Highlights

Much of the ISM non-manufacturing report, at a composite of 54.8, is strong with employment, however, an exception, down 4.1 points from September to a 53.1 level that points to a slower pace of hiring in October. But new orders are very solid, at 57.7 but again now from September’s 60.6. Business activity is also at 57.7 but is also down from September. Backlog orders grew for a second month and export orders remained solid and costs for the sample are up in another positive indication on demand. Employment growth may be down, but this report, like the services PMI earlier this morning, is pointing to a solid fourth-quarter start for the bulk of the economy.

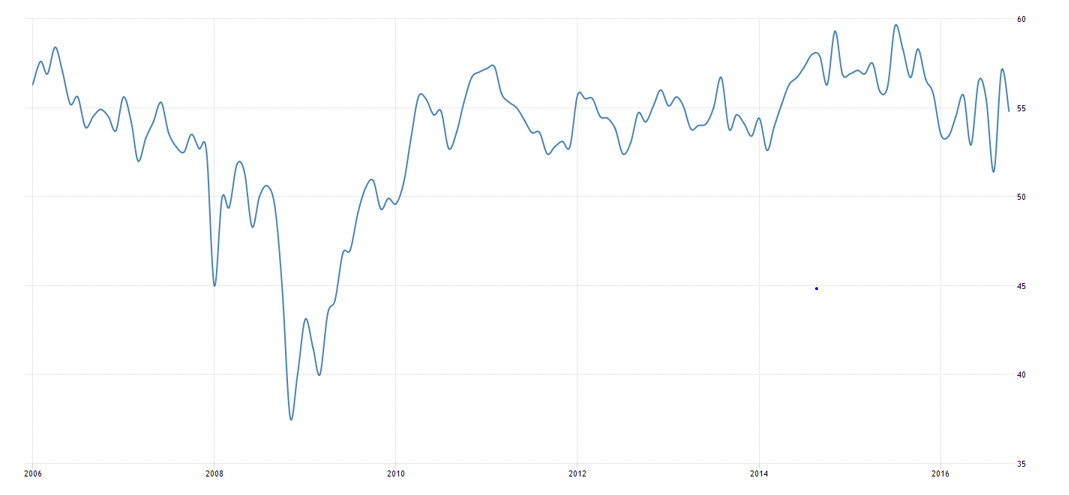

United States ISM Non Manufacturing PMI

The ISM Non-Manufacturing PMI index fell to 54.8 in October of 2016 from 57.1 in September and below market expectations of 56. Activity, new orders and employment grew at a sloer pace while prices increased for the seventh straight month.

As previously discussed, I expect the manufacturing sector to muddle through at its current, lower levels, as spending cuts shift to the service sector:

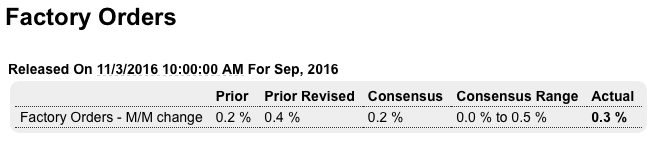

Highlights

Good news is hard to find in the September factory orders report which is best described as flat. New orders did rise, up a moderate 0.3 percent in the month, and the prior month’s gain is revised 2 tenths higher to 0.4 percent, but core capital goods orders (nondefense ex-aircraft) are down a sharp 1.3 percent and total unfilled orders keep contracting, down 0.4 percent for a fourth straight decline. Maybe the best news is that manufacturers are keeping their inventories down, unchanged in the month and down relative to shipments, to 1.34 from 1.35. Monday’s advance indications on October from the ISM don’t point to much change for a factory sector that continues to be held down by generally weak global demand and by weak investment in new equipment.