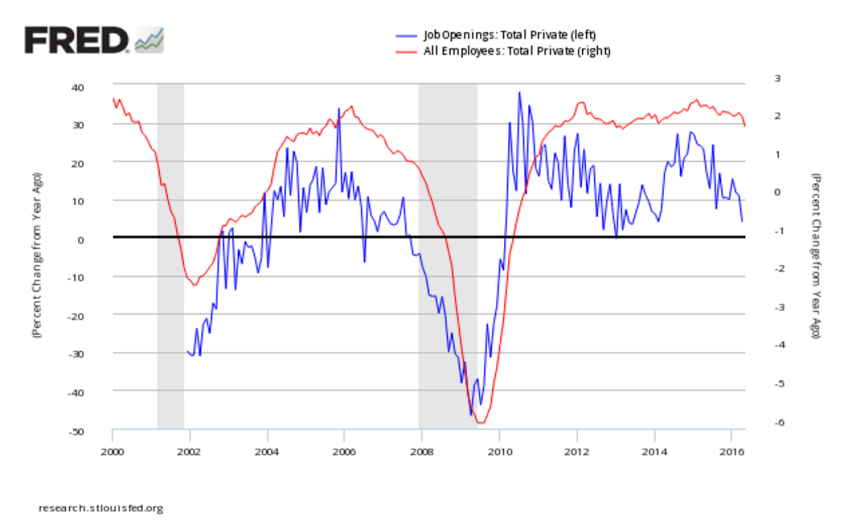

The deceleration in jobs openings released yesterday leads the deceleration in employment. Downward job revisions also mean lower income estimates, so watch for personal income and savings to be revised down as well. And it all started decelerating after oil capex collapsed at the end of 2014. Job Openings Hit Record High, But Hiring Fades In JOLTS Survey By Ed CarsonJune 8 (IBD) — Job openings matched a record high in April but hiring activity sank to the lowest since last August, the Labor Department said Wednesday in its Job Openings and Labor Turnover Summary report. The number of job openings rose by 118,000 to 5.788 million, equaling last July’s peak on records going back to 2001. Meanwhile, the actual number of hires slid by 198,000 to 5.092 million. Separations declined by 108,000 to 4.988 million. Layoffs fell to their lowest level since September 2014. The number of workers quitting their jobs dipped slightly. Claims remain depressed, best I can tell due to states making them so hard to get. This means the economy is deprived of the federal spending, making things worse:Inventories remain far too high even with the slightly lower 1.35% sales/inventory ratio. And the large sales increase was based on the April vs March car sales increase. So with the May vs April car sales flat, total sales growth looks to resume it’s prior slide, as per the chart.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

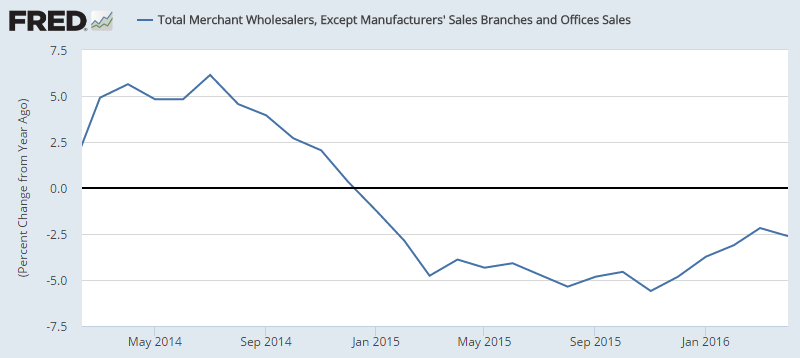

The deceleration in jobs openings released yesterday leads the deceleration in employment. Downward job revisions also mean lower income estimates, so watch for personal income and savings to be revised down as well. And it all started decelerating after oil capex collapsed at the end of 2014.

Job Openings Hit Record High, But Hiring Fades In JOLTS Survey

By Ed Carson

June 8 (IBD) — Job openings matched a record high in April but hiring activity sank to the lowest since last August, the Labor Department said Wednesday in its Job Openings and Labor Turnover Summary report. The number of job openings rose by 118,000 to 5.788 million, equaling last July’s peak on records going back to 2001. Meanwhile, the actual number of hires slid by 198,000 to 5.092 million. Separations declined by 108,000 to 4.988 million. Layoffs fell to their lowest level since September 2014. The number of workers quitting their jobs dipped slightly.

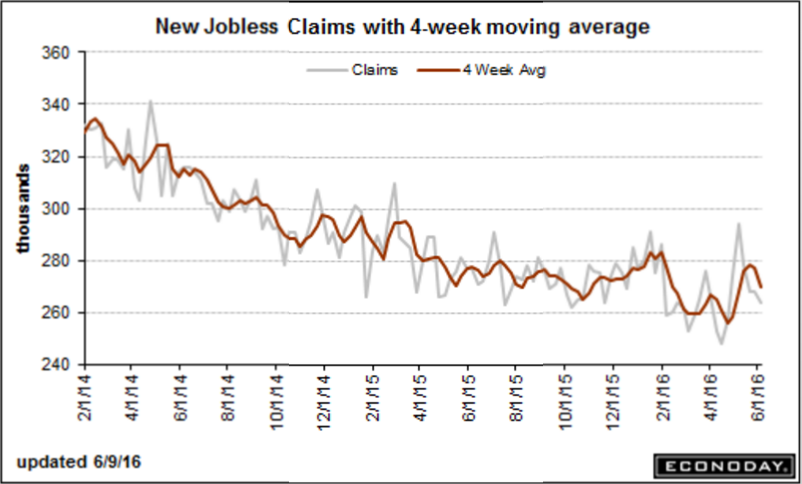

Claims remain depressed, best I can tell due to states making them so hard to get. This means the economy is deprived of the federal spending, making things worse:

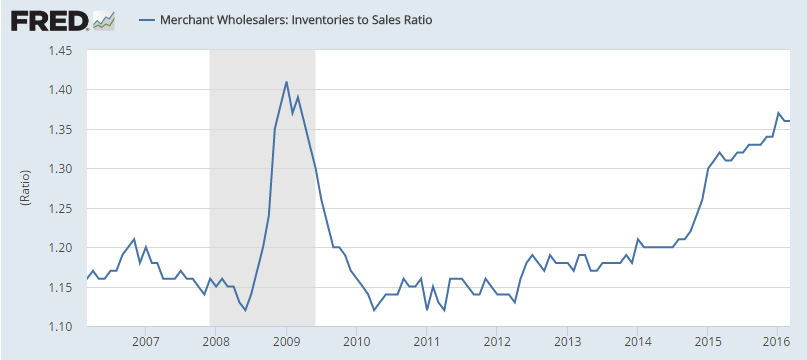

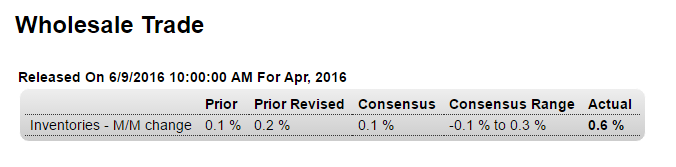

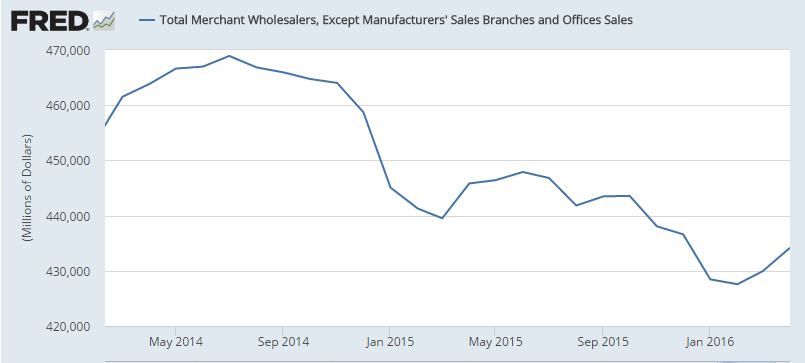

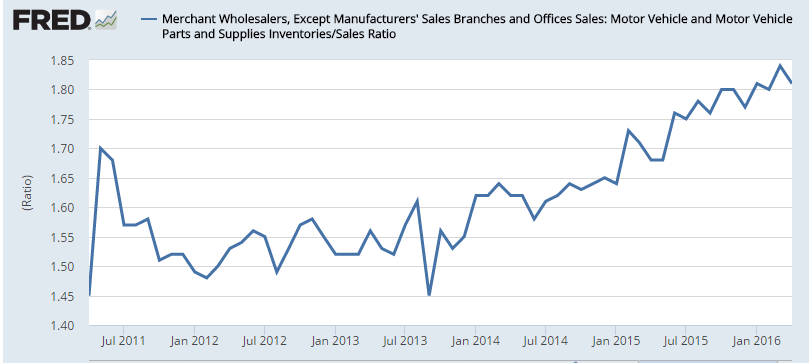

Inventories remain far too high even with the slightly lower 1.35% sales/inventory ratio. And the large sales increase was based on the April vs March car sales increase. So with the May vs April car sales flat, total sales growth looks to resume it’s prior slide, as per the chart. So while April may show some GDP strength due to inventory building, I expect it all to more than reverse by quarter end:

Highlights

Wholesales inventories rose a very sharp 0.6 percent in April in a result that will lift early estimates for second-quarter GDP. And the build (risking a double negative) is not unwanted as sales in the wholesale sector rose a very strong 1.0 percent. The mix actually points to a leaner level of inventories with the stock-to-sales ratio down to 1.35 from 1.36.

Sales of autos were especially strong in the wholesale sector during April, up 1.6 percent and making for a 0.4 percent decline in inventories in a draw that will, based on solid unit sales data for May, have to be replenished.

This doesn’t bode well either- inventories remain high given the pace of sales.

This hasn’t updated but it’s only down to 1.35: