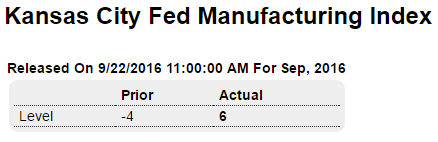

Better, apart from employment and prices, which happen to be the Fed’s mandate. So interesting that the KC Fed President wants to hike rates: Highlights Just about every month the Kansas City manufacturing index is in the negative column, but not in September which comes in at plus 6 for the second positive reading this year and the best reading since December 2014. New orders are sharply higher, at plus 12 vs August’s minus 7 with backlogs holding steady. Production and shipments are especially strong this month, at plus 15 and plus 16 vs negative readings in August. Employment, however, is still contracting, at minus 3. Prices are very soft especially selling prices which are at minus 7 for a second straight month. Kansas City, like the Dallas region, has been getting hit hard by low energy and commodity prices though this report does mark a rare respite.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Better, apart from employment and prices, which happen to be the Fed’s mandate. So interesting that the KC Fed President wants to hike rates:

Highlights

Just about every month the Kansas City manufacturing index is in the negative column, but not in September which comes in at plus 6 for the second positive reading this year and the best reading since December 2014. New orders are sharply higher, at plus 12 vs August’s minus 7 with backlogs holding steady. Production and shipments are especially strong this month, at plus 15 and plus 16 vs negative readings in August. Employment, however, is still contracting, at minus 3. Prices are very soft especially selling prices which are at minus 7 for a second straight month. Kansas City, like the Dallas region, has been getting hit hard by low energy and commodity prices though this report does mark a rare respite.

Slides from yesterday’s presentation: