The Fed’s labor market index is showing some slack: Labor Market Conditions IndexHighlightsEmployment has been strong, especially the participation rate, but isn’t being reflected in the Federal Reserve’s labor market conditions index which came in at minus 2.1 in March vs a downwardly revised 2.5 percent decline in February. The index, experimental in nature, is a broad composite of 19 separate indicators and is rarely cited by policy makers. Another bad one, on the heels of very weak auto sales. And even though inventories are now falling, shipments and sales are falling just as fast, keeping the inventory to shipments and sales ratios at elevated levels: Factory OrdersHighlightsFactory orders fell 1.7 percent in February, more than reversing what was a strong January which, however, is revised 4 tenths lower to a gain of 1.2 percent. February weakness includes a 0.4 percent drop in non-durable orders, one that reflects weakness in petroleum and coal products, and a steep 3.0 percent decline in durable orders which are revised 2 tenths lower from the advance release of minus 2.8 percent.The February report makes for uncomfortable reading with orders for core capital goods falling 2.5 percent and pointing to continuing trouble for business investment. Other readings include a sharp 0.7 percent fall for total shipments, a 0.3 percent fall for unfilled orders, and a 0.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

The Fed’s labor market index is showing some slack:

Labor Market Conditions Index

Highlights

Employment has been strong, especially the participation rate, but isn’t being reflected in the Federal Reserve’s labor market conditions index which came in at minus 2.1 in March vs a downwardly revised 2.5 percent decline in February. The index, experimental in nature, is a broad composite of 19 separate indicators and is rarely cited by policy makers.

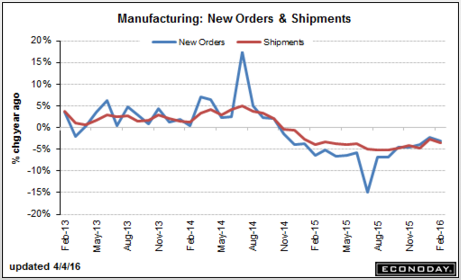

Another bad one, on the heels of very weak auto sales. And even though inventories are now falling, shipments and sales are falling just as fast, keeping the inventory to shipments and sales ratios at elevated levels:

Factory Orders

Highlights

Factory orders fell 1.7 percent in February, more than reversing what was a strong January which, however, is revised 4 tenths lower to a gain of 1.2 percent. February weakness includes a 0.4 percent drop in non-durable orders, one that reflects weakness in petroleum and coal products, and a steep 3.0 percent decline in durable orders which are revised 2 tenths lower from the advance release of minus 2.8 percent.The February report makes for uncomfortable reading with orders for core capital goods falling 2.5 percent and pointing to continuing trouble for business investment. Other readings include a sharp 0.7 percent fall for total shipments, a 0.3 percent fall for unfilled orders, and a 0.4 percent fall for inventories though the latter is actually a positive given the decline in shipments and keeps the inventory-to-shipments ratio at 1.37.

This year’s fall in the dollar did nothing to visibly boost February’s data though there are hints of relief in last week’s giant surge for the ISM new orders index, one that points to a significant rebound in this report for March.

Durable Goods Orders -3.0% in Feb.

New orders for manufactured durable goods in February, down three of the last four months, decreased $7.0 billion or 3.0% to $229.1 billion, down from the previously published 2.8% decrease. This followed a 4.3% January increase.