Down 5% after last week’s up 5%… ;) MBA Mortgage Applications Note that the total is in decline:This (limited) measure of retail sales is still depressed and weakening as well:Two manufacturing indexes out today. The first was slightly lower than last month and trending down: PMI Manufacturing IndexHighlightsMarkit Economics’ U.S. manufacturing sample continues to report nearly dead flat conditions, at a final May index of 50.7 which compares with 50.5 for the mid-month flash and a final 50.8 for April. Production is in outright contraction (below 50) for the first time in 6-1/2 years as growth in new orders is as slow as it’s been all year. Export orders posted a marginal drop while total backlog orders are also down. The sample, however, increased hiring in an anomaly that won’t likely last given the weakness in orders. Efforts to slow inventory accumulation contributed to the decline in production. Price data include an uptick in input costs, tied in part to higher steel prices, but little change for selling prices which is actually an improvement following three straight months of decline.Negative factors cited by the sample include weak capital investment across the energy sector, uncertainty related to the presidential election and generally subdued economic conditions. Coming up on the calendar at 10:00 a.m.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

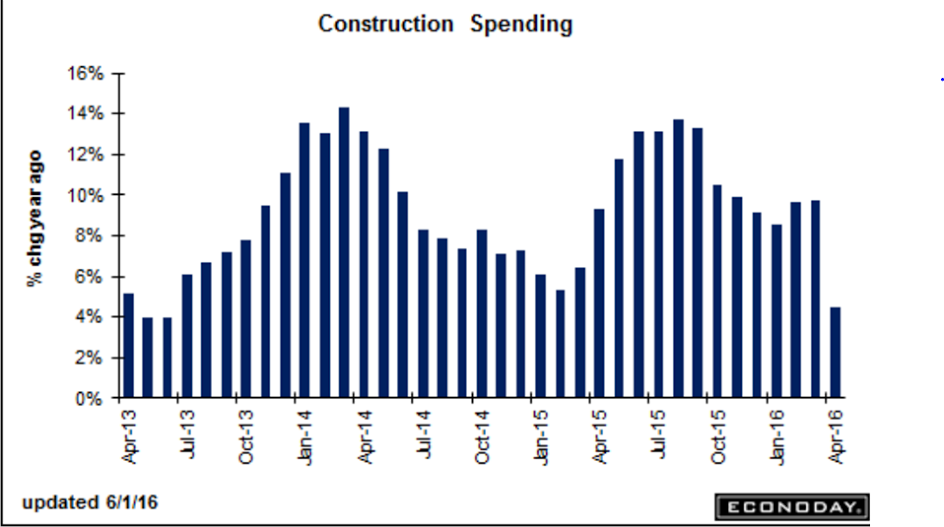

Down 5% after last week’s up 5%… ;)

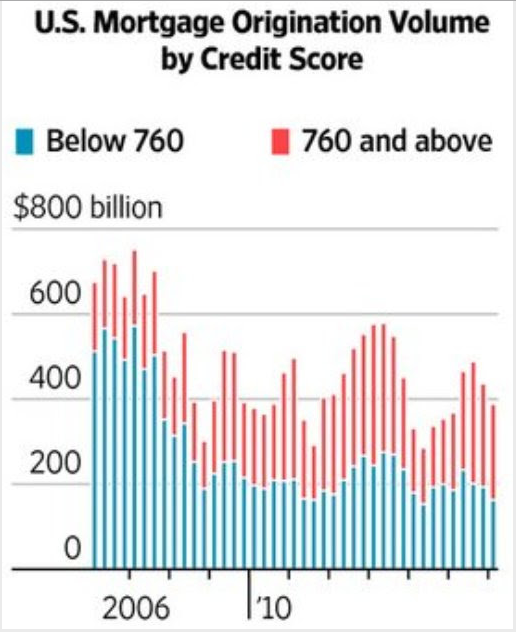

MBA Mortgage Applications

Note that the total is in decline:

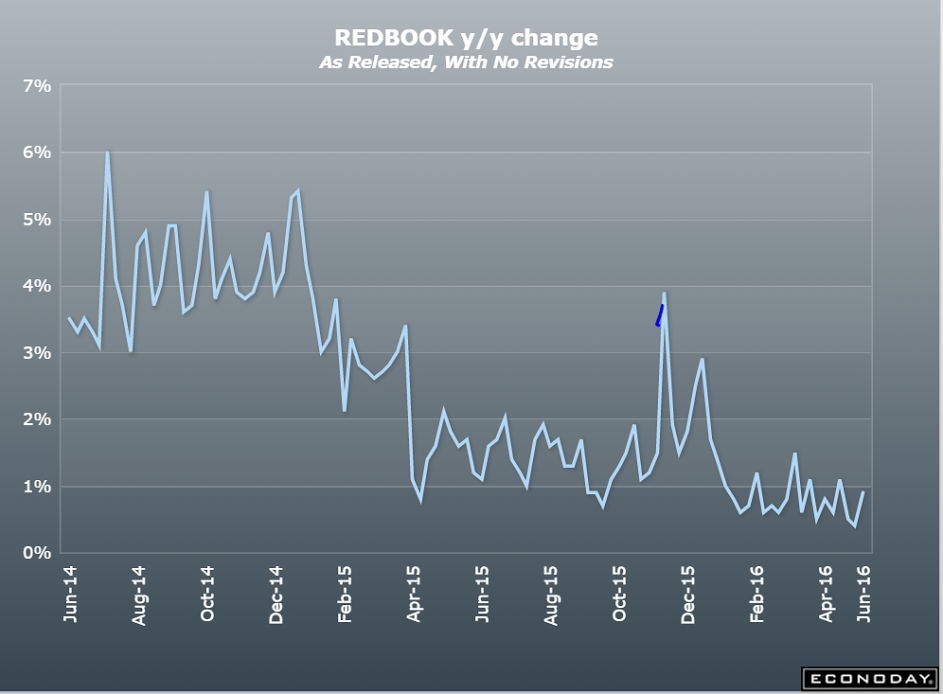

This (limited) measure of retail sales is still depressed and weakening as well:

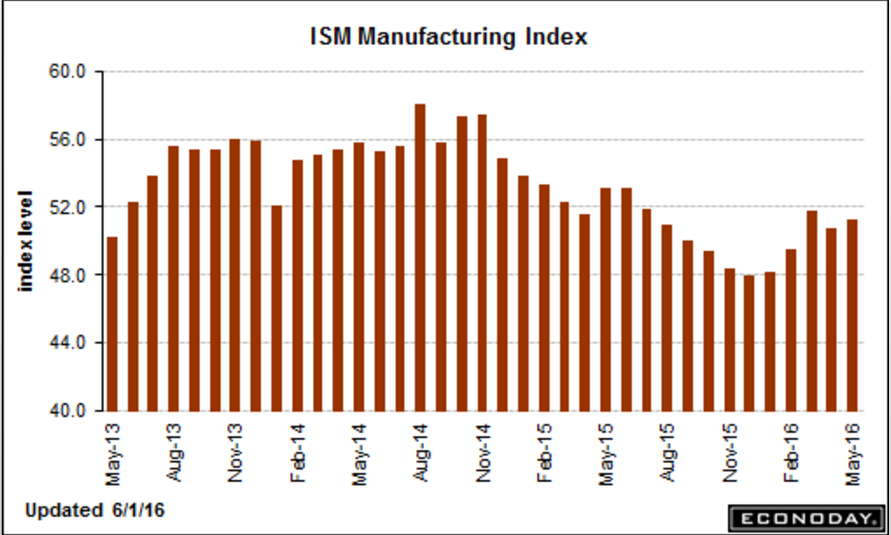

Two manufacturing indexes out today.

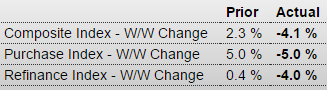

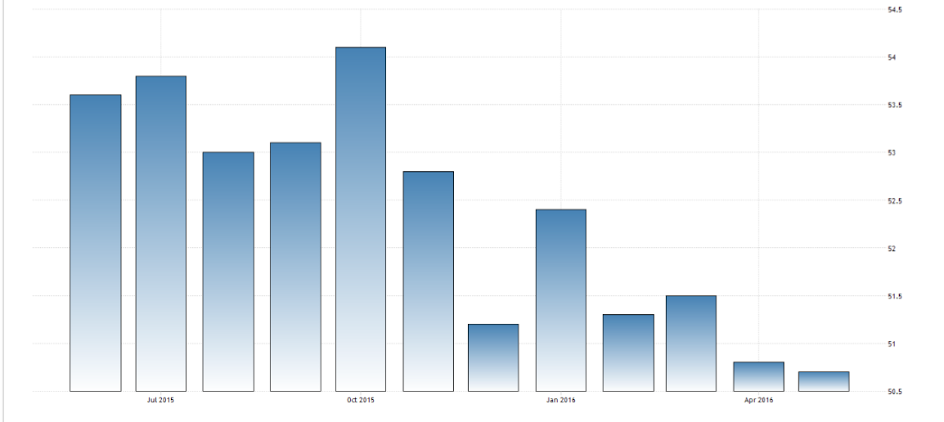

The first was slightly lower than last month and trending down:

PMI Manufacturing Index

Highlights

Markit Economics’ U.S. manufacturing sample continues to report nearly dead flat conditions, at a final May index of 50.7 which compares with 50.5 for the mid-month flash and a final 50.8 for April. Production is in outright contraction (below 50) for the first time in 6-1/2 years as growth in new orders is as slow as it’s been all year. Export orders posted a marginal drop while total backlog orders are also down. The sample, however, increased hiring in an anomaly that won’t likely last given the weakness in orders. Efforts to slow inventory accumulation contributed to the decline in production. Price data include an uptick in input costs, tied in part to higher steel prices, but little change for selling prices which is actually an improvement following three straight months of decline.Negative factors cited by the sample include weak capital investment across the energy sector, uncertainty related to the presidential election and generally subdued economic conditions. Coming up on the calendar at 10:00 a.m. ET will be the closely watched ISM manufacturing index which forecasters see coming in very close to this report, at a consensus 50.6.

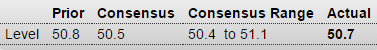

The second was up some from last month but still relatively weak:

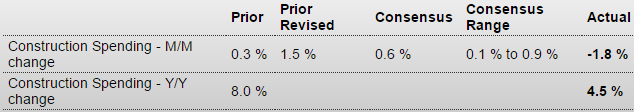

Construction was way down, which is not at all good for GDP:

Construction Spending

Highlights

A major downturn for construction spending in April is offset to a large degree by a major upward revision to the prior month. Construction spending fell 1.8 percent in April for the worst reading since January 2011. But March’s gain, initially at only plus 0.3 percent, is now plus 1.5 percent. And February is also revised higher, up 4 tenths to plus 1.4 percent. Still, the year-on-year rate does point to slowing, at plus 4.5 percent which is down from a long run in the high single digits and the lowest since June 2013.