From the MBA: The Refinance Index increased 7 percent from the previous week. The seasonally adjusted Purchase Index increased 12 percent from one week earlier. The unadjusted Purchase Index decreased 12 percent compared with the previous week and was 6 percent lower than the same week one year ago. HighlightsPurchase applications for home mortgages rose strongly in the June 3 week and were up 12 percent from the prior week when seasonally adjusted to account for the Memorial Day holiday, while refinancing increased by 7 percent. Unadjusted, however, purchase applications decreased by 12 percent from the previous week. Mortgage activity continues to benefit from very low rates, with the average 30-year mortgage rate for conforming loans (7,000 or less) down 2 basis points from the prior week at 3.83 percent. Productivity is output per employee. So as output growth slows, productivity declines and unit labor costs increase until employment growth is reduced. So looks to me like the slowing of output growth and declining productivity lead to the employment declines. And it’s a continuing process: Weak Productivity, Rising Wages Putting Pressure on U.S. Companies By Josh MitchellJune 7 (WSJ) — Labor productivity fell at a 0.6% annual rate in the first quarter. Productivity grew an average 2.2% since World War II but has expanded just 0.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

From the MBA:

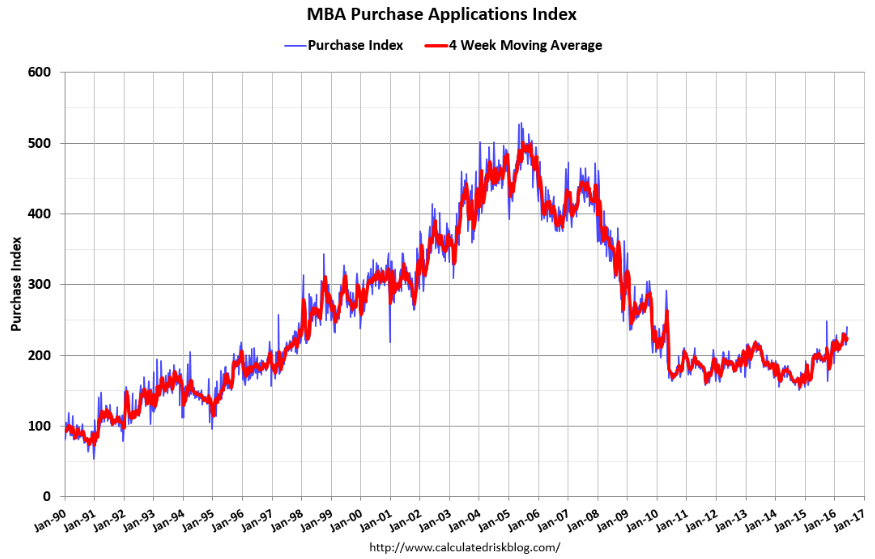

The Refinance Index increased 7 percent from the previous week. The seasonally adjusted Purchase Index increased 12 percent from one week earlier. The unadjusted Purchase Index decreased 12 percent compared with the previous week and was 6 percent lower than the same week one year ago.

Highlights

Purchase applications for home mortgages rose strongly in the June 3 week and were up 12 percent from the prior week when seasonally adjusted to account for the Memorial Day holiday, while refinancing increased by 7 percent. Unadjusted, however, purchase applications decreased by 12 percent from the previous week. Mortgage activity continues to benefit from very low rates, with the average 30-year mortgage rate for conforming loans ($417,000 or less) down 2 basis points from the prior week at 3.83 percent.

Productivity is output per employee. So as output growth slows, productivity declines and unit labor costs increase until employment growth is reduced.

So looks to me like the slowing of output growth and declining productivity lead to the employment declines.

And it’s a continuing process:

Weak Productivity, Rising Wages Putting Pressure on U.S. Companies

By Josh Mitchell

June 7 (WSJ) — Labor productivity fell at a 0.6% annual rate in the first quarter. Productivity grew an average 2.2% since World War II but has expanded just 0.5% over the last five years. Hourly compensation, encompassing everything from salaries to retirement benefits and health care costs, surged at a 3.9% annual rate in the first quarter. It rose 3.7% over the past year. In the first quarter, labor costs per unit of output rose 4.5% at a yearly rate and 3% from a year earlier. Fed Chairwoman Janet Yellen said on Monday she was “cautiously optimistic” that productivity would return to faster growth.

Seems there might be a lot more slack than most have been estimating:

US unemployed have quit looking for jobs at a ‘frightening’ level: Survey

By Jeff Cox

June 8 (CNBC) — Nearly half of unemployed Americans have quit looking for work, and the numbers are even worse for the long-term jobless, according to a poll released Wednesday that paints a grim picture of the labor market.

Some 59 percent of those who have been out of work for two years or more say they have stopped looking, the Harris Poll of unemployed Americans showed. Overall, 43 percent of the jobless said they have given up, according to the poll released in conjunction with Express Employment Professionals, a job placement service.

“This is a tale of two economies,” Express CEO Bob Funk said in a statement. “It’s frightening to see this many people who could work say they have given up.”

The results come just a few days after a government report showed thatthe unemployment rate fell to 4.7 percent in May, but the drop came primarily because of a sharp decline in the labor force participation rate. The number of people of all ages whom the government considers “not in the labor force” swelled by 664,000 to a record 94.7 million Americans, according to Labor Department data.

Recent paper I co authored, Maximizing Price Stability in a Monetary Economy