If rates were being raised due to excess demand for mortgages the higher rates wouldn’t likely slow things down. But in this case demand has been relatively low, so the jump in rates not due to demand will likely slow demand: Highlights Purchase applications for home mortgages fell a seasonally adjusted 6 percent in the November 11 week as a sharp increase in mortgage rates took its toll on application activity. The rise in rates had an even greater impact on refinancing, where applications fell by 11 percent from the prior week. The weekly decline put the Purchase Index just 3 percent above the level a year ago, down 8 percentage points from the prior week. The average interest rate on 30-year fixed-rate conforming mortgages (7,000 or less) rose 18 basis points to 3.95 percent.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

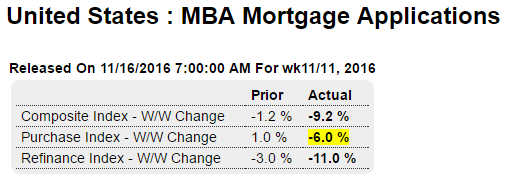

If rates were being raised due to excess demand for mortgages the higher rates wouldn’t likely slow things down. But in this case demand has been relatively low, so the jump in rates not due to demand will likely slow demand:

Highlights

Purchase applications for home mortgages fell a seasonally adjusted 6 percent in the November 11 week as a sharp increase in mortgage rates took its toll on application activity. The rise in rates had an even greater impact on refinancing, where applications fell by 11 percent from the prior week. The weekly decline put the Purchase Index just 3 percent above the level a year ago, down 8 percentage points from the prior week. The average interest rate on 30-year fixed-rate conforming mortgages ($417,000 or less) rose 18 basis points to 3.95 percent.

Spike in Mortgage Rates Throws a Wrench Into U.S. Housing Market

By Vince Golle

Prashant GopalNov 15 (Bloomberg) —

Higher borrowing costs limit some buyers, could slow building Price gains may weaken as people seek smaller, cheaper homes The spike in borrowing costs in response to President-elect Donald Trump’s pro-growth agenda is causing some heartburn in America’s housing industry.

San Diego mortgage broker Shanne Sleder said a third of his clients, many of whom were already stretching budgets to buy homes in pricey southern California, are having to reconsider what they can afford as rates soar.

“With a number of the people we were in the middle of pre-approving, as rates are going up, it’s getting tighter and tighter qualifying them,” Sleder said. He’s urging them to lock in rates. “In some cases, the higher rates are making it so they are not as comfortable with the payment.”

Not so good here either:

Highlights

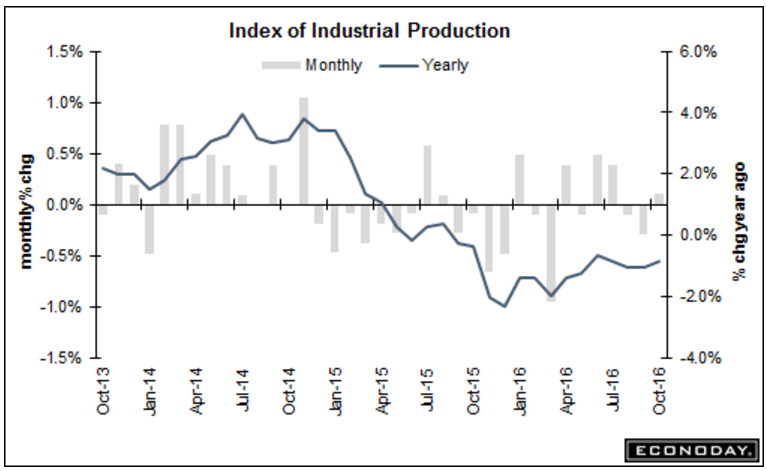

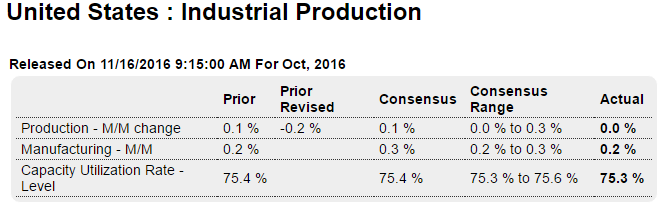

The headline isn’t as bad as it looks as the manufacturing component of the industrial production report moved forward for a second month. Industrial production was unchanged in October with September, reflecting downgrades to both utility and mining production, revised a sharp 3 tenths lower to minus 0.2 percent. But manufacturing volumes firmed again, up 0.2 percent for a second straight month.

Vehicle production was very strong in October, up 0.9 percent to extend a long line of impressive gains. Year-on-year, vehicles are up a very solid 5.0 percent and are eclipsed only by the 6.7 percent gain for the selected hi-tech component which rose 1.0 percent in October to extend its run of impressive gains. Another positive is a 0.2 percent gain for business equipment which has otherwise been weak most of the year.

September’s mining output is revised to a 0.4 percent decline from an initial 0.4 percent gain. But October was a very good month for the sector as output jumped 2.1 percent for the largest monthly increase in 2-1/2 years and reflecting gains for coal. Mining’s year-on-year rate, however, remains well underwater at minus 7.0 percent. Utilities output, reflecting the nation’s unseasonably warm weather, fell 2.6 percent in October with September revised to minus 3.0 percent from an initial minus 1.0 percent.

Overall capacity utilization fell 1 tenth in the month to 75.3 percent though manufacturing, once gain, is positive, up 1 tenth to 74.9 percent. The factory sector has been flat all year but there have been recent signs of life, from this report as well as regional reports including from the Philly Fed whose November’s data will be posted tomorrow.