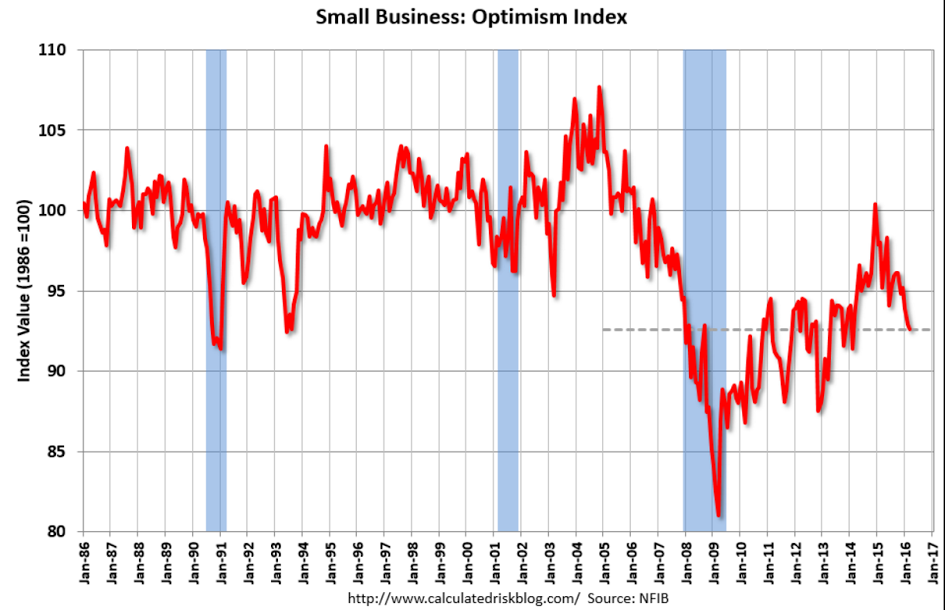

When this we going up a bit it made headlines. Now when it’s flashing recession it doesn’t: NFIB Small Business Optimism IndexHighlightsSmall business owners remain pessimistic, with the small business optimism index dipping another 0.3 points in March to 92.6, surpassing February’s two year low and remaining well below the 42-year average of 98. Four of the 10 component indices posted a gain and six posted declines. Among the most optimistic parts of the index, plans to increase capital outlays rose to remain at very solid levels while the job openings were a little less hard to fill in March, but still very hard. But earnings trends continued turning from bad to worse in March, and though small business owners were more optimistic than in February in their expectations that the economy will improve, this component of the index is still in deep pessimistic territory at a net negative 17 percent.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

When this we going up a bit it made headlines. Now when it’s flashing recession it doesn’t:

NFIB Small Business Optimism Index

Highlights

Small business owners remain pessimistic, with the small business optimism index dipping another 0.3 points in March to 92.6, surpassing February’s two year low and remaining well below the 42-year average of 98. Four of the 10 component indices posted a gain and six posted declines. Among the most optimistic parts of the index, plans to increase capital outlays rose to remain at very solid levels while the job openings were a little less hard to fill in March, but still very hard. But earnings trends continued turning from bad to worse in March, and though small business owners were more optimistic than in February in their expectations that the economy will improve, this component of the index is still in deep pessimistic territory at a net negative 17 percent.

Below prior recession levels:

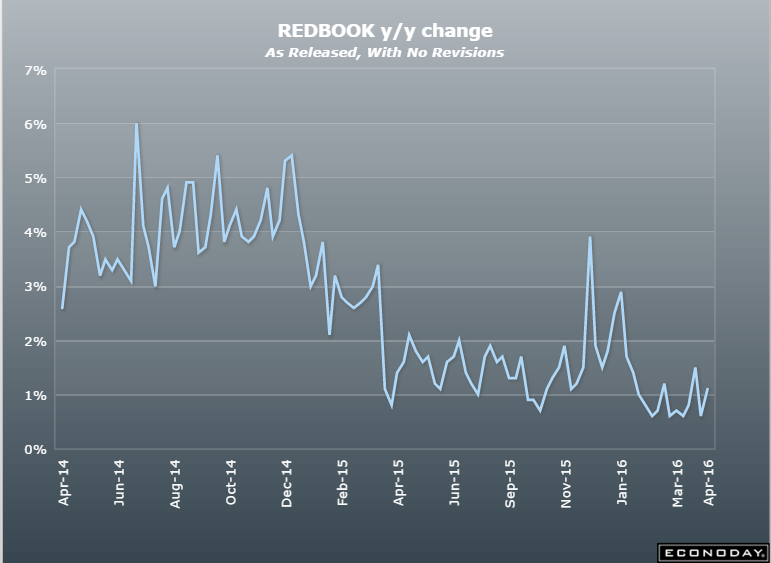

And no upturn hear yet:

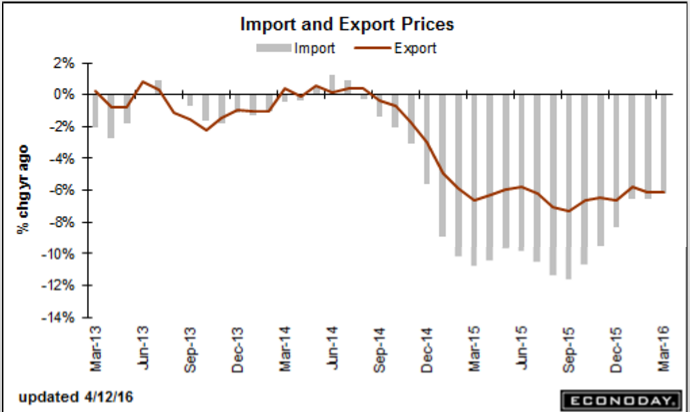

Deflationary pressures continue: