Manufacturing historically just chugs along at maybe a 3% growth rate or so. However as oil capital expenditures collapsed, manufacturing ratcheted down accordingly. And now it looks like it may be resuming it’s traditional modest growth rate from a much lower base than otherwise. This is not to say that the reduction in spending on capex is being replaced, as the spending deficiency now continues after having spread to the (much larger) service sector. Still on the low side but better than expected: HighlightsThe final manufacturing PMI for June is little changed from the flash, down 1 tenth to a 51.3 level that points to no more than modest growth for the sector. But the news is mostly good in June, at least compared to May when the index was even weaker at 50.7. June saw a pickup in new orders and a 2-year high in export growth. Production was also up as was employment. But inventories were down as the sample, in a defensive move, keeps a lid on restocking. Coming up next is the closely watched ISM manufacturing where a modest 51.5 headline is expected. This chart is about a month old:Also better than expected: HighlightsISM’s sample is reporting significant acceleration to a level that is still, however, no more than moderate. The index easily beat expectations, at 53.2 in June and the best reading since February last year.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Manufacturing historically just chugs along at maybe a 3% growth rate or so. However as oil capital expenditures collapsed, manufacturing ratcheted down accordingly. And now it looks like it may be resuming it’s traditional modest growth rate from a much lower base than otherwise. This is not to say that the reduction in spending on capex is being replaced, as the spending deficiency now continues after having spread to the (much larger) service sector.

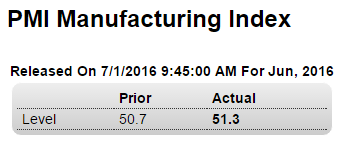

Still on the low side but better than expected:

Highlights

The final manufacturing PMI for June is little changed from the flash, down 1 tenth to a 51.3 level that points to no more than modest growth for the sector. But the news is mostly good in June, at least compared to May when the index was even weaker at 50.7. June saw a pickup in new orders and a 2-year high in export growth. Production was also up as was employment. But inventories were down as the sample, in a defensive move, keeps a lid on restocking. Coming up next is the closely watched ISM manufacturing where a modest 51.5 headline is expected.

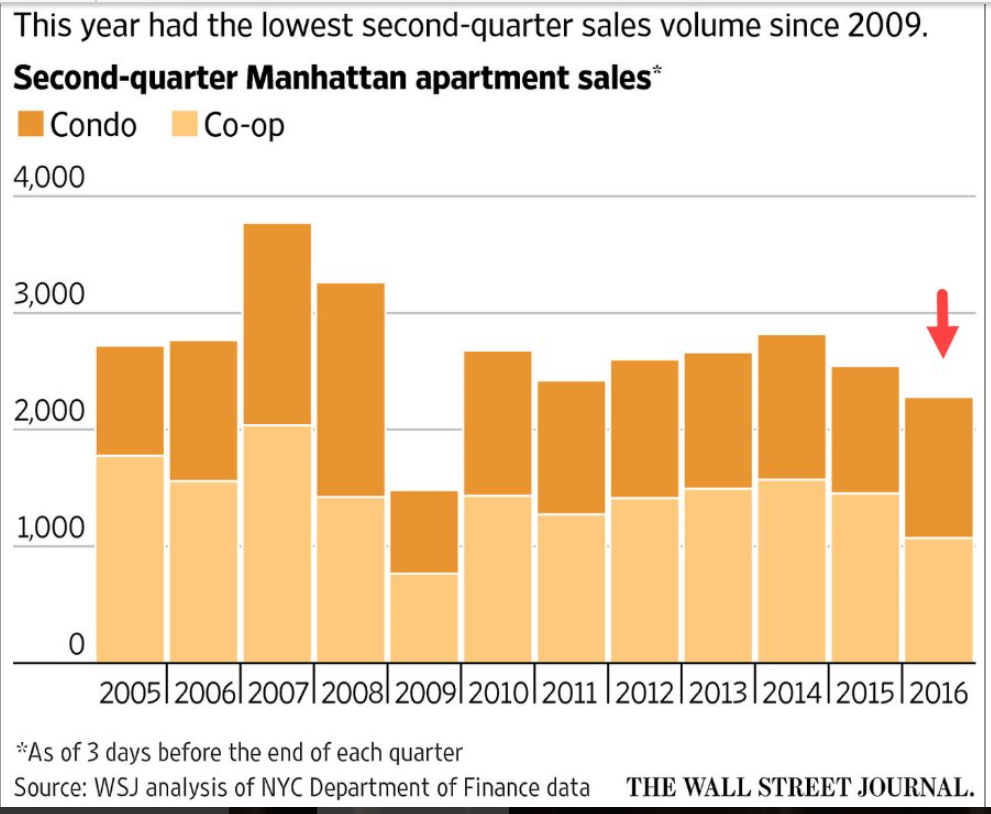

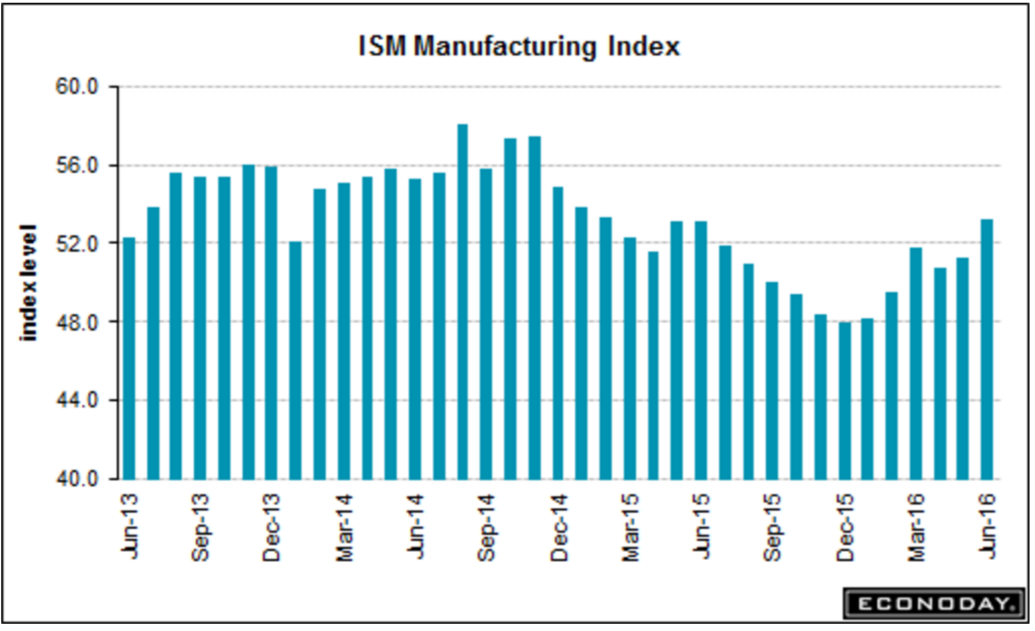

This chart is about a month old:

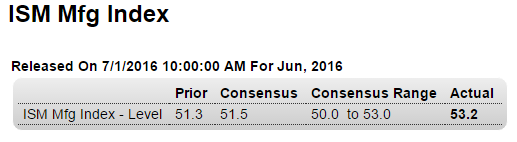

Also better than expected:

Highlights

ISM’s sample is reporting significant acceleration to a level that is still, however, no more than moderate. The index easily beat expectations, at 53.2 in June and the best reading since February last year. New orders are especially solid, at 57.0 for a 1.3 point gain and the best reading since March. And export orders are keeping up, 1.0 point higher at 53.5 for the 4th straight plus-50 showing. Production is active, inventories may be on the climb, but employment is flat. A negative for profits but a plus for the inflation outlook is continued pressure in raw material costs. New orders are very closely watched in this report and the strength will lift expectations for June’s factory data.

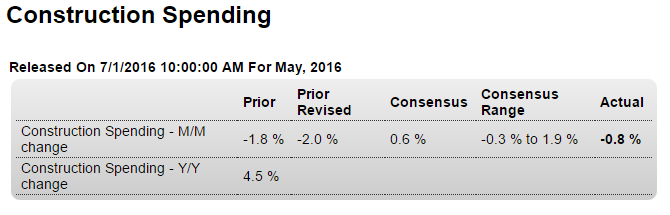

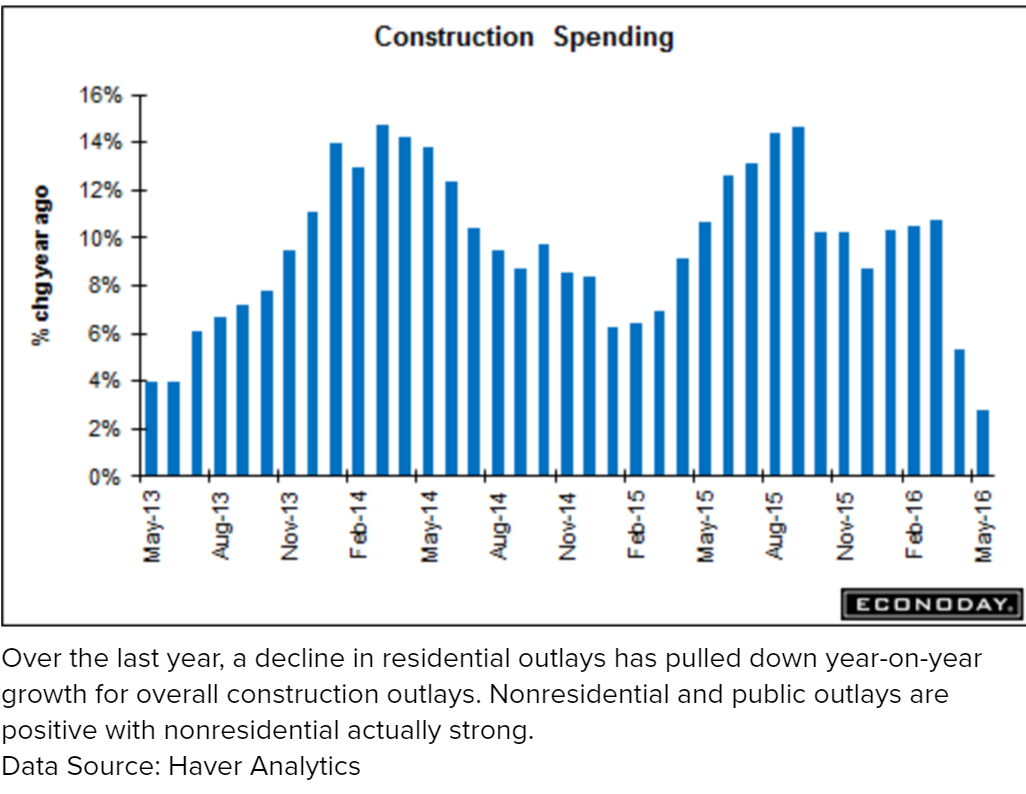

Growth in construction spending continues its decline, as this hope as a driver of positive growth continues to disappoint:

Highlights

Construction spending proved surprisingly weak in May, down 0.8 percent vs expectations for a 0.6 percent gain. The decline follows an even steeper and downwardly revised 2.0 percent drop in April. Spending on single-family homes, despite the rise underway in housing starts, fell 1.3 percent in May for a third straight decline with the year-on-year gain moving slightly lower to a still constructive 6.3 percent. Spending on multi-family homes has been much stronger, up 1.8 percent in the month for a 23.9 percent year-on-year gain.Construction spending on non-housing has been very soft with May down 0.7 percent following April’s 0.1 percent dip. Year-on-year, private nonresidential spending is up 3.9 percent led by the office category and pulled down by manufacturing. Public spending on buildings and highways has been flat to slightly negative.

Housing is on the climb this year but a gradual one, which has its positives given the bubbles of the past. The construction sector as a whole still looks to be a positive contributor to overall economic growth.

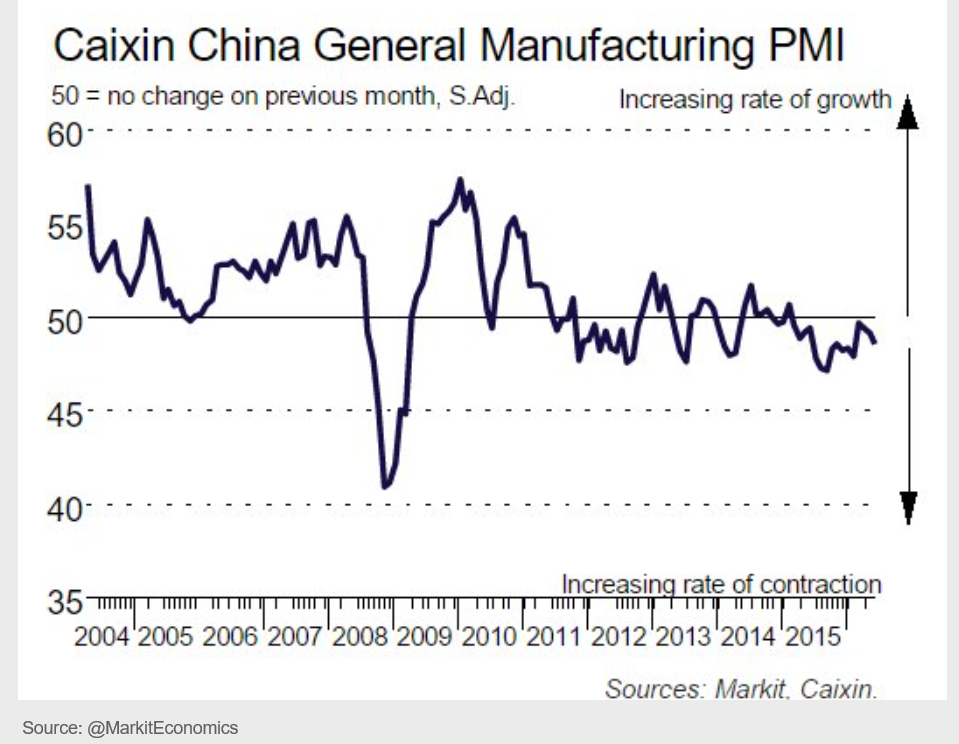

Remember when markets cared about China’s economy?

;)

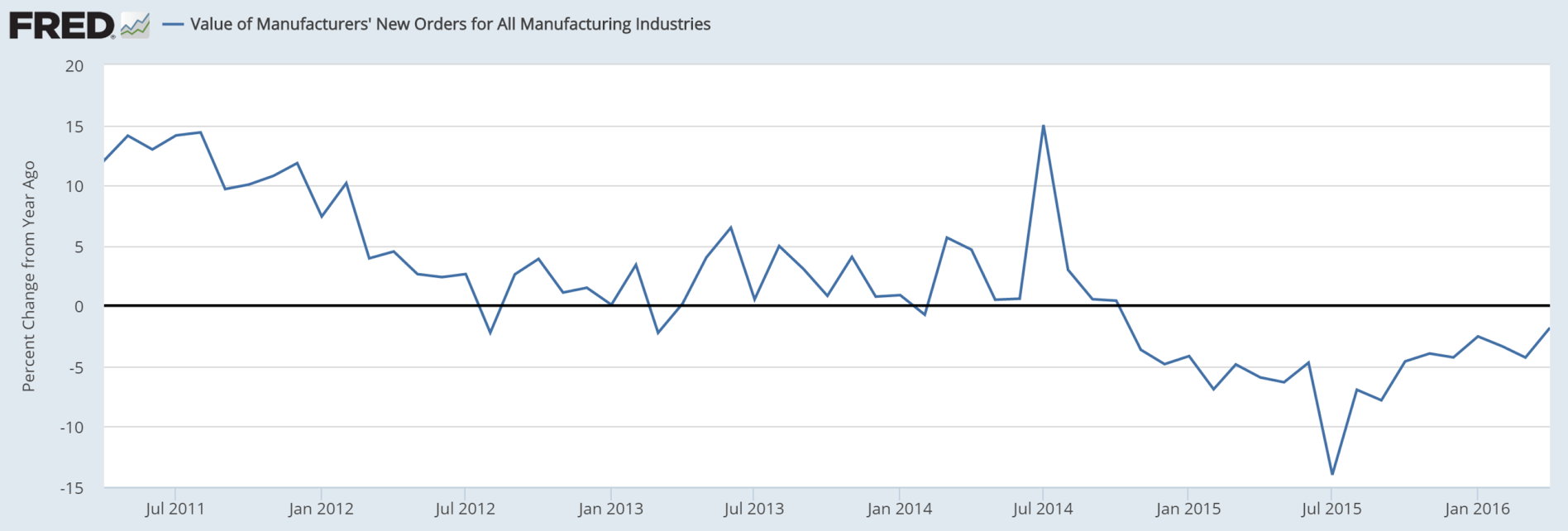

Looks like the collapse in oil capex hit the NYC rentiers as well ;):