Less than the expected 55.2 as weakness in the services sector continues, and as post election hopes fade: Highlights Growth in new orders, though still near a 12-month high, has slowed so far this month, pulling down the flash services PMI for December by more than 1 point to 53.4. But, given the comparison with November’s unusual strength in new orders, the slowing is deceptive. Other readings in the report are clearly favorable including a gain in backlogs that has triggered a gain in hiring. Optimism is still weaker than average but is up from the record lows hit in June, boosted by orders and also by expectations for greater economic strength in the year ahead. Price data are also coming alive, with input costs up and selling prices showing rare traction. Despite the strength, today’s report will likely lower expectations for December’s ISM non-manufacturing report which was also unusually strong in November (the ISM will be posted in the first week of January). Coming back some from a drop of maybe 0 billion, so this increase will just be a drop in the bucket at this point: North American E&Ps Forecast to Boost Capex For First Time Since 2014, With U.S. Rising 24.5% By Carolyn Davis Dec 19 (NaturalGasIntel) — North America will spearhead a recovery in global upstream investment in 2017, with U.S.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

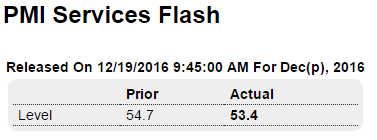

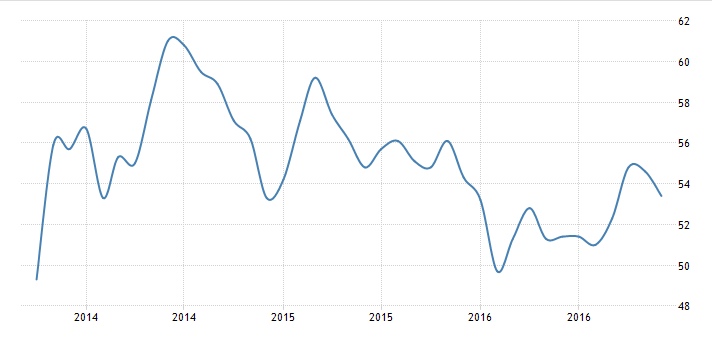

Less than the expected 55.2 as weakness in the services sector continues, and as post election hopes fade:

Highlights

Growth in new orders, though still near a 12-month high, has slowed so far this month, pulling down the flash services PMI for December by more than 1 point to 53.4. But, given the comparison with November’s unusual strength in new orders, the slowing is deceptive. Other readings in the report are clearly favorable including a gain in backlogs that has triggered a gain in hiring. Optimism is still weaker than average but is up from the record lows hit in June, boosted by orders and also by expectations for greater economic strength in the year ahead. Price data are also coming alive, with input costs up and selling prices showing rare traction. Despite the strength, today’s report will likely lower expectations for December’s ISM non-manufacturing report which was also unusually strong in November (the ISM will be posted in the first week of January).

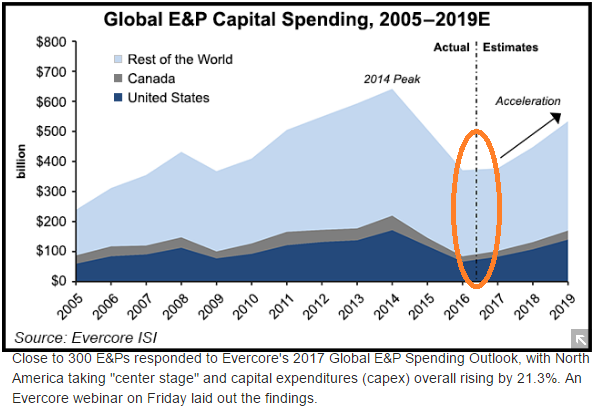

Coming back some from a drop of maybe $250 billion, so this increase will just be a drop in the bucket at this point:

North American E&Ps Forecast to Boost Capex For First Time Since 2014, With U.S. Rising 24.5%

By Carolyn Davis

Dec 19 (NaturalGasIntel) — North America will spearhead a recovery in global upstream investment in 2017, with U.S. spending — weighted on the onshore — forecast to jump by 24.5%, while Canada outlays will be 9.5% higher, according to an annual survey by Evercore ISI.

Senior Managing Director James C. West, who has overseen spending surveys of global exploration and production (E&P) operators for 17 years, told NGI’s Shale Dailythat producers “are definitely more optimistic than in the last two years.”

If oil and natural gas prices continue to climb, spending in the coming year could go even higher, he said.

Close to 300 E&Ps responded to Evercore’s 2017 Global E&P Spending Outlook, with North America taking “center stage” and capital expenditures (capex) overall rising by 21.3%. An Evercore webinar on Friday laid out the findings.

Early Signs of Bigger Budgets

U.S. spending is pegged to rise from around $66.51 billion to $82.77 billion, while Canadian E&Ps are expected to raise spending from around $17.54 billion to $19.21 billion. However, those are “conservative” estimates, West said, as the survey was completed before the Organization of the Petroleum Exporting Countries in late November formally agreed to reduce oil output beginning Jan. 1.