At least so far, even with the easier comparisons with last year’s weak sales at this time, there’s still very little growth:Nothing happening here: The chart shows how it stopped rising when oil capex collapsed, and has been working its way lower ever since: Consumer ConfidenceHighlightsLack of wage gains and the exaggerated political climate have yet to dent consumer spirits as consumer confidence is holding firm, at a solid 96.2 in March. An initial drop in February had raised concerns but less so now, not only following the gain in March but also with a 1.8 point upward revision to February to a more respectable 94.0.A negative in the March data is the closely watched jobs-hard-to-get subcomponent which isn’t pointing to strength for Friday’s employment report, rising a very sharp 3.0 percentage points to 26.6 percent. An offset, however, is a 2.6 percentage point rise in those describing jobs as plentiful to 25.4 percent. Another offset is the consumer’s 6-month outlook on the jobs market with slightly more seeing jobs opening up and slightly fewer seeing less jobs ahead. The future income assessment is stable and favorable as are the assessments of business conditions.Buying plans are mixed with autos down but with housing stable and appliances up. Inflation expectations are steady at 4.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

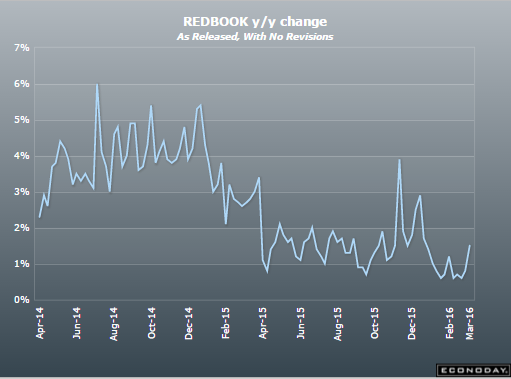

At least so far, even with the easier comparisons with last year’s weak sales at this time, there’s still very little growth:

Nothing happening here:

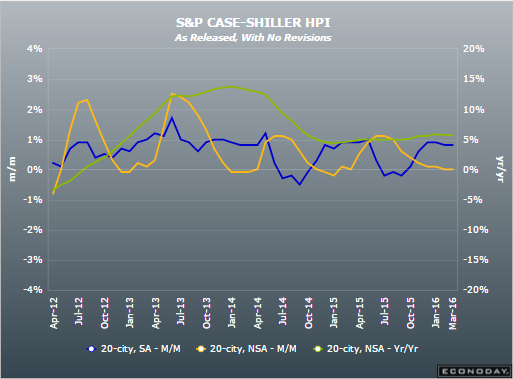

The chart shows how it stopped rising when oil capex collapsed, and has been working its way lower ever since:

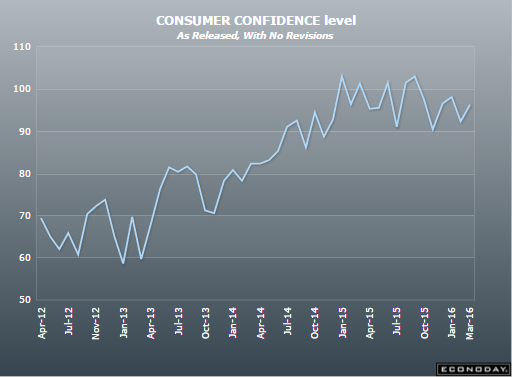

Consumer Confidence

Highlights

Lack of wage gains and the exaggerated political climate have yet to dent consumer spirits as consumer confidence is holding firm, at a solid 96.2 in March. An initial drop in February had raised concerns but less so now, not only following the gain in March but also with a 1.8 point upward revision to February to a more respectable 94.0.A negative in the March data is the closely watched jobs-hard-to-get subcomponent which isn’t pointing to strength for Friday’s employment report, rising a very sharp 3.0 percentage points to 26.6 percent. An offset, however, is a 2.6 percentage point rise in those describing jobs as plentiful to 25.4 percent. Another offset is the consumer’s 6-month outlook on the jobs market with slightly more seeing jobs opening up and slightly fewer seeing less jobs ahead. The future income assessment is stable and favorable as are the assessments of business conditions.

Buying plans are mixed with autos down but with housing stable and appliances up. Inflation expectations are steady at 4.7 percent which is very subdued for this reading, one that won’t please Federal Reserve policy makers who are trying to pull inflation higher.

This report isn’t gangbusters but it is solid and should help take the edge off of yesterday’s disappointing data on personal spending.