You can see from the chart this is not any kind of ‘engine of growth’ at this point in time: Existing Home SalesHighlightsExisting home sales rose more than expected in March, up 5.1 percent to a 5.330 million annualized rate that, however, fails to reverse a downwardly revised 7.3 percent drop in February. And the year-on-year rate, at only 1.5 percent, is decidedly weak. But looking at the first quarter as a whole, which is important for housing data given their volatility, existing home sales are up a much more respectable 4.8 percent.March’s gain is led by the most important component, single-family homes where the rate rose 5.5 percent in the month to 4.760 million. Year-on-year, single-family homes are up 2.6 percent. The showing for condos is less convincing, up only 1.8 percent in the month for a year-on-year decline of 6.6 percent.Prices in this report are up, a monthly 5.0 percent for the median for a year-on-year rate of plus 5.7 percent which closely tracks rates in FHFA and Case-Shiller data. The median price for an existing home is 2,700 which, outside of last year’s Spring selling season when the median peaked above 0,000, is the best of the recovery. A bit of improvement for March but in general this series remains depressed compared with prior cycles:Oil and commodity prices spiking as the $ weakens some.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

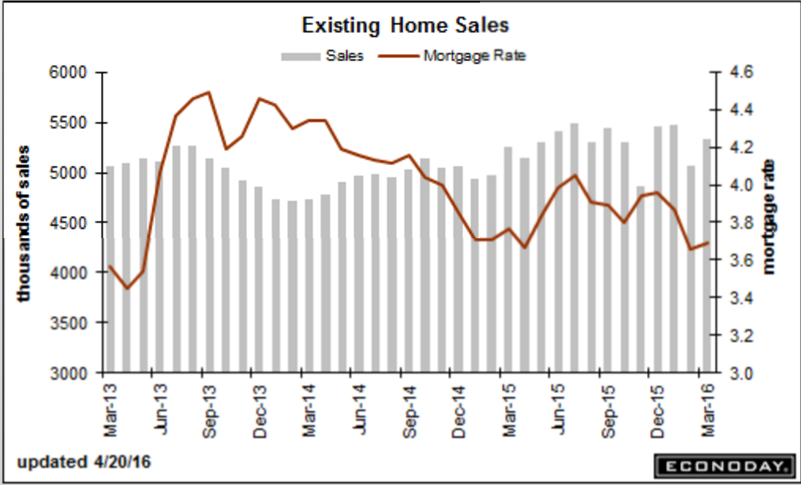

You can see from the chart this is not any kind of ‘engine of growth’ at this point in time:

Existing Home Sales

Highlights

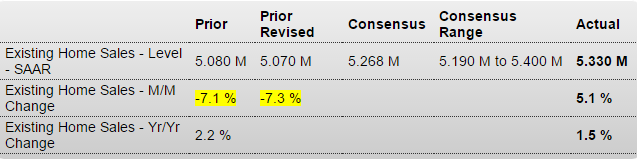

Existing home sales rose more than expected in March, up 5.1 percent to a 5.330 million annualized rate that, however, fails to reverse a downwardly revised 7.3 percent drop in February. And the year-on-year rate, at only 1.5 percent, is decidedly weak. But looking at the first quarter as a whole, which is important for housing data given their volatility, existing home sales are up a much more respectable 4.8 percent.March’s gain is led by the most important component, single-family homes where the rate rose 5.5 percent in the month to 4.760 million. Year-on-year, single-family homes are up 2.6 percent. The showing for condos is less convincing, up only 1.8 percent in the month for a year-on-year decline of 6.6 percent.

Prices in this report are up, a monthly 5.0 percent for the median for a year-on-year rate of plus 5.7 percent which closely tracks rates in FHFA and Case-Shiller data. The median price for an existing home is $222,700 which, outside of last year’s Spring selling season when the median peaked above $230,000, is the best of the recovery.

A bit of improvement for March but in general this series remains depressed compared with prior cycles:

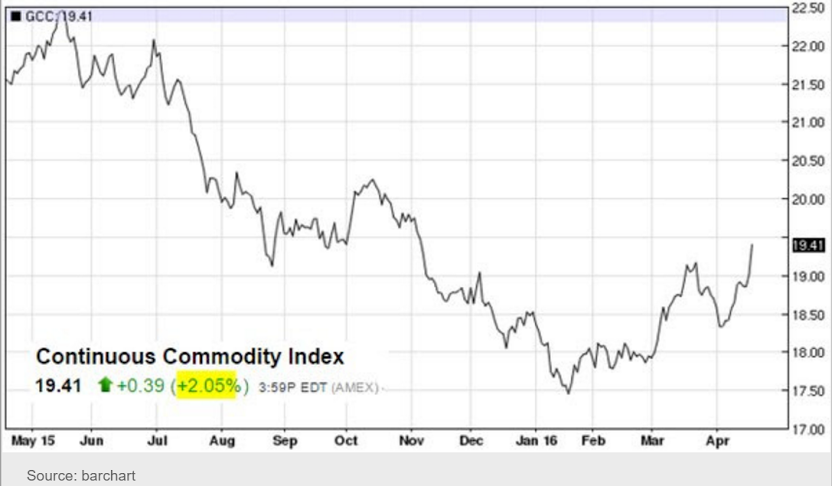

Oil and commodity prices spiking as the $ weakens some. No way for me to tell if there’s something fundamental going on or it’s just volatility from portfolio shifting in very thin markets. (And Saudi pricing being picked up by our news services may not necessarily be what the Saudis are in fact showing their clients):