If true, the .10 increase in the differential for Asia is substantial. However the other, much smaller adjustments are not material, so it’s hard to say from this information whether or not this is a policy move designed to stabilize prices at current levels: (Bloomberg) — Saudi Aramco raised prices for most crude grades sold to Northwest Europe, Mediterranean next month while lowering prices for most grades it sells to U.S. Official pricing statement confirms increased prices for Asia reported earlier today by Bloomberg Differential for Arab Light crude sold to U.S. kept unch at 35c/bbl premium to ASCI benchmark Other grades sold to U.S. all lowered by 20c m/m, to .40 premium for Extra Light, .25 discount for Medium, .75 discount for Heavy Light crude to NWE raised 15c to discount of .45 versus ICE Bwave marker; other grades raised except Extra Light Light crude to Mediterranean raised 25c to discount of .

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

If true, the $1.10 increase in the differential for Asia is substantial.

However the other, much smaller adjustments are not material, so it’s hard to say from this information whether or not this is a policy move designed to stabilize prices at current levels:

(Bloomberg) — Saudi Aramco raised prices for most crude grades sold to Northwest Europe, Mediterranean next month while lowering prices for most grades it sells to U.S.

- Official pricing statement confirms increased prices for Asia reported earlier today by Bloomberg

- Differential for Arab Light crude sold to U.S. kept unch at 35c/bbl premium to ASCI benchmark

- Other grades sold to U.S. all lowered by 20c m/m, to $2.40 premium for Extra Light, $1.25 discount for Medium, $1.75 discount for Heavy

- Light crude to NWE raised 15c to discount of $4.45 versus ICE Bwave marker; other grades raised except Extra Light

- Light crude to Mediterranean raised 25c to discount of $3.95 versus ICE Bwave marker; other grades raised except Extra Light

Saudis Said to Boost Oil Pricing for Asia by Most in 14 Months

By Serene Cheong

May 5 (Bloomberg)

Arab Light said to be set at 25 cent premium to Oman-Dubai

That’s strongest differential for grade since September 2015Saudi Arabia was said to raise its pricing for June oil sales to Asia by the most since April 2015, in a sign that the world’s biggest exporter is expecting demand to recover as the global crude market rebalances.

State-owned Saudi Arabian Oil Co. increased its official selling price for Arab Light crude to Asia by $1.10 a barrel to 25 cents more than regional benchmarks Oman and Dubai, said people with knowledge of the matter who asked not to be identified because the information is confidential. The company, known as Saudi Aramco, was predicted to raise its pricing for the grade by 65 cents a barrel, according to the median estimate in a Bloomberg survey of five refiners and traders.

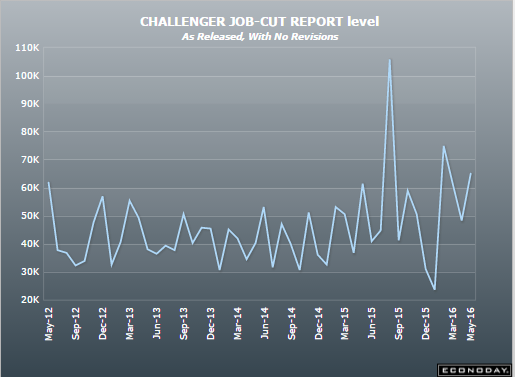

Looks like this is continuing to trend higher, post oil capex collapse: