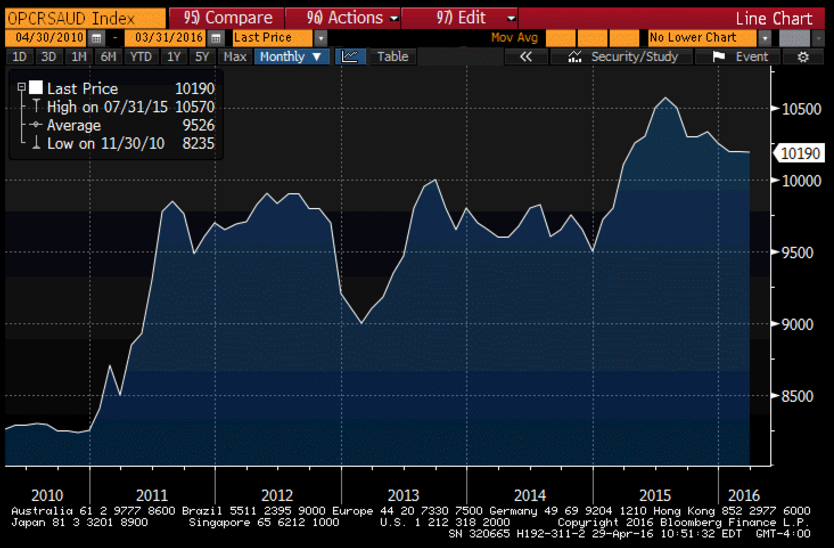

Saudi production remains well below their claimed 12 million bpd current max capacity, as they continue to set price and let sales and output float. Market action suggest they have altered their posted prices, but so far publicly available information doesn’t indicate a change in pricing policy. If so, the latest move up in prices will prove temporary: The American Consumer is Doing Less to Support GDP Growth By Rick DavisSummary and CommentaryAlthough the headline remained positive, this is not a report that shows a robust economy. Among the troubling aspects of the report:The growth rate for consumer spending took another significant hit, dropping substantially for the third consecutive quarter. In fact, the growth rate for consumer spending on goods was barely positive, at a miserable +0.03%. And non-discretionary spending on health care and housing provided most of the remaining growth in consumer services spending.Private investment contracted for the first time since the first quarter of 2011.Exports went deeper into the red.Looking at the past three quarters as a group, we can see a slow-motion slide into either stagnation or contraction. It is truly sad when stagnation looks to be the better alternative. This continues to fall.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Saudi production remains well below their claimed 12 million bpd current max capacity, as they continue to set price and let sales and output float.

Market action suggest they have altered their posted prices, but so far publicly available information doesn’t indicate a change in pricing policy. If so, the latest move up in prices will prove temporary:

The American Consumer is Doing Less to Support GDP Growth

By Rick Davis

Summary and Commentary

Although the headline remained positive, this is not a report that shows a robust economy. Among the troubling aspects of the report:

The growth rate for consumer spending took another significant hit, dropping substantially for the third consecutive quarter. In fact, the growth rate for consumer spending on goods was barely positive, at a miserable +0.03%. And non-discretionary spending on health care and housing provided most of the remaining growth in consumer services spending.Private investment contracted for the first time since the first quarter of 2011.Exports went deeper into the red.

Looking at the past three quarters as a group, we can see a slow-motion slide into either stagnation or contraction. It is truly sad when stagnation looks to be the better alternative.

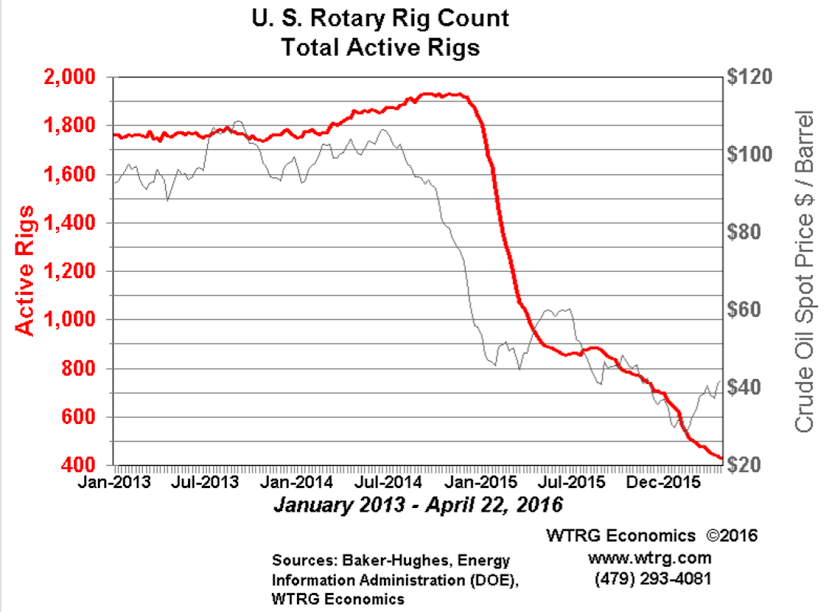

This continues to fall. Production is already declining and this means more of same, which means oil imports will continue to rise, adding to the US trade deficit and increasing that fundamental source of dollar weakness. And while the higher prices add to the cost of imported oil, the prices aren’t high enough for additional capital expenditures. So you might say we’re in the ‘sour spot’ where the higher price is a negative for GDP until it gets high enough for capex to increase. But with the Saudis still firmly in control of price doesn’t seem to me that’s likely to happen?

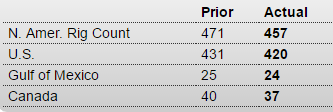

Baker-Hughes Rig Count

Highlights

The Baker Hughes North American rig count is down 14 in the April 29th week to 457. The U.S. rig count is down 11 at 420 and is down 485 rigs from last year. The Canadian rig count is down 3 rigs from last week to 37 and, compared to last year, is down 42 rigs.