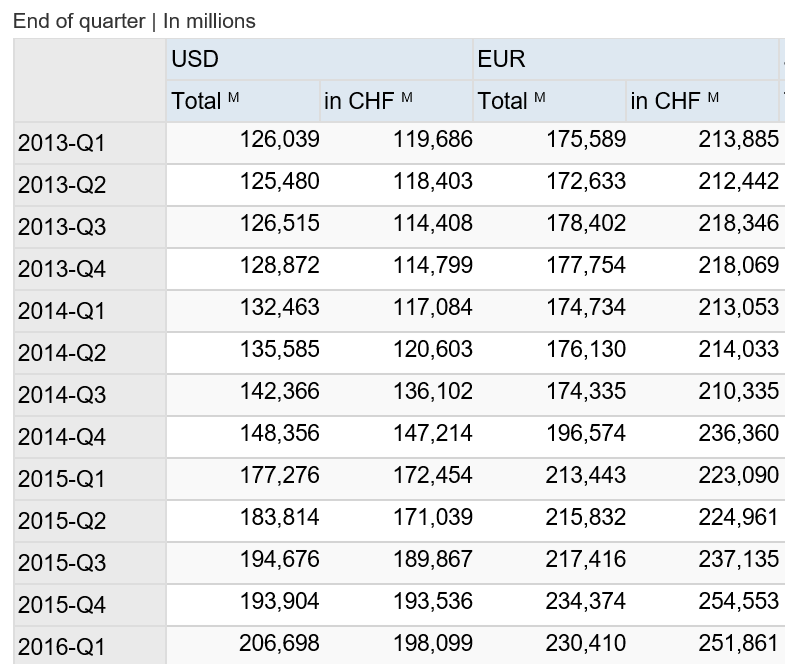

It looks like the SNB (Swiss National Bank- the central bank) has been building $ reserves faster than euro reserves, which has worked to support the $ vs the euro. That is, when they were buying euro to keep their currency down they were selling quite a few of those euro for $ to keep their portfolio ‘balanced’. And for the last two quarters reported below, $ holdings went up about 12.5 billion while euro holding fell by about 4 billion, which means the shifting is ongoing. This means, for example, that when what I call ‘portfolio managers’ were selling their euro to buy and hold Swiss francs, the SNB was in turn selling more than half of those euro to buy $US, thereby holding both $ and euro as reserves as shown in the tables below. Furthermore, there’s no way to know if the SNB is planning to stay at their current balance or continue to shift to $. And even if the Swiss franc weakens for any reason, the SNB isunder no obligation to sell their euro or $ reserves to buy francs. The Swiss franc is not specifically convertible to euro or any other currency, so those reserves remain at the SNB until they decide to do something else with them. Likewise the holders of Swiss francs, should they desire another currency, can only sell them in the market place at market prices.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

It looks like the SNB (Swiss National Bank- the central bank) has been building $ reserves faster than euro reserves, which has worked to support the $ vs the euro.

That is, when they were buying euro to keep their currency down they were selling quite a few of those euro for $ to keep their portfolio ‘balanced’.

And for the last two quarters reported below, $ holdings went up about 12.5 billion while euro holding fell by about 4 billion, which means the shifting is ongoing.

This means, for example, that when what I call ‘portfolio managers’ were selling their euro to buy and hold Swiss francs, the SNB was in turn selling more than half of those euro to buy $US, thereby holding both $ and euro as reserves as shown in the tables below.

Furthermore, there’s no way to know if the SNB is planning to stay at their current balance or continue to shift to $. And even if the Swiss franc weakens for any reason, the SNB is

under no obligation to sell their euro or $ reserves to buy francs. The Swiss franc is not specifically convertible to euro or any other currency, so those reserves remain at the SNB until they decide to do something else with them.

Likewise the holders of Swiss francs, should they desire another currency, can only sell them in the market place at market prices.

So my narrative is that Europeans and other holders of euro, in an attempt to ‘flee to safety’ sold their euro and bought Swiss francs which are nothing more than Swiss tax credits. The SNB then sold more than half of those euro for $ for much the same reason. So the effect on fx markets has been that of large numbers of euro being sold for $, driving down the euro vs the $, which may or may not have run its course.

I also suspect that those sellers of euro have ongoing euro liabilities and at some point need to sell their francs to buy euro. That is, they are fundamentally ‘short’ euro.

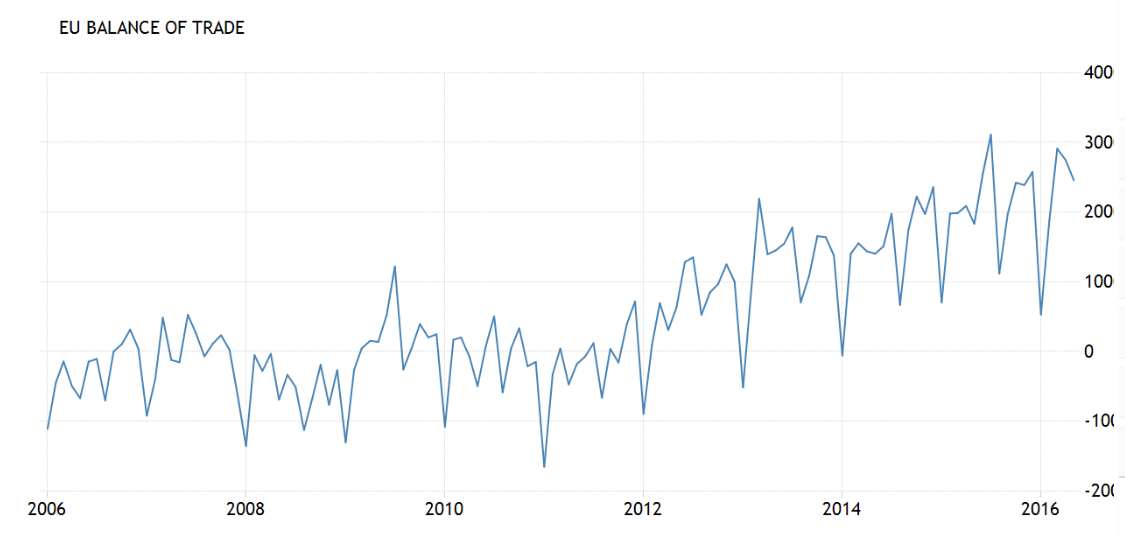

Meanwhile, the euro, driven down by fear, has worked to generate euro area trade surpluses which are ‘draining’ the euro sold by all the agents selling euro to buy other currencies. And this trade surplus will continue to drain euro from global markets until it reverses.

SNB reserve report from the SNB website:

Corporate Profits Set to Shrink for Fourth Consecutive Quarter

By Kate Linebaugh

July 17 (WSJ) — More than 90 of the biggest U.S. companies will report results this week. Based on analysts’ forecasts for companies in the S&P 500 index, Thomson Reuters predicted that adjusted earnings per share for the second quarter were down 4.7% from a year earlier. That follows a 5% drop in the first quarter and would be the fourth straight period of declines.

Revenue, meanwhile, is expected to slip 0.8%, marking the sixth straight quarter of declines, according to Thomson Reuters. For the second quarter, more than 80 S&P 500 companies have issued earnings warnings, according to Thomson Reuters.