This too has followed the shale boom/bust cycle and is headed lower: No recovery here: This looks back over the last three months and seems to be decelerating from already modest levels: Up a bit but still low: The flash Markit US Services PMI came in at 51.9 in September of 2016 from 51 in August, reaching the highest figure in five months and above market expectations of 51.1. Activity picked up for the first time in three months due to ongoing new business growth while new orders, employment and inflationary pressures eased.Still contracting: Here some good news! But as per the chart something changed after the collapse in oil capex? Maybe because confidence is one man, one vote, not one dollar, one vote?

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

This too has followed the shale boom/bust cycle and is headed lower:

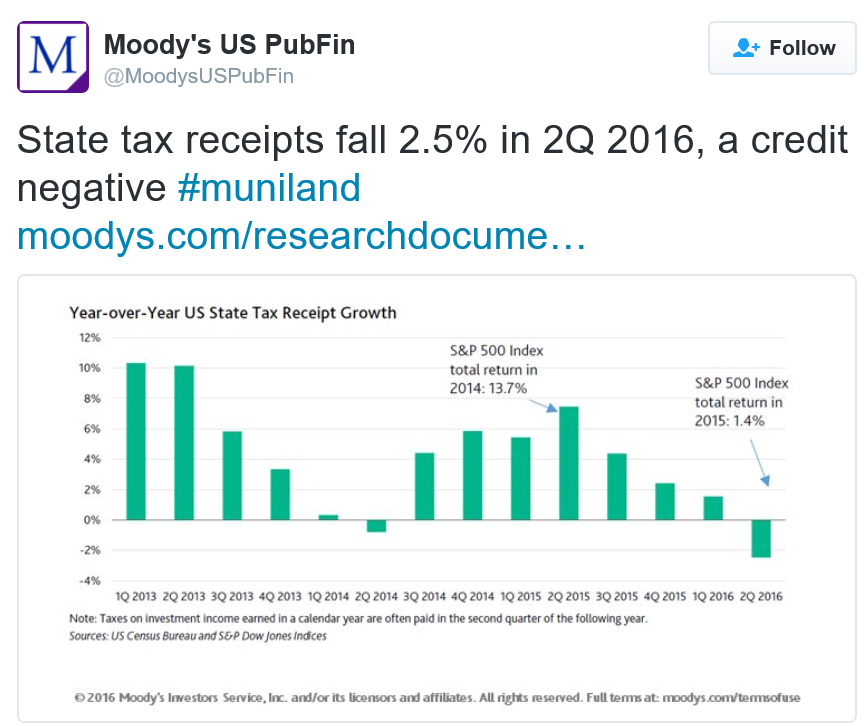

No recovery here:

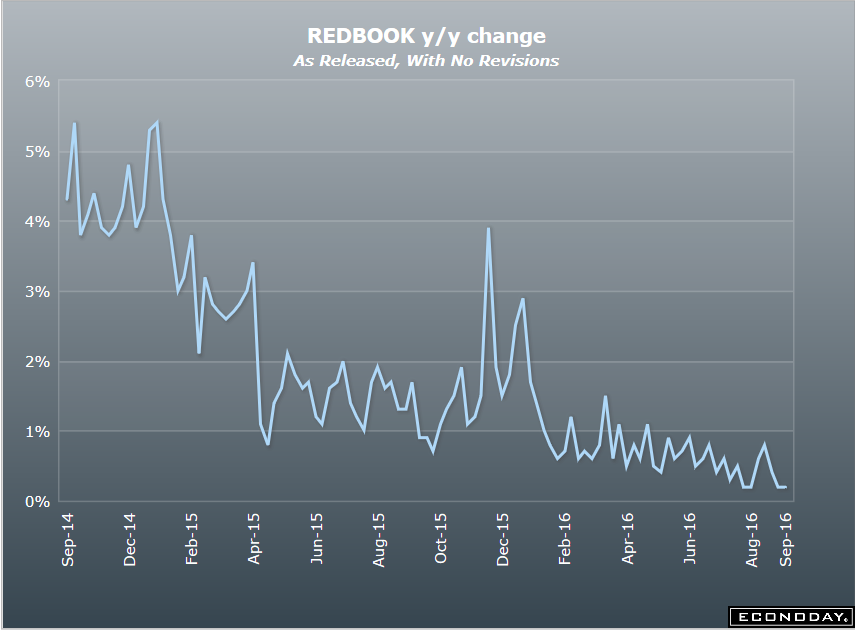

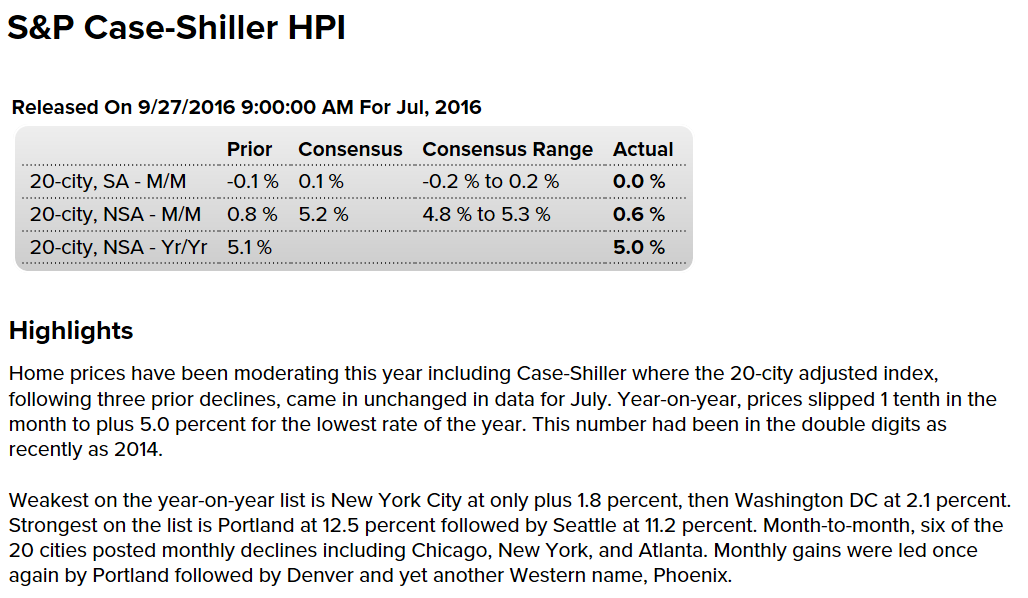

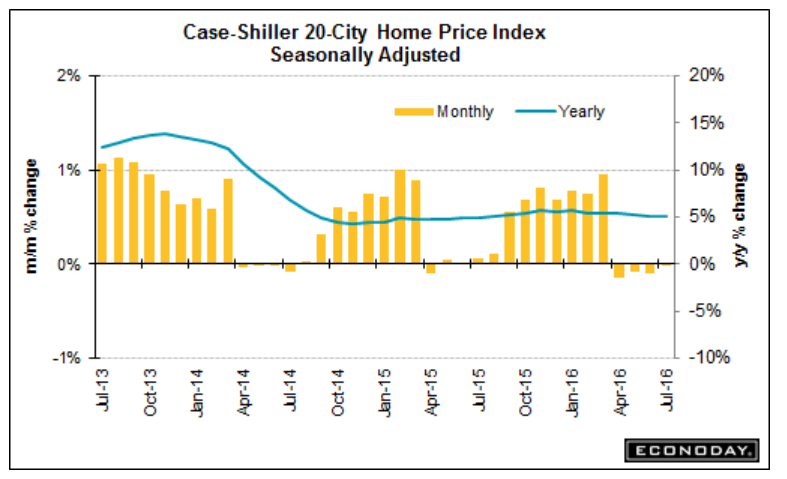

This looks back over the last three months and seems to be decelerating from already modest levels:

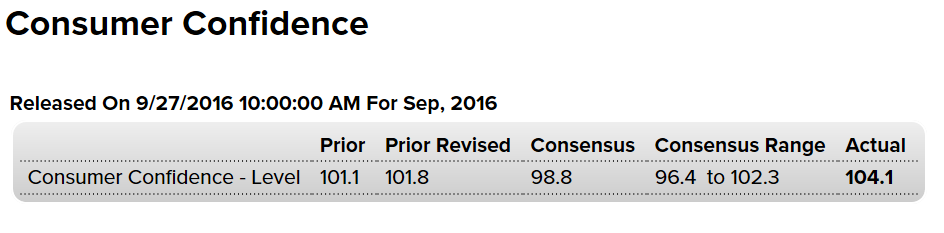

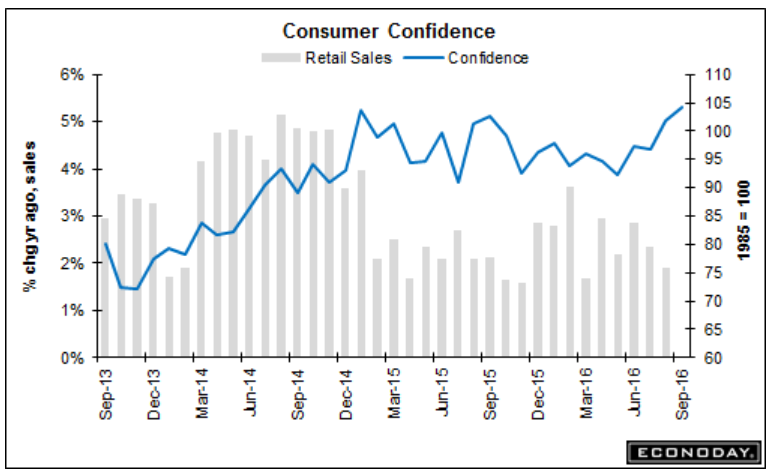

Up a bit but still low:

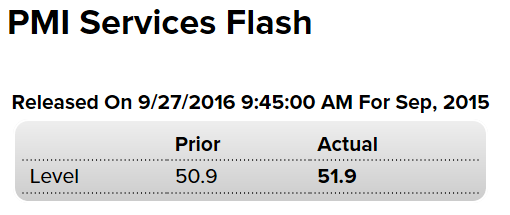

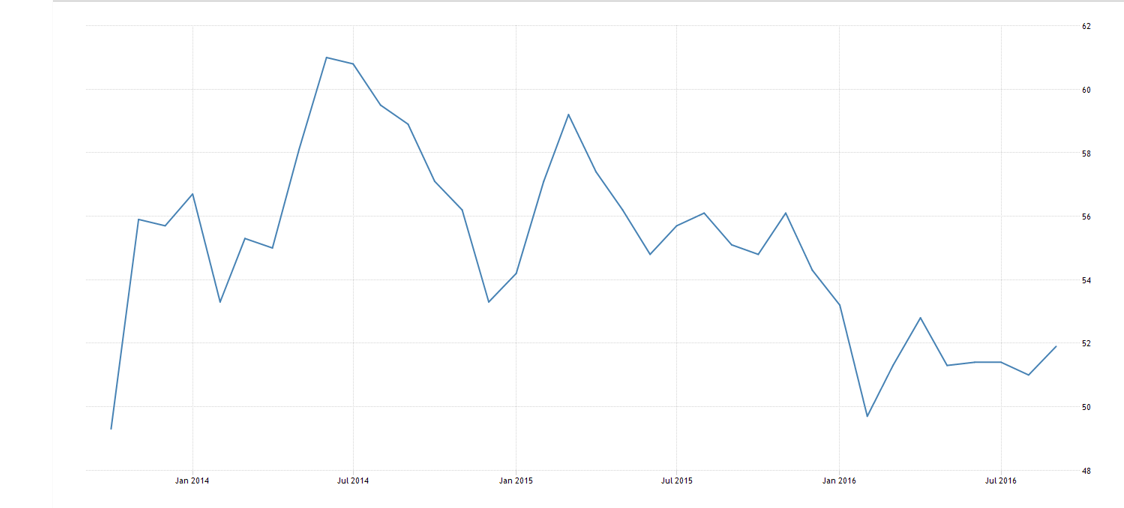

The flash Markit US Services PMI came in at 51.9 in September of 2016 from 51 in August, reaching the highest figure in five months and above market expectations of 51.1. Activity picked up for the first time in three months due to ongoing new business growth while new orders, employment and inflationary pressures eased.

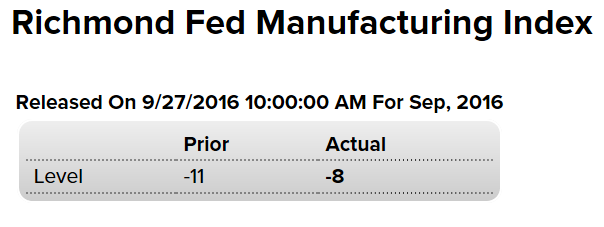

Still contracting:

Here some good news! But as per the chart something changed after the collapse in oil capex? Maybe because confidence is one man, one vote, not one dollar, one vote?