Higher than expected, and last month revised higher as well. And oil imports are increasing as output falls and consumption remains firm: More bad news doesn’t stop the KC Fed from calling for a rate hike: HighlightsThe good news didn’t last long for the Kansas City manufacturing index which, after popping to plus 2 in June for the first positive score since January last year, is back in the negative column at minus 6 in July. New orders are at minus 5 with backlog orders at minus 3. Not surprisingly, employment is at minus 5 and isn’t like to move up until orders pick up. Production is at minus 15 and shipments are at minus 17. Price data show modest pressure for inputs but continued contraction for selling prices. Inventories are flat. This year’s snap back for oil, which is now fading somewhat, hasn’t yet made for much improvement for this or the Dallas Fed report. Despite bright spots in isolated readings, the manufacturing sector continues to hold down the nation’s economic growth. Down to 1.8%. I’m still thinking lower due to larger inventory adjustments, though it may come with the later revisions: So they are just now waking up to the fact that total vehicle sales have been dropping for the last year? Lackluster U.S.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

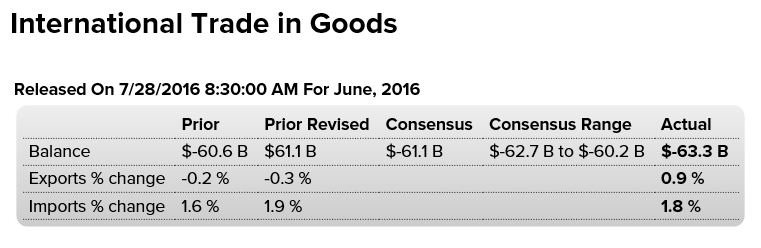

Higher than expected, and last month revised higher as well. And oil imports are increasing as output falls and consumption remains firm:

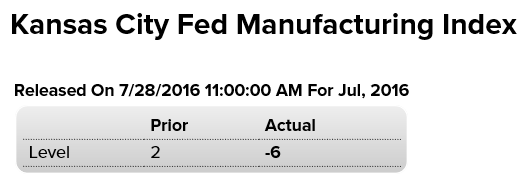

More bad news doesn’t stop the KC Fed from calling for a rate hike:

Highlights

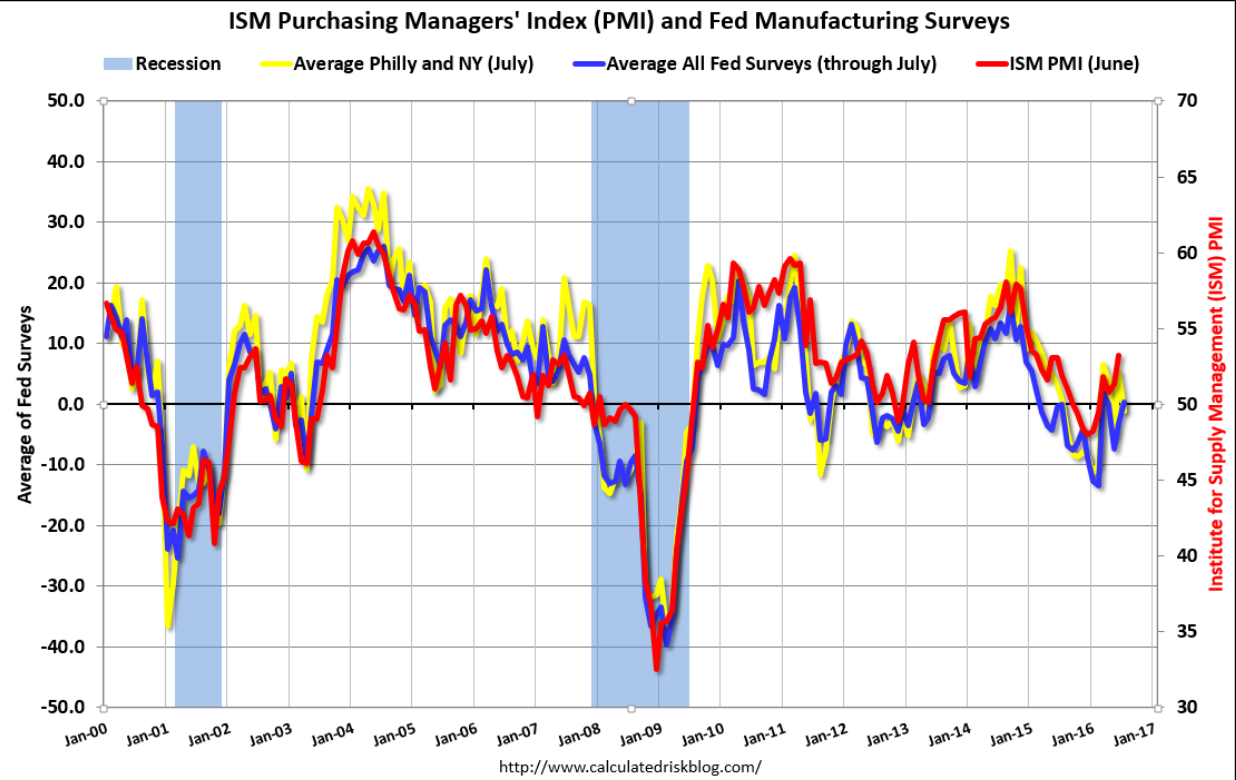

The good news didn’t last long for the Kansas City manufacturing index which, after popping to plus 2 in June for the first positive score since January last year, is back in the negative column at minus 6 in July. New orders are at minus 5 with backlog orders at minus 3. Not surprisingly, employment is at minus 5 and isn’t like to move up until orders pick up. Production is at minus 15 and shipments are at minus 17. Price data show modest pressure for inputs but continued contraction for selling prices. Inventories are flat. This year’s snap back for oil, which is now fading somewhat, hasn’t yet made for much improvement for this or the Dallas Fed report. Despite bright spots in isolated readings, the manufacturing sector continues to hold down the nation’s economic growth.

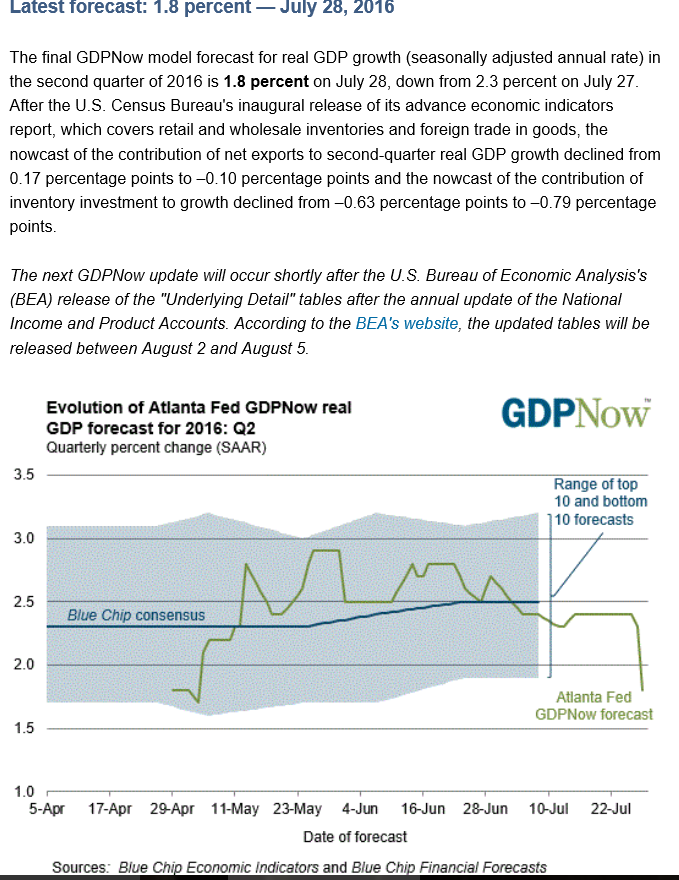

Down to 1.8%. I’m still thinking lower due to larger inventory adjustments, though it may come with the later revisions:

So they are just now waking up to the fact that total vehicle sales have been dropping for the last year?

Lackluster U.S., China sales drag on Ford Motor profit; shares tumble

By Bernie Woodall

July 28 (Reuters) — Ford Motor reported weaker-than-expected profit in the second quarter, and said its full-year earnings forecast was at risk with U.S. auto sales expected to fall in the second half, sending shares tumbling in premarket trading. Auto sales in the United States and China were lower than anticipated in the quarter, and Ford reported its first quarterly loss in the Asia Pacific in three years.