This time the warm weather is cited for the weakness as utility spending fell. Yes, capitalism is about sales, and unspent income reduces sales, unless other agents spend more than their income, etc. etc. And with the private sector in general necessarily pro cyclical, unspent income stories beg fiscal adjustments, which at the moment are universally out of style. U.K. Industrial Output Plunges Most in Almost Three Years By Jill WardJan 12 (Bloomberg) — UK industrial production fell the most in almost three years in November as warmer-than-usual weather reduced energy demand.Output dropped 0.7 per cent from the previous month, with electricity, gas and steam dropping 2.1 per cent, the Office for National Statistics said in London on Tuesday. Economists had forecast no growth on the month.The data highlight the uncertain nature of UK growth, which remains dependent on domestic demand and services. After stagnating in October and falling in November, industrial production will have to rise 0.5 per cent to avoid a contraction in the fourth quarter.Manufacturing also delivered a lower-than-forecast performance in November, with output dropping 0.4 per cent on the month. On an annual basis, factory output fell 1.2 per cent, a fifth consecutive decline. To the same point, capital expenditures constitute spending that offsets unspent income, etc.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

This time the warm weather is cited for the weakness as utility spending fell. Yes, capitalism is about sales, and unspent income reduces sales, unless other agents spend more than their income, etc. etc.

And with the private sector in general necessarily pro cyclical, unspent income stories beg fiscal adjustments, which at the moment are universally out of style.

U.K. Industrial Output Plunges Most in Almost Three Years

By Jill Ward

Jan 12 (Bloomberg) — UK industrial production fell the most in almost three years in November as warmer-than-usual weather reduced energy demand.

Output dropped 0.7 per cent from the previous month, with electricity, gas and steam dropping 2.1 per cent, the Office for National Statistics said in London on Tuesday. Economists had forecast no growth on the month.

The data highlight the uncertain nature of UK growth, which remains dependent on domestic demand and services. After stagnating in October and falling in November, industrial production will have to rise 0.5 per cent to avoid a contraction in the fourth quarter.

Manufacturing also delivered a lower-than-forecast performance in November, with output dropping 0.4 per cent on the month. On an annual basis, factory output fell 1.2 per cent, a fifth consecutive decline.

To the same point, capital expenditures constitute spending that offsets unspent income, etc. And so without some other spending stepping up to replace this lost capex GDP goes nowhere, as previously discussed. This $90 billion cut is only one source of capex reductions:

Oil Plunge Sparks Bankruptcy Concerns

Jan 11 (WSJ) — As many as a third of American oil-and-gas producers could tip toward bankruptcy and restructuring by mid-2017, according to Wolfe Research. Together, North American oil-and-gas producers are losing nearly $2 billion every week at current prices, according to AlixPartners. American producers are expected to cut their budgets by 51% to $89.6 billion from 2014, according to Cowen & Co. In a biannual review by a trio of banking regulators, the value of loans rated as “substandard, doubtful or loss” among oil and gas borrowers almost quintupled to $34.2 billion, or 15% of the total energy loans evaluated. That compares with $6.9 billion, or 3.6%, in 2014.

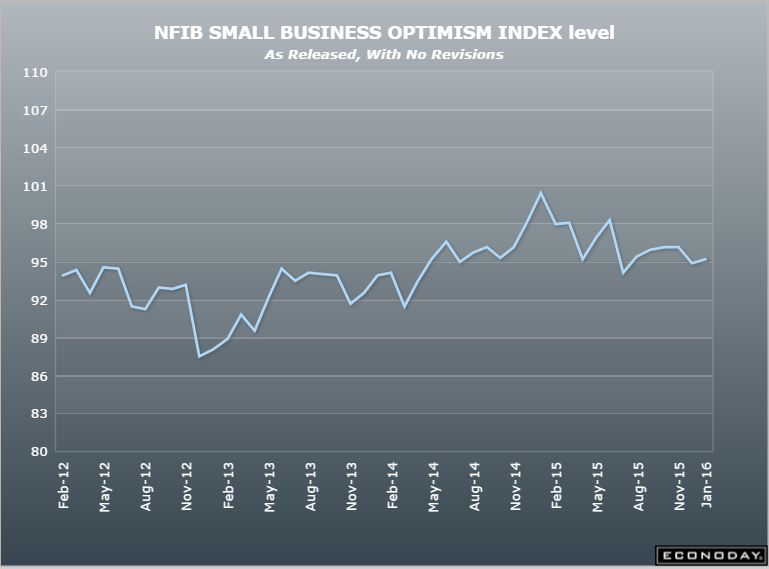

Still trending lower since the oil capex collapse a little over a year ago: