And another bad one as sales are falling just as fast as inventories: Wholesale TradeHighlightsWholesale inventories fell an as-expected 0.1 percent in December with November revised 1 tenth lower to minus 0.4 percent. Wholesalers have been liquidating inventories as sales have been falling, down 0.3 percent in the latest month following a 1.3 percent sales decline in November. And they’ve been successful, keeping down the stock-to-sales ratio at 1.32 the last two reports which is still however up noticeably from 1.24 in December 2015. The factory sector hasn’t been as successful keeping down inventories, showing a 0.2 percent rise in December. This sets the stage for December retail inventories which will be released with the business inventories report on Friday following the retail sales report. Been heading south ever since oil capex collapsed: Small business optimism index fell back sharply in January, to 93.9 from December’s 95.2 and reflecting deepening pessimism over both the economic outlook and sales expectations. Plans to increase employment also came down but nevertheless remain solidly in the plus column. And two important components remain exceptionally positive, jobs hard to fill and plans to increase capital outlays with the latter pointing to future hiring and belying the negative expectations for the economy.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

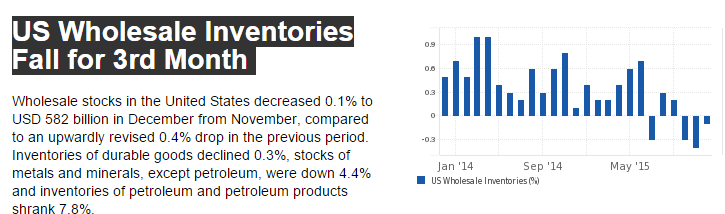

And another bad one as sales are falling just as fast as inventories:

Wholesale Trade

Highlights

Wholesale inventories fell an as-expected 0.1 percent in December with November revised 1 tenth lower to minus 0.4 percent. Wholesalers have been liquidating inventories as sales have been falling, down 0.3 percent in the latest month following a 1.3 percent sales decline in November. And they’ve been successful, keeping down the stock-to-sales ratio at 1.32 the last two reports which is still however up noticeably from 1.24 in December 2015. The factory sector hasn’t been as successful keeping down inventories, showing a 0.2 percent rise in December. This sets the stage for December retail inventories which will be released with the business inventories report on Friday following the retail sales report.

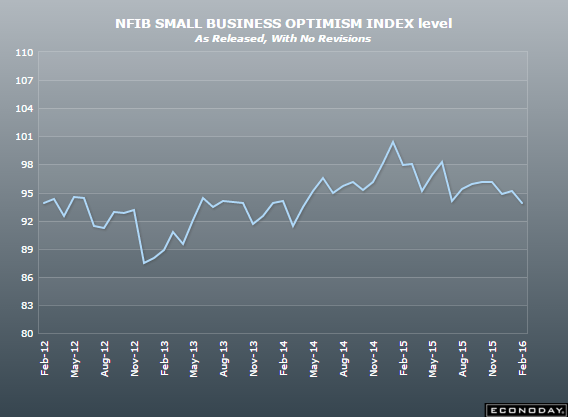

Been heading south ever since oil capex collapsed:

Small business optimism index fell back sharply in January, to 93.9 from December’s 95.2 and reflecting deepening pessimism over both the economic outlook and sales expectations. Plans to increase employment also came down but nevertheless remain solidly in the plus column. And two important components remain exceptionally positive, jobs hard to fill and plans to increase capital outlays with the latter pointing to future hiring and belying the negative expectations for the economy. But key negatives also include pessimism over earnings, a trend that doesn’t support hiring or business investment. The details are mixed to downbeat in this report, one that falls in line with the general tenor so far of January’s economic data.

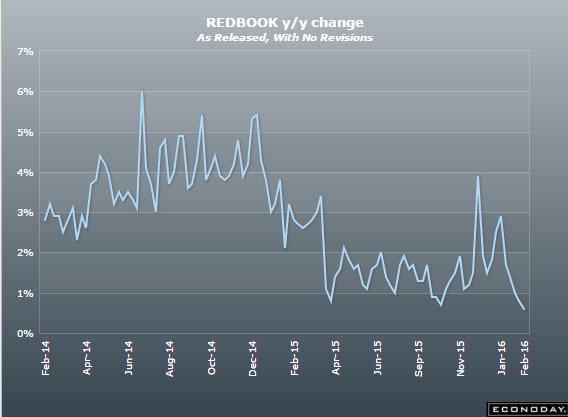

This keeps getting worse even as comps with last year get ‘easier’: