Higher than expected but last month was revised down by 53,000 (and same could happen of course for this month). And this is just a forecast for the Friday jobs report, not a hard number. Also note that as per the chart the annual growth rate has been declining and it’s too soon to say that the decline has reversed: Highlights The March employment report may not prove as impressive as February or January but it still looks to be very strong, based on ADP’s 263,000 estimate for private payrolls. The consensus before ADP’s result was calling for a 170,000 rise in March private payrolls which would follow gains of 227,000 and 221,000 in the two prior months. Details in the ADP report include a strong 49,000 gain for construction and a 30,000 increase for manufacturing. Professional & business services are another strong positive, up 57,000. This report will ease concern that heavy weather in the mid-month sample week for March may skew Friday’s report lower. Trumped up expectations keep coming off: Highlights Markit Economics’ U.S. manufacturing sample has reported a loss of momentum as is its U.S. service sample. The services PMI slowed to 52.8 in March, down 1 tenth from the mid-month flash and down a full point from February. This is the lowest rate of plus-50 growth in six months.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

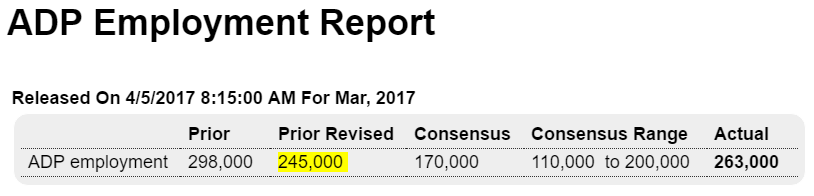

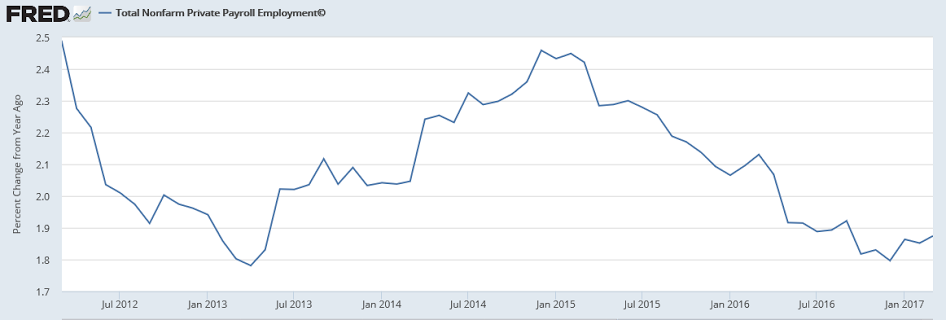

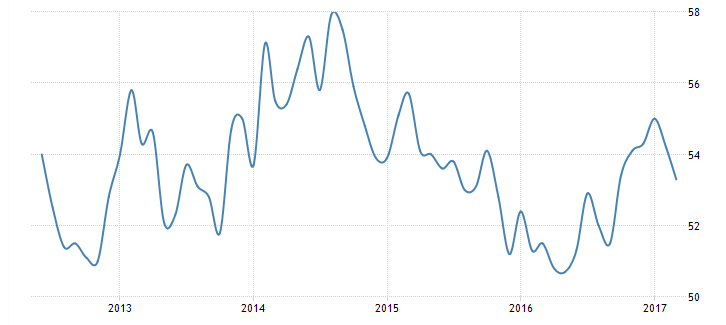

Higher than expected but last month was revised down by 53,000 (and same could happen of course for this month). And this is just a forecast for the Friday jobs report, not a hard number. Also note that as per the chart the annual growth rate has been declining and it’s too soon to say that the decline has reversed:

Highlights

The March employment report may not prove as impressive as February or January but it still looks to be very strong, based on ADP’s 263,000 estimate for private payrolls. The consensus before ADP’s result was calling for a 170,000 rise in March private payrolls which would follow gains of 227,000 and 221,000 in the two prior months. Details in the ADP report include a strong 49,000 gain for construction and a 30,000 increase for manufacturing. Professional & business services are another strong positive, up 57,000. This report will ease concern that heavy weather in the mid-month sample week for March may skew Friday’s report lower.

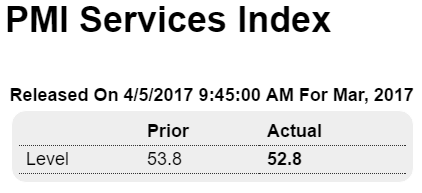

Trumped up expectations keep coming off:

Highlights

Markit Economics’ U.S. manufacturing sample has reported a loss of momentum as is its U.S. service sample. The services PMI slowed to 52.8 in March, down 1 tenth from the mid-month flash and down a full point from February. This is the lowest rate of plus-50 growth in six months. New orders are at their slowest growth rate in a full year and service providers were keeping busy working down backlogs which are at a 9-month low. Employment growth is at a 5-month low. Despite the slowing in activity, wages and input costs are on the rise as are selling prices though only modestly.

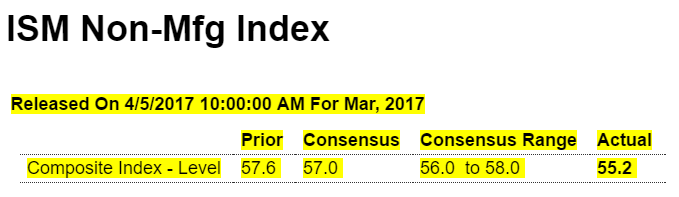

This report points to a quarter-end fizzle for the bulk of the economy. Watch for ISM non-manufacturing later this morning at 10:00 a.m. ET, a report that, in sharp contrast to this report, has been running at a very solid clip.

Highlights

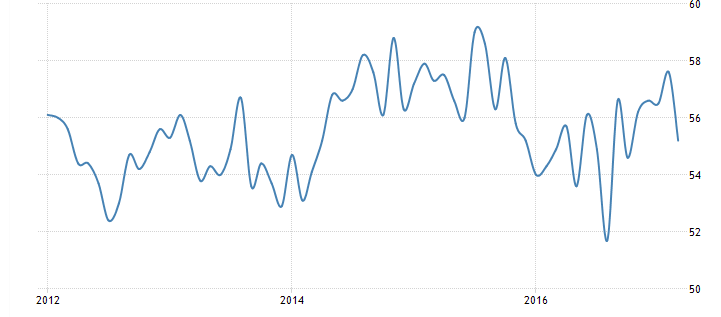

Slowing in employment is a warning signal in the March ISM non-manufacturing report where the headline composite slowed to a 5-month low of 55.2. Employment growth slowed abruptly in the month, down 3.6 points to 51.6 and a 7-month low. This contrasts sharply with ADP’s very strong report earlier this morning and underlines concern that March’s heavy weather may have held down the labor market.

New orders also slowed in the month, down 2.3 points to what however is still a very strong 58.9. New export orders are the standout positive in the report, up 5.5 points to 62.5 which is the first 60 score in 4 years and the best result since May 2007. Backlog orders also slowed but again not by much, down 1 point at 53.0 which remains constructive for this reading. Business activity also slowed and inventories, in another indication of slowing, were drawn down. Supplier deliveries also slowed but only slightly yet still could be a hint of weather effects.

The big gain for export orders is a reminder that foreign demand for U.S. services is very strong in what is a major contrast with soft demand for U.S. goods. But the overall slowing centered in employment makes this report an unwelcome signal of weakness going into Friday’s jobs data.