U.S. small business borrowing stalls in March By Ann Saphir May 1 (Reuters) — Borrowing by small U.S. firms stalled in March, as business owners remained cautious about investing amid policy uncertainty, data released on Monday showed. The Thomson Reuters/PayNet Small Business Lending Index for March registered 134, down 1 percent from last March. The index was up 4 percent from February, which had four fewer working days. Doesn’t seem to scale very well… ;) Tesla said net loss attributable to common shareholders widened to 0.3 million in the first quarter ended March 31, from 2.3 million a year earlier. On a per-share basis, net loss narrowed to .04 per share from .13 per share. Excluding items, the company lost .33 per share. Analysts on average had expected a loss of 81 cents per share, according to Thomson Reuters I/B/E/S. Revenue more than doubled to .70 billion from .15 billion, and edged past analysts’ average expectation of .62 billion.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

U.S. small business borrowing stalls in March

By Ann Saphir

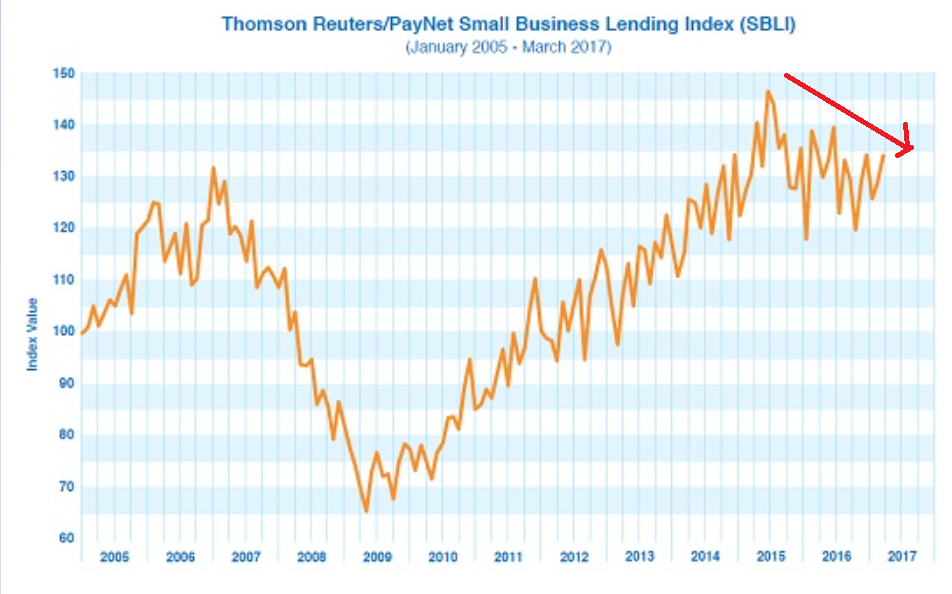

May 1 (Reuters) — Borrowing by small U.S. firms stalled in March, as business owners remained cautious about investing amid policy uncertainty, data released on Monday showed.

The Thomson Reuters/PayNet Small Business Lending Index for March registered 134, down 1 percent from last March. The index was up 4 percent from February, which had four fewer working days.

Doesn’t seem to scale very well…

;)

Tesla said net loss attributable to common shareholders widened to $330.3 million in the first quarter ended March 31, from $282.3 million a year earlier. On a per-share basis, net loss narrowed to $2.04 per share from $2.13 per share.

Excluding items, the company lost $1.33 per share. Analysts on average had expected a loss of 81 cents per share, according to Thomson Reuters I/B/E/S.

Revenue more than doubled to $2.70 billion from $1.15 billion, and edged past analysts’ average expectation of $2.62 billion.