The PMC annual bike ride is this weekend, so much appreciate that those of you who haven’t yet done soget your donations in, thanks, and if any of you will be there, let me know and I’ll be looking for you! http://www2.pmc.org/profile/WM0015 Settling down a bit: Better than expected: Better than expected, lots of volatility, and anticipates existing home sales by a couple of months, which have flattened this year: Highlights After three straight declines, the pending home sales index posts a gain and a strong one, at 1.5 percent in June data that signal a long needed bounce for final sales of existing homes. Regional data show little variation with the West leading in June and the Midwest trailing. Pending sales take a month or two to close which points to strength for

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

The PMC annual bike ride is this weekend, so much appreciate that those of you who haven’t yet done so

get your donations in, thanks, and if any of you will be there, let me know and I’ll be looking for you!

http://www2.pmc.org/profile/WM0015

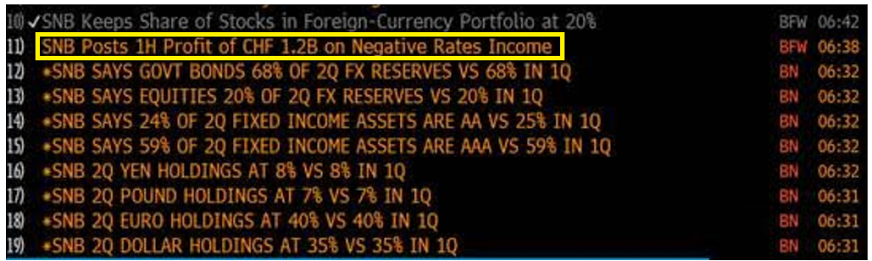

Settling down a bit:

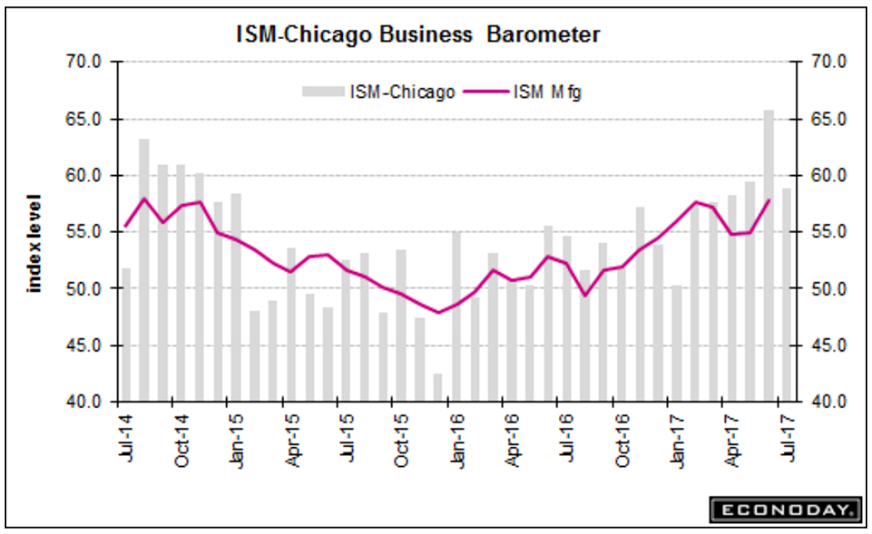

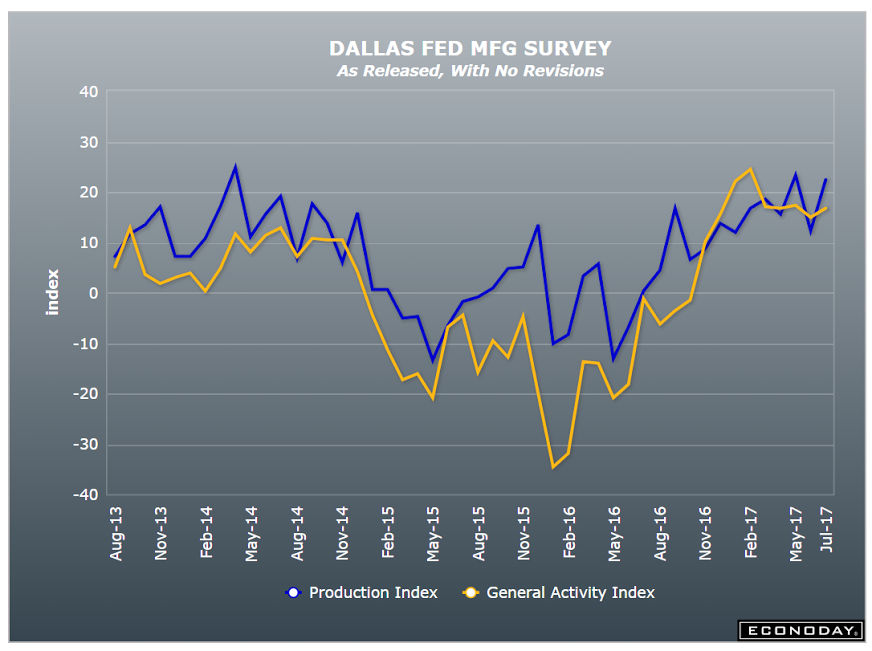

Better than expected:

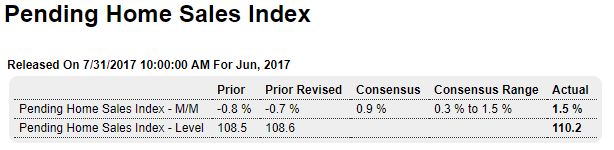

Better than expected, lots of volatility, and anticipates existing home sales by a couple of months, which have flattened this year:

Highlights

After three straight declines, the pending home sales index posts a gain and a strong one, at 1.5 percent in June data that signal a long needed bounce for final sales of existing homes. Regional data show little variation with the West leading in June and the Midwest trailing. Pending sales take a month or two to close which points to strength for existing home sales in July and August. The housing sector struggled through the Spring season but, with second-half acceleration driven by low mortgage rates and high employment levels, can still post a solid year.

So the Swiss National Bank bought hundreds of billions of $ worth of foreign currencies, paying for them with ‘new’ swiss franc balances on their own books, which are subject to a negative interest rate. That means the SNB is gradually removing those funds it used to buy its fx reserves. Nice trade!!!

;)