Less than expected as the deceleration continues. I read this as reflecting a drop in consumer spending. The savings rate has been down, and the personal income curve has been bent lower as well, and retail sales have also slowed. So it can all be read this way:The consumer has less real disposable income, has cut back on spending, and has been ‘forced’ to put some of that reduced spending on his credit card, though less than the prior month, which doesn’t bode well for future spending: Highlights Though growth in headline consumer credit, at .4 billion, came in lower than expected, the component for revolving credit posted another sizable increase, at .1 billion vs .9 billion in May. This component, which is where credit card debt is tracked, has been on the rise

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

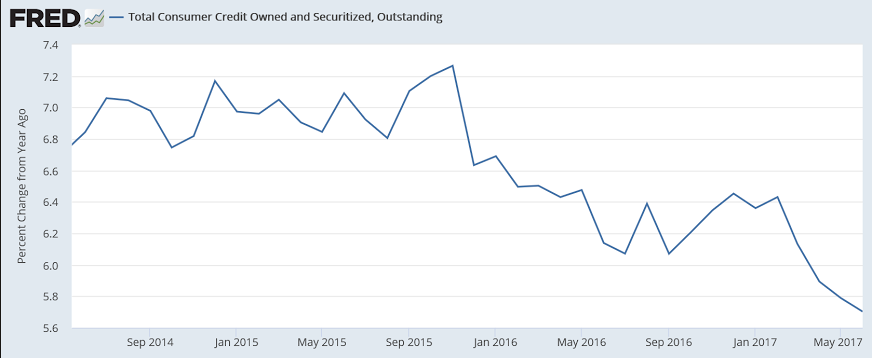

Less than expected as the deceleration continues. I read this as reflecting a drop in consumer spending.

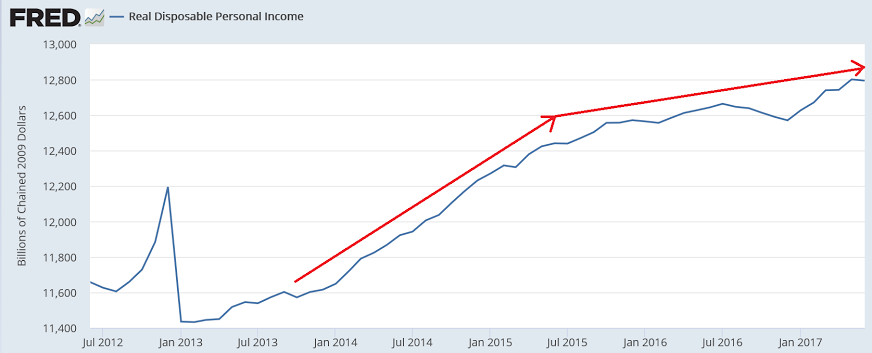

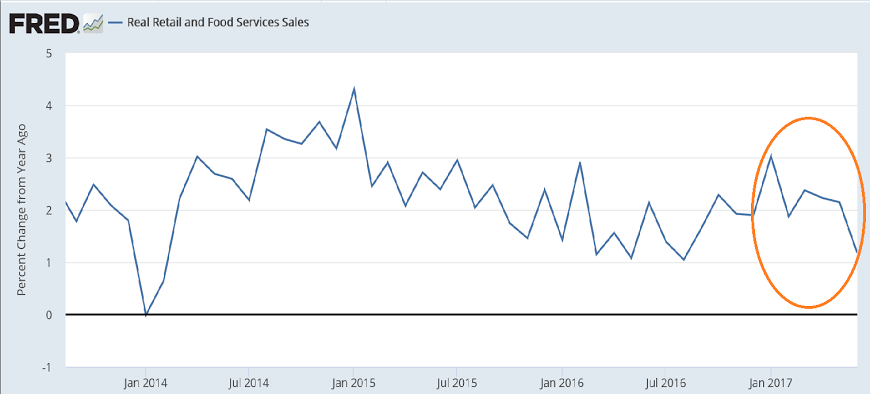

The savings rate has been down, and the personal income curve has been bent lower as well, and retail sales have also slowed.

So it can all be read this way:

The consumer has less real disposable income, has cut back on spending, and has been ‘forced’ to put some of that reduced spending on his credit card, though less than the prior month, which doesn’t bode well for future spending:

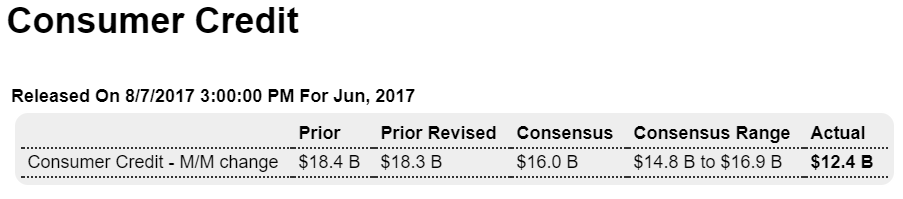

Highlights

Though growth in headline consumer credit, at $12.4 billion, came in lower than expected, the component for revolving credit posted another sizable increase, at $4.1 billion vs $6.9 billion in May. This component, which is where credit card debt is tracked, has been on the rise this year raising the question whether financial firms are beginning to lend to less qualified borrowers. Whether or not gains here are good for credit quality, they are a plus for short-term consumer spending. The soft headline in June is due to a lower-than-usual increase in non-revolving credit where growth, at $8.3 billion, is nevertheless substantial. Vehicle financing and student loans are tracked in non-revolving credit.

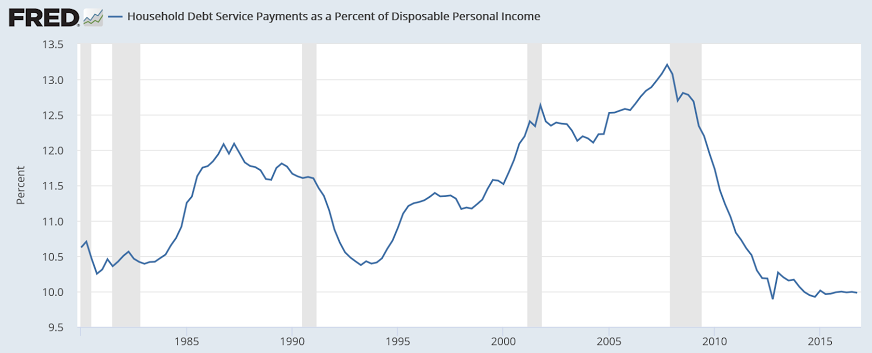

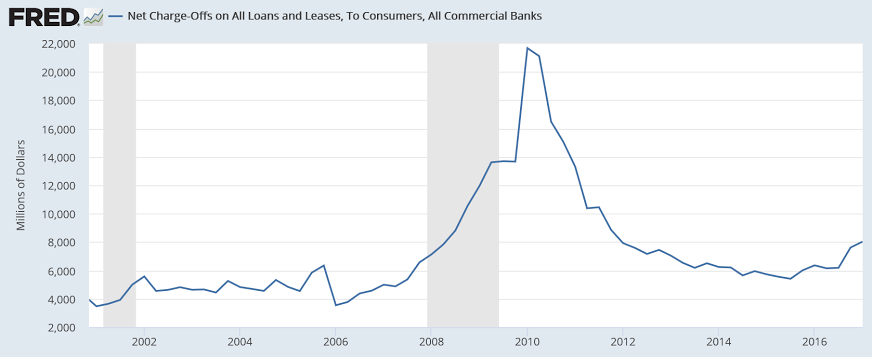

Debt service looks historically low so seems this isn’t what’s holding back the consumer: