From bad to much worse: Highlights Consumer credit rose a nearly as-expected .2 billion in February with January revised .1 billion higher to .9 billion. Revolving credit perked up with a .9 billion gain following January’s .6 billion decline. Nonrevolving credit, which includes vehicle financing and also student loans, rose .3 billion which is on the slow side for this reading. Credit growth isn’t robust but is steady and constructive for the economy. Analyst Opinion of the Consumer Credit Situation Not only does this data set suffer from backward revision (moderate to significant enough to change trends), but the use of compounding (projecting monthly change as annual change) by the Federal Reserve to determine consumer credit growth rates exaggerates the volatility in this data. The data in February was not significantly different than January’s – and consumer credit growth is around 6.4% year-over-year. the default rate of consumer loans is now growing year-over-year, that the amount of consumer credit outstanding relative to consumer expenditures is at all time highs, Household Debt Payments As A Percent of Disposable Income is near all time lows. Rail traffic seems to have bottomed and is now beginning to improve some from the lower levels: Rail Week Ending 01 April 2017: March Totals Up 5.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

From bad to much worse:

Highlights

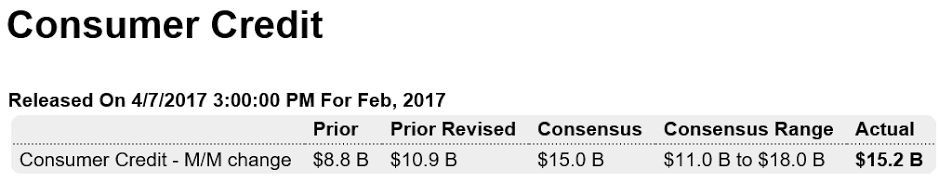

Consumer credit rose a nearly as-expected $15.2 billion in February with January revised $2.1 billion higher to $10.9 billion. Revolving credit perked up with a $2.9 billion gain following January’s $2.6 billion decline. Nonrevolving credit, which includes vehicle financing and also student loans, rose $12.3 billion which is on the slow side for this reading. Credit growth isn’t robust but is steady and constructive for the economy.

Analyst Opinion of the Consumer Credit Situation

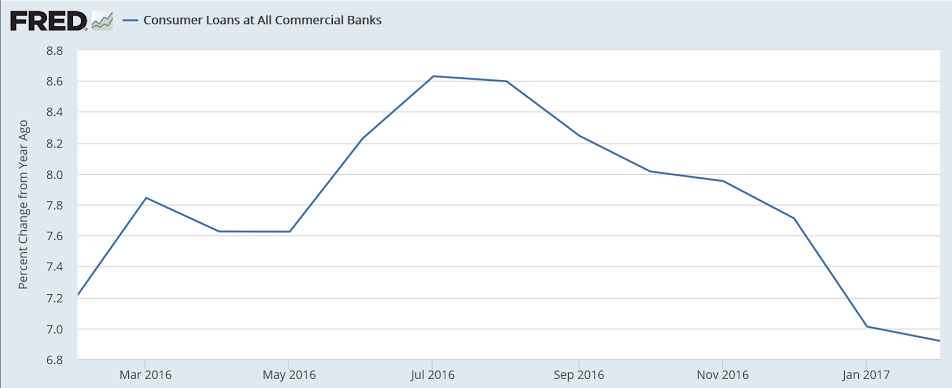

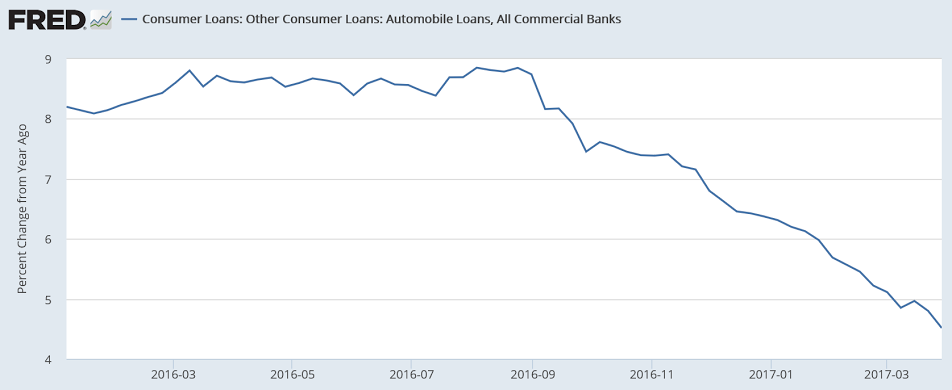

Not only does this data set suffer from backward revision (moderate to significant enough to change trends), but the use of compounding (projecting monthly change as annual change) by the Federal Reserve to determine consumer credit growth rates exaggerates the volatility in this data. The data in February was not significantly different than January’s – and consumer credit growth is around 6.4% year-over-year.

the default rate of consumer loans is now growing year-over-year, that the amount of consumer credit outstanding relative to consumer expenditures is at all time highs, Household Debt Payments As A Percent of Disposable Income is near all time lows.

Rail traffic seems to have bottomed and is now beginning to improve some from the lower levels:

Rail Week Ending 01 April 2017: March Totals Up 5.5% Year-over-Year

Week 13 of 2017 shows same week total rail traffic (from same week one year ago) improved according to the Association of American Railroads (AAR) traffic data. The data this year has big ups and downs but is now trending up.