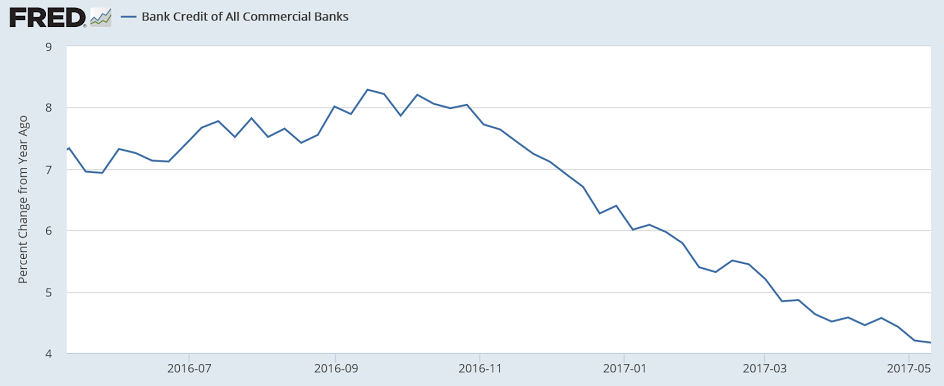

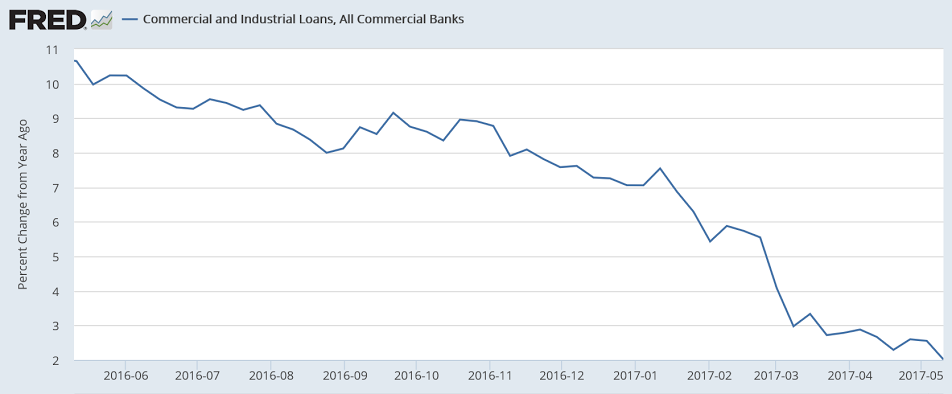

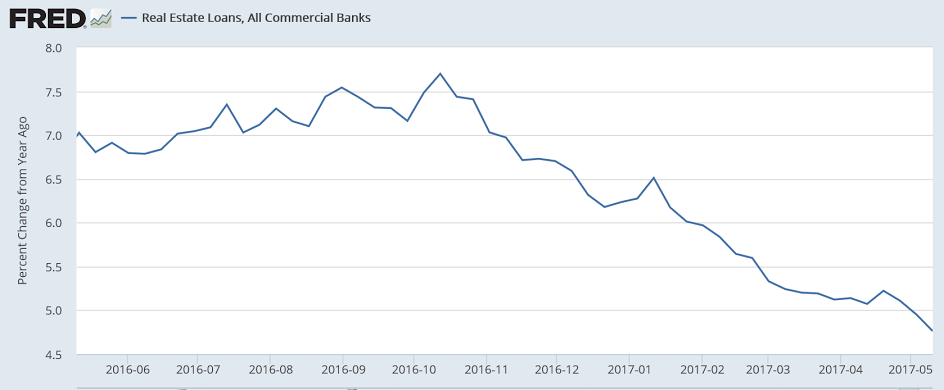

Going from bad to worse, so the way things are going seems the contribution to year over year GDP growth in q2 from credit expansion will be less than it was in q1: Never yet seen a current account surplus like this and a weak currency? (Euro area surplus = rest of world deficit, etc.) And the pressure has been building for over 3 years now as fear drivenportfolio selling, worked to keep the currency down:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

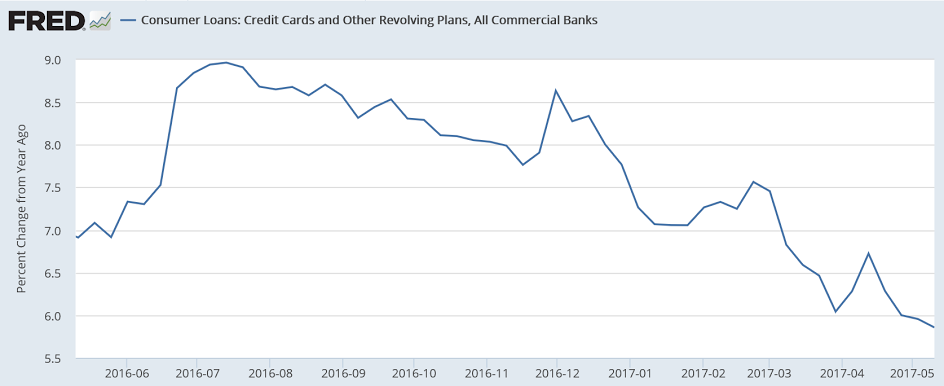

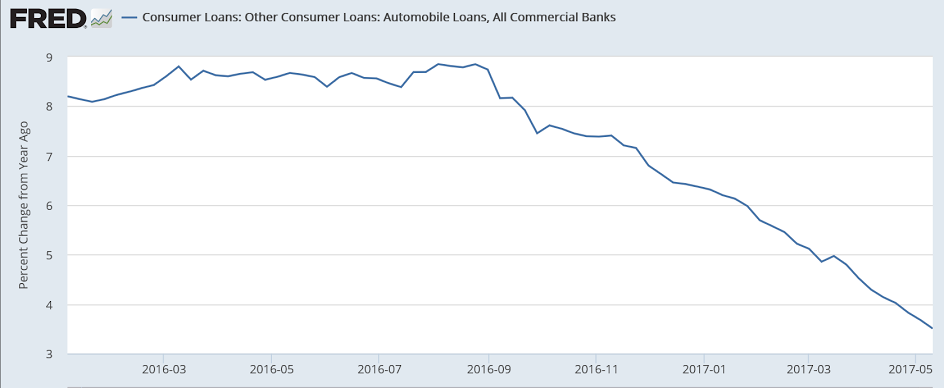

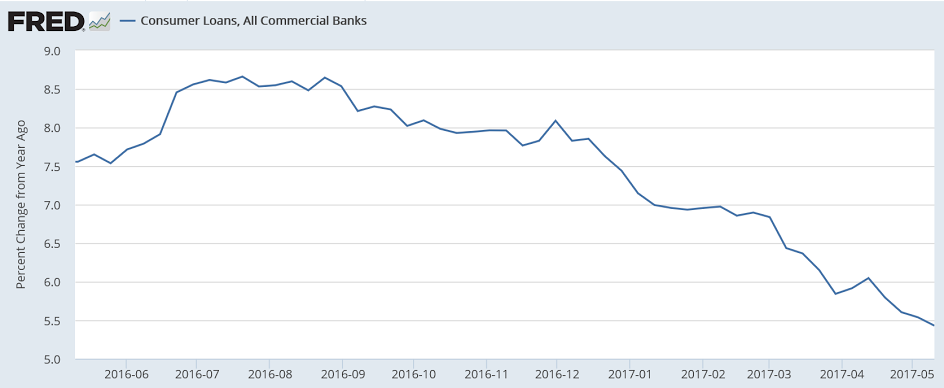

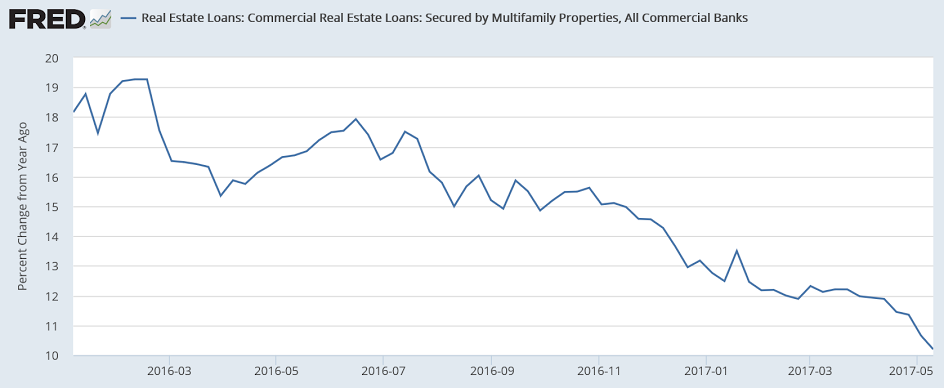

Going from bad to worse, so the way things are going seems the contribution to year over year GDP growth in q2 from credit expansion will be less than it was in q1:

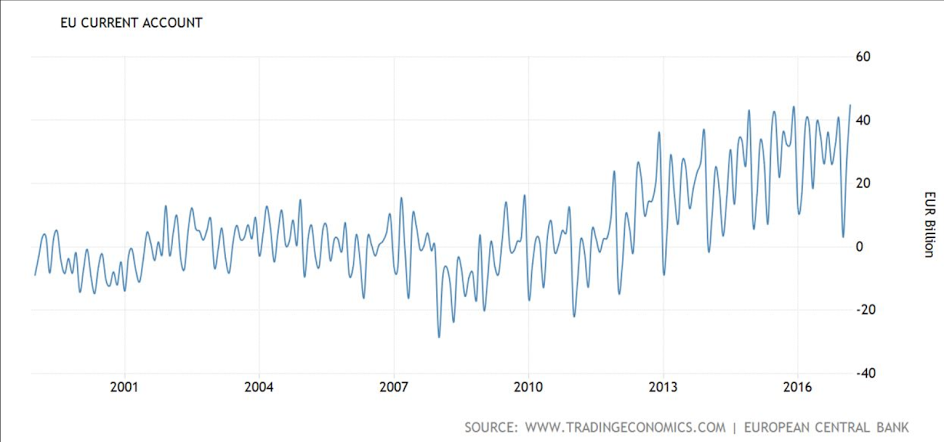

Never yet seen a current account surplus like this and a weak currency? (Euro area surplus = rest of world deficit, etc.) And the pressure has been building for over 3 years now as fear driven

portfolio selling, worked to keep the currency down: