Summary:

Still no sign of a rebound: Home prices rising about 6% annually and loans now growing at under 4% annually looks in line with at best flat housing sales: Looks like the blip up as hurricane destroyed vehicles were replaced has run its course: This had looked like it peaked a couple of years ago, but since went back up to new highs:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

Still no sign of a rebound: Home prices rising about 6% annually and loans now growing at under 4% annually looks in line with at best flat housing sales: Looks like the blip up as hurricane destroyed vehicles were replaced has run its course: This had looked like it peaked a couple of years ago, but since went back up to new highs:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

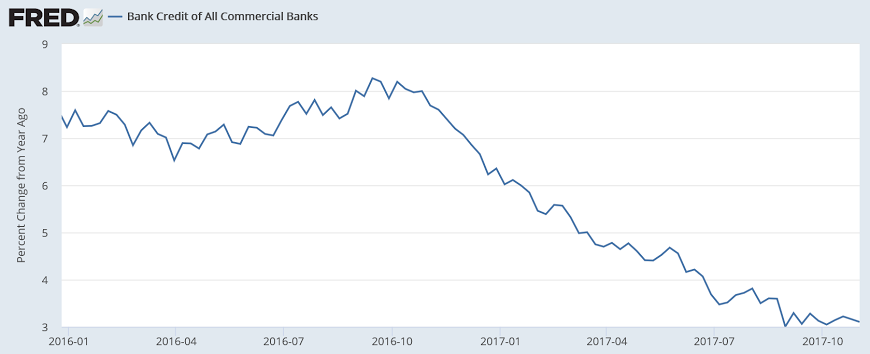

Still no sign of a rebound:

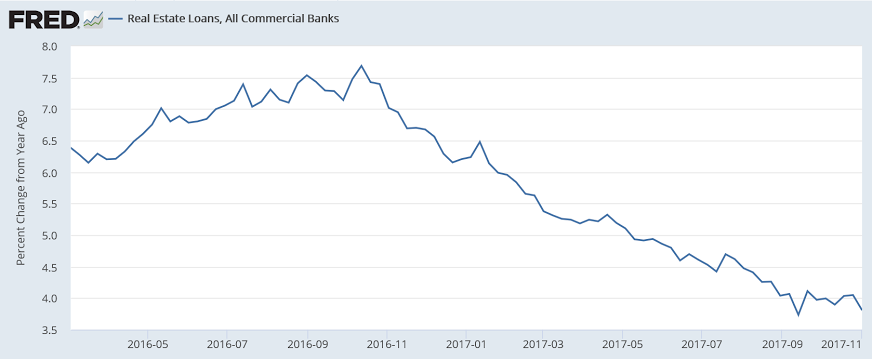

Home prices rising about 6% annually and loans now growing at under 4% annually looks in line with at best flat housing sales:

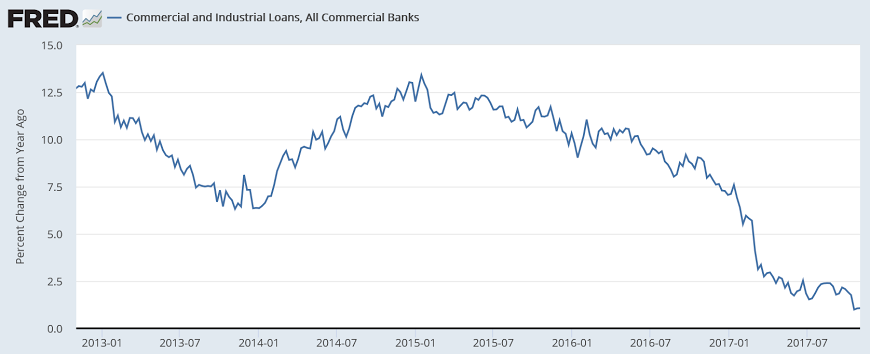

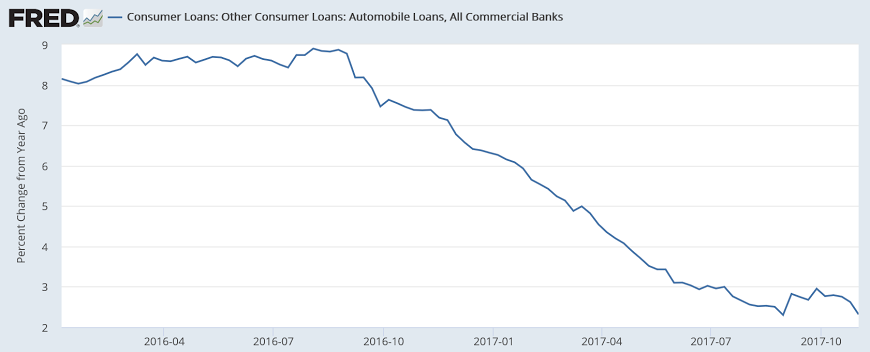

Looks like the blip up as hurricane destroyed vehicles were replaced has run its course:

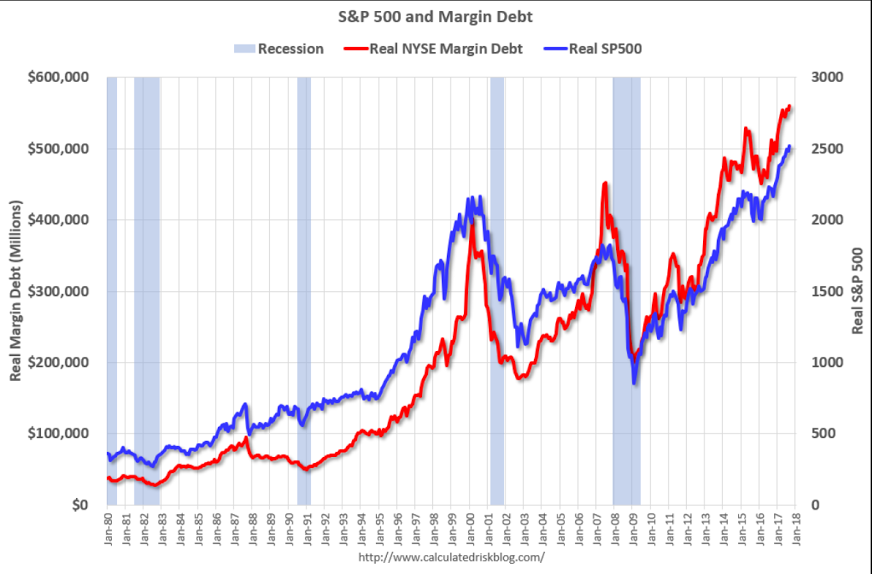

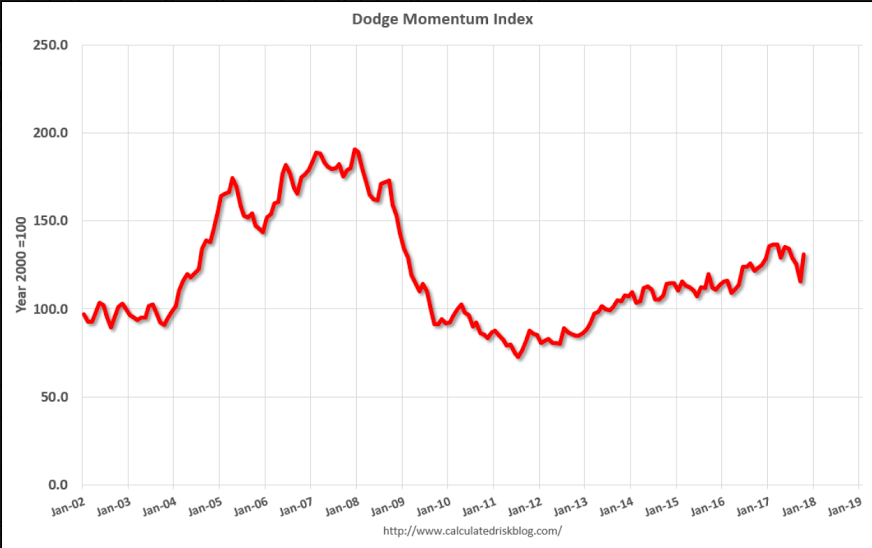

This had looked like it peaked a couple of years ago, but since went back up to new highs: