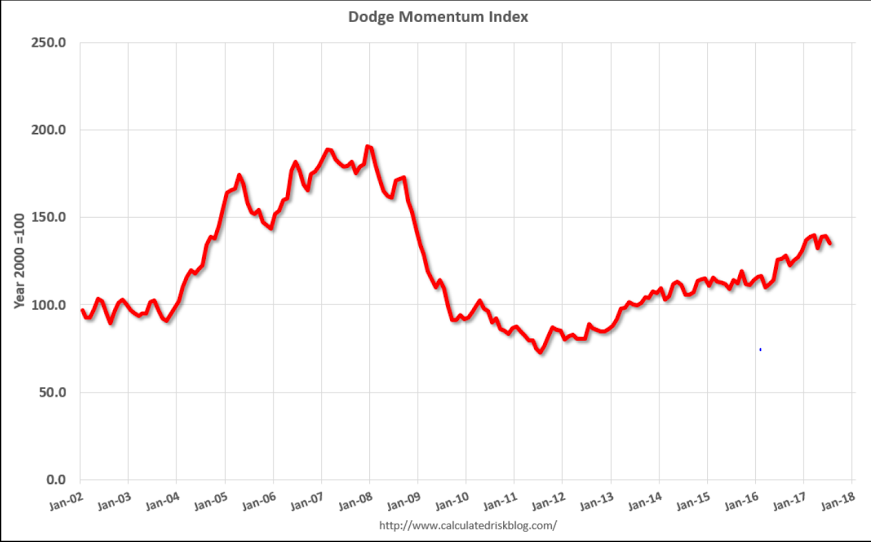

This is reflected in the deceleration of commercial real estate lending: From Dodge Data Analytics: Dodge Momentum Index Stumbles in July The Dodge Momentum Index fell in July, dropping 3.3% to 135.0 (2000=100) from its revised June reading of 139.6. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The move lower in July was due to a 6.6% decline in the institutional component of the Momentum Index, while the commercial component fell 1.1%.This month continues a recent trend of volatility in the Momentum Index where a string of gains is interrupted by a step backwards in planning intentions. Not just

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

This is reflected in the deceleration of commercial real estate lending:

From Dodge Data Analytics: Dodge Momentum Index Stumbles in July

The Dodge Momentum Index fell in July, dropping 3.3% to 135.0 (2000=100) from its revised June reading of 139.6. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The move lower in July was due to a 6.6% decline in the institutional component of the Momentum Index, while the commercial component fell 1.1%.This month continues a recent trend of volatility in the Momentum Index where a string of gains is interrupted by a step backwards in planning intentions.

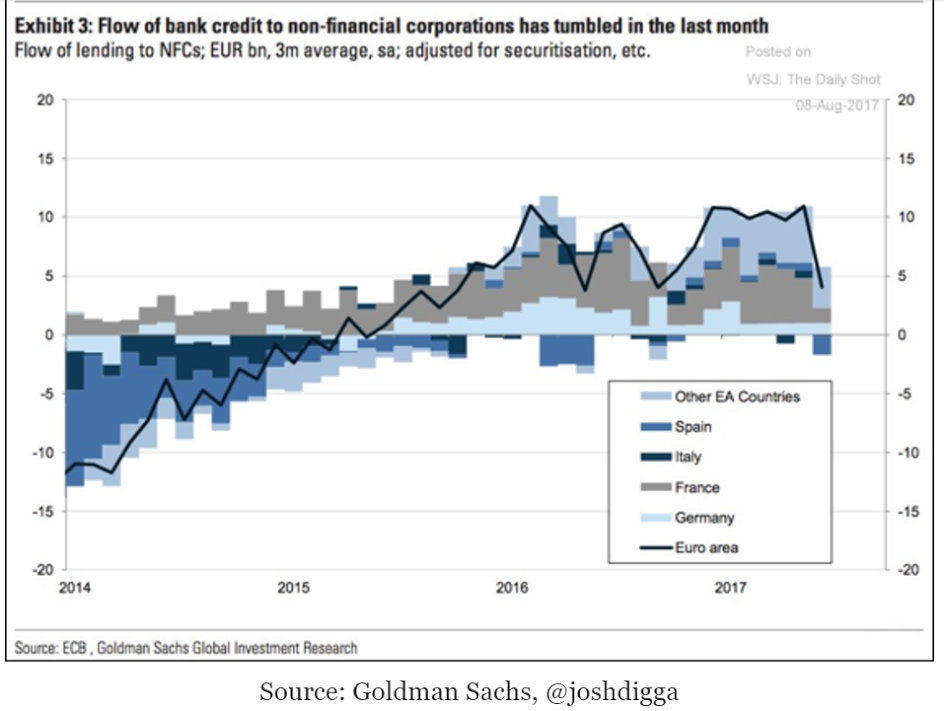

Not just the US!

This is slowing things down as well:

China’s capital controls apply brakes on ‘go out’ drive

Aug 9 (Nikkei) — China’s outbound direct investment plunged 46% on the year to $48.1 billion in the six months through June, trailing foreign direct investment of $65.6 billion. Foreign acquisitions, remittances, money exchanges and other outbound transactions of more than $5 million became subject to mandatory pre-screening by regulators starting last November. Regulators also said real estate, hotel, entertainment, film, sports club and other “irrational” overseas investments would be tightly monitored. In June it was learned Chinese bank regulators had told lenders to more strictly examine overseas investments by Dalian Wanda Group, HNA Group and three other major conglomerates.

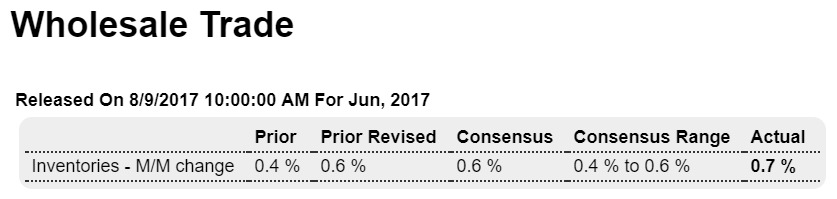

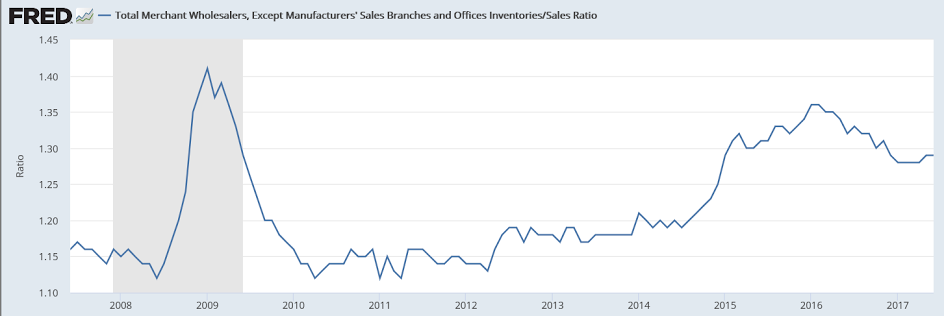

Good chance the inventories are ‘unwanted’ due to low sales as retail sales were a lot lower than expected:

Highlights

Wholesale inventories rose a sharp 0.7 percent in June in what was a wanted build given a likewise 0.7 percent rise in sales. The stock-to-sales ratio is unchanged at a lean 1.29. If there is an imbalance, it’s inventories of autos which rose 1.4 percent while sales fell 0.5 percent. Otherwise this a very positive report, pointing at the same time to sales growth and inventory growth.

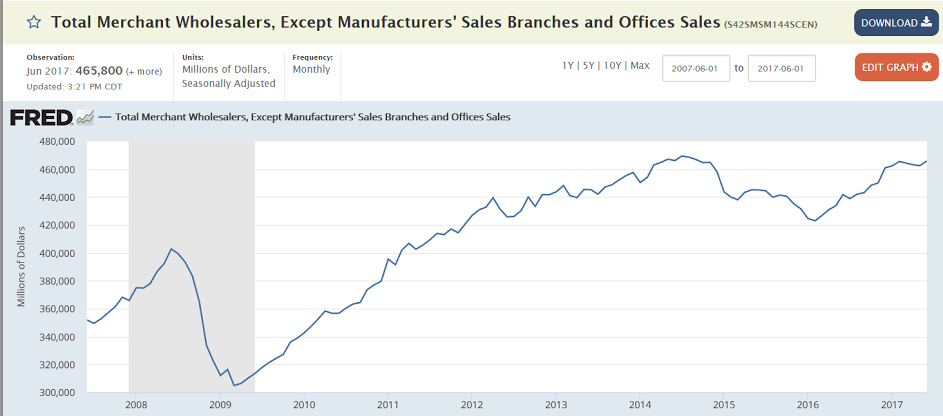

Inventories still look elevated to me:

This is the sales chart they think is so good- still short of 2014 levels and this chart isn’t adjusted for inflation: