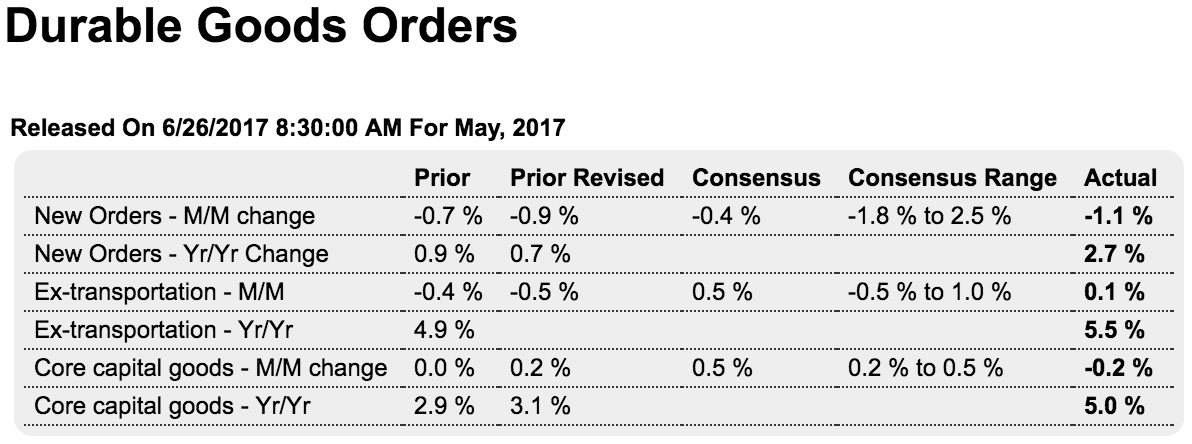

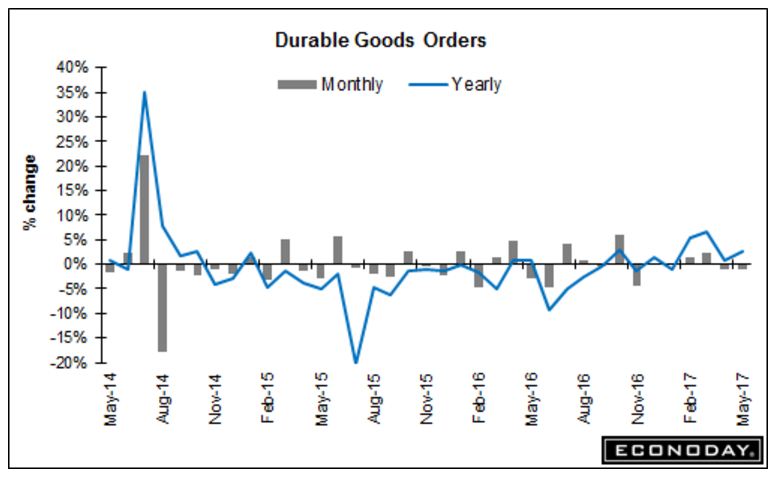

Worse than expected and prior month revised lower, but otherwise muddling through at modest rates of annual growth: Highlights Aircraft had been the strength but is now the weakness for durable goods which, pulled down by a second straight downswing for commercial aircraft, fell 1.1 percent in May. When excluding transportation, a reading that excludes aircraft, orders actually rose, but not very much at only 0.1 percent which falls 4 tenths shy of Econoday’s consensus. An unquestionable negative in the report is an unexpected 0.2 percent decline for core capital goods orders (nondefense excluding aircraft). Orders for commercial aircraft fell a rounded 12 percent for a second straight month with orders for defense aircraft, which are always volatile, also hurting May,

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Worse than expected and prior month revised lower, but otherwise muddling through at modest rates of annual growth:

Highlights

Aircraft had been the strength but is now the weakness for durable goods which, pulled down by a second straight downswing for commercial aircraft, fell 1.1 percent in May. When excluding transportation, a reading that excludes aircraft, orders actually rose, but not very much at only 0.1 percent which falls 4 tenths shy of Econoday’s consensus. An unquestionable negative in the report is an unexpected 0.2 percent decline for core capital goods orders (nondefense excluding aircraft).

Orders for commercial aircraft fell a rounded 12 percent for a second straight month with orders for defense aircraft, which are always volatile, also hurting May, down 31 percent. Shipments of core capital goods, like orders for this category, are another weakness in the report, down 0.2 percent and when combined with April’s tiny 0.1 percent gain, don’t point to any punch at all for business investment in second-quarter GDP.

But there are positives in the report including a solid 0.6 percent jump in machinery orders, a category that helped limit the monthly dip in capital goods. Vehicles are also a positive with a strong 1.2 percent gain that follows a 0.5 percent rise in the prior month. Shipments of vehicles are on a similar climb.

Other readings include a 0.8 percent gain in total shipments that follows, however, two prior declines and an unwanted 0.2 percent decline in total unfilled orders which is once again back in the contraction column. Inventories rose 0.2 percent which is about in line with the rate of general activity.

This report isn’t all bad but the capital goods readings are a tangible disappointment for the second-quarter outlook, pointing to lack of confidence in business prospects. The data contrast sharply with the ongoing strength in regional surveys. But in actual government data, the factory sector isn’t having a breakout year as some had hoped.

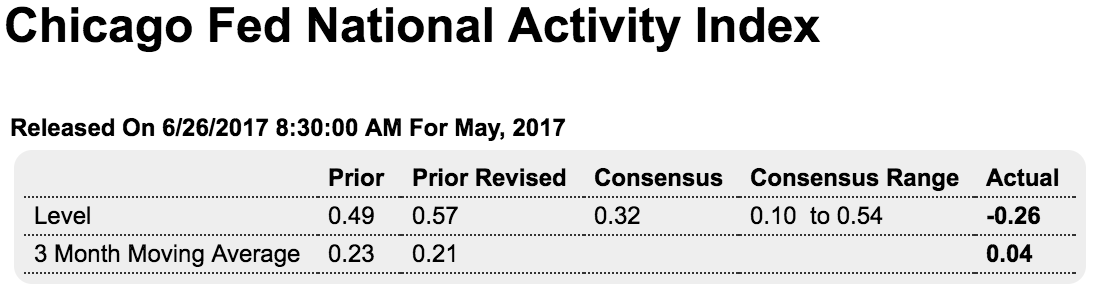

Also worse than expected:

Highlights

A decline in manufacturing production and weakness in employment combined to pull down the national activity index to minus 0.26 in May from a revised plus 0.57 in April. The production component fell to minus 0.16 from April’s 0.53 reflecting May’s 0.4 percent decline in manufacturing production. The employment component fell to minus 0.02 from 0.12 on a sharp drop in civilian employment in the household sample of the employment report and a modest slowing in payroll growth. The consumer & housing component is also a negative, at minus 0.09 from minus 0.07 and once again the result of weakness in housing permits. This report underscores how soft May really was for a second-quarter that looks increasingly at risk.

Also down a bit:

Highlights

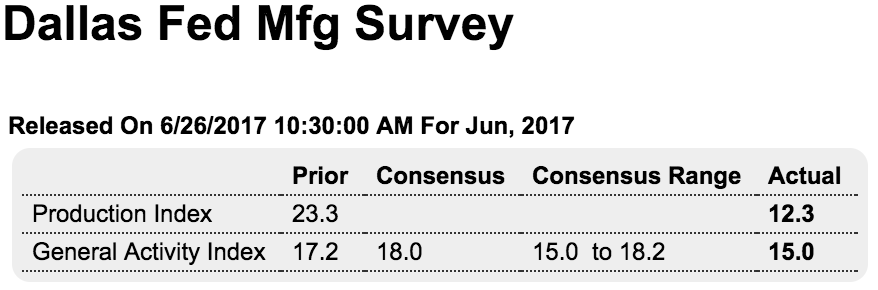

In an understandable slowing from unusual acceleration, the Dallas Fed’s general activity index slipped to 15.0 in June vs 17.2 in May. New orders have slowed to 9.6 from May’s 18.1 with unfilled orders moving to 1.3 from 8.1. The report underscores production as an important reading and here the story is the same, slowing to 12.3 from 23.3 in May.

Price data are steady with inputs continuing to show pressure, at 15.6, but selling prices lagging significantly, at 3.6. Employment data show continued pressure for wages & benefits, at 21.1 vs 24.3, with hiring positive at a 1.3 point gain to 9.6.

Though the general activity index is at its lowest level since November last year, cooling in this report is welcome given the unsustainable rates of growth in prior months. But with the price of oil on a severe downswing right now and testing the $40 area, future acceleration for this report may be limited.