Highlights The labor train is back on the tracks as nonfarm payrolls reversed the prior month’s weakness and came in on the high side of expectations, up 211,000 in April vs a revised 79,000 in March for the third 200,000 plus reading so far this year. Payroll gains are centered in business services, in what points to capacity constraints among employers, and also government which added 17,000 to April’s total. Strength in the labor market continues to pull down the unemployment rate which fell 1 tenth to 4.4 percent for the lowest reading since May 2001. This rate is derived from a separate set of data where the number for unemployed fell by 146,000. There were very few new entrants into the labor market during the month, squeezing what are already tight conditions and pulling down the pool of available workers to 12.8 million from 13.0 million. And the labor participation rate, despite gains in employment, is down 1 tenth to 62.9 percent. Tight conditions haven’t yet sparked much pressure in average hourly earnings which did rise a respectable 0.3 percent in the month though the year-on-year rate fell 1 tenth to a very soft 2.5 percent. How long wages can stay quiet given the lack of available labor is an open question.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Highlights

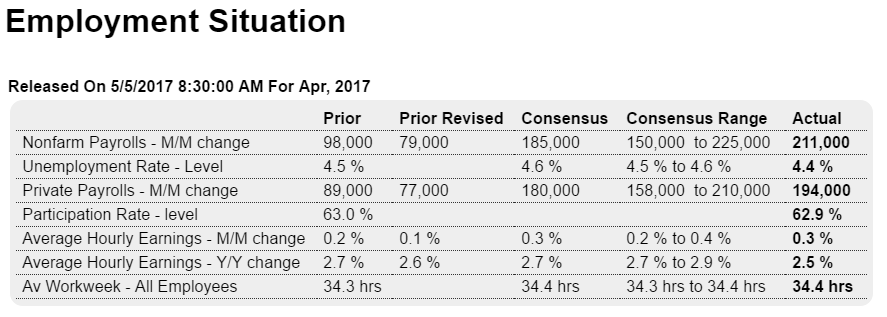

The labor train is back on the tracks as nonfarm payrolls reversed the prior month’s weakness and came in on the high side of expectations, up 211,000 in April vs a revised 79,000 in March for the third 200,000 plus reading so far this year. Payroll gains are centered in business services, in what points to capacity constraints among employers, and also government which added 17,000 to April’s total.

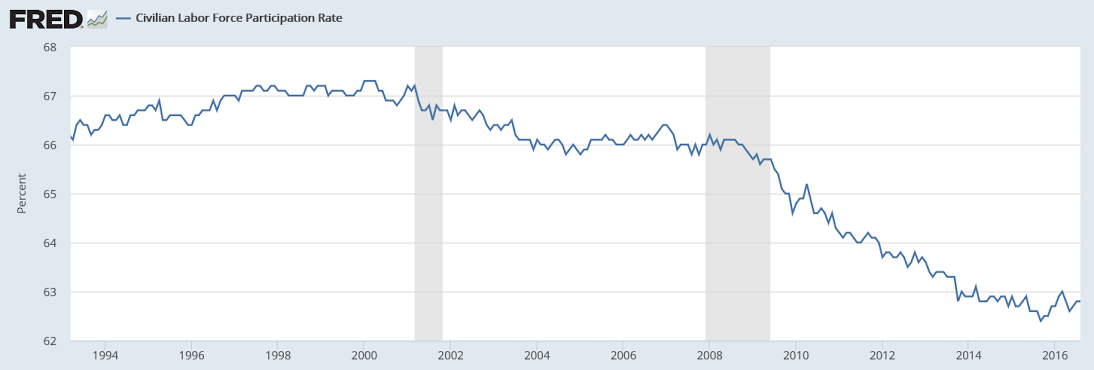

Strength in the labor market continues to pull down the unemployment rate which fell 1 tenth to 4.4 percent for the lowest reading since May 2001. This rate is derived from a separate set of data where the number for unemployed fell by 146,000. There were very few new entrants into the labor market during the month, squeezing what are already tight conditions and pulling down the pool of available workers to 12.8 million from 13.0 million. And the labor participation rate, despite gains in employment, is down 1 tenth to 62.9 percent.

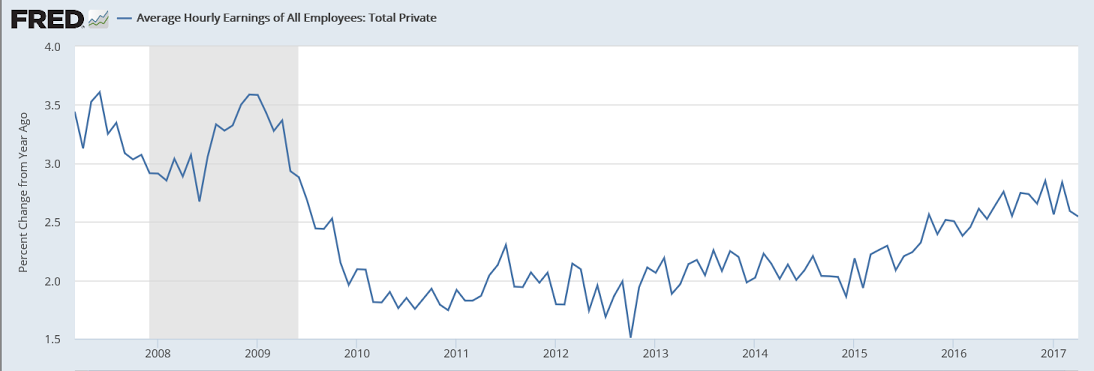

Tight conditions haven’t yet sparked much pressure in average hourly earnings which did rise a respectable 0.3 percent in the month though the year-on-year rate fell 1 tenth to a very soft 2.5 percent. How long wages can stay quiet given the lack of available labor is an open question.

The first quarter was unusually weak for the economy and today’s report marks an important start for what will hopefully be a much stronger second quarter. But very sizable payroll growth in January and February (at 216,000 and 232,000) failed to give any lift to the consumer who, when it came to spending, retrenched in the first quarter. Still, this report is an unquestionable plus that suggests prior weakness may very well have been, as the FOMC argued in Wednesday’s statement, no more than “transitory”.

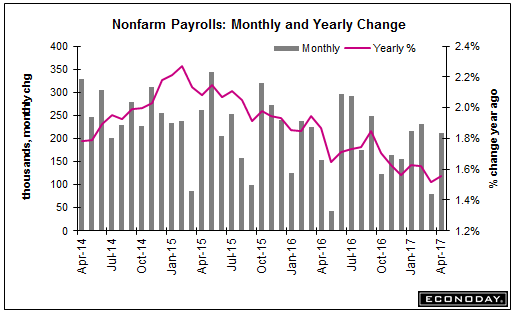

There has been a continuous deceleration since late 2014 when oil capex collapsed, and they take that last zig up from last month’s report, which could well be revised lower as was last month’s report, and proclaim things are moving back up!

No sign of ‘tightness in the labor markets’ here:

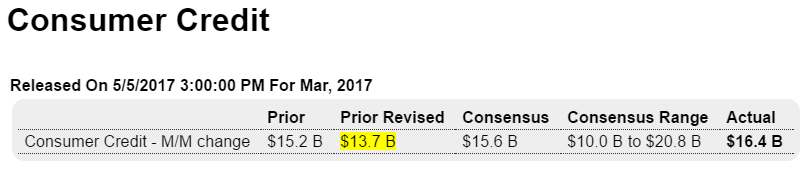

May 5, 2017: Highlights

The FRBNY Staff Nowcast stands at 1.8% for 2017:Q2. News from this week’s data releases reduced the nowcast for Q2 by 0.5 percentage point. Negative surprises from the ISM manufacturing survey as well as import and export data were only partly offset by positive surprises from the employment report.

No burst of activity here: