These spiked up with the Presidential election and are only slowly coming back down: Muddling through at just over a 2% annual rate, but q2 looking weaker than q1: Highlights Forget about all the strength in the low sample-sized regional reports. Government data are not pointing to strength at all as manufacturing readings in the May industrial production report are a matter of concern. Industrial production could manage no better than an unchanged reading in May while the manufacturing component fell 0.4 percent. Both are lower than expected with manufacturing below Econoday’s low estimate. Vehicle production fell sharply in the month, down 2.0 percent in a reminder that consumer spending on autos has been very weak this year. And in a reminder of how weak capital goods

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

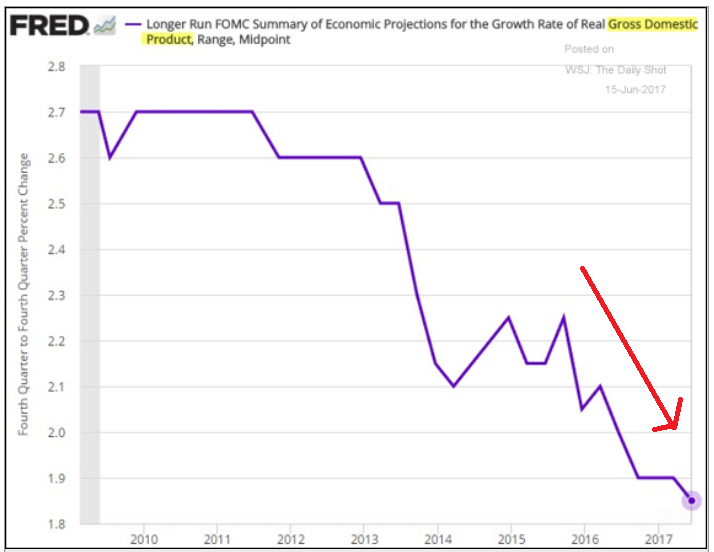

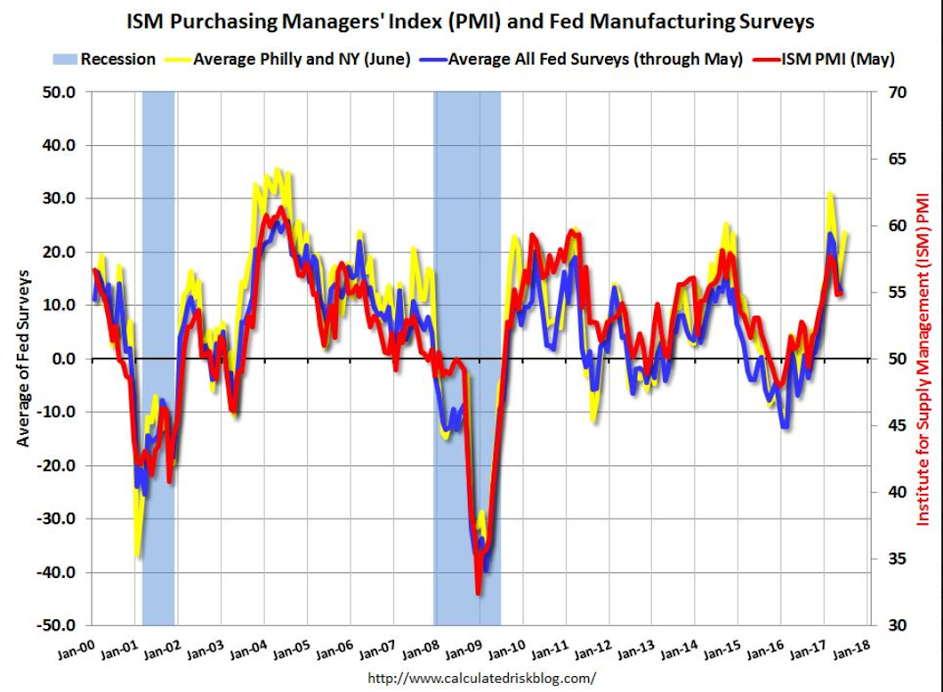

These spiked up with the Presidential election and are only slowly coming back down:

Muddling through at just over a 2% annual rate, but q2 looking weaker than q1:

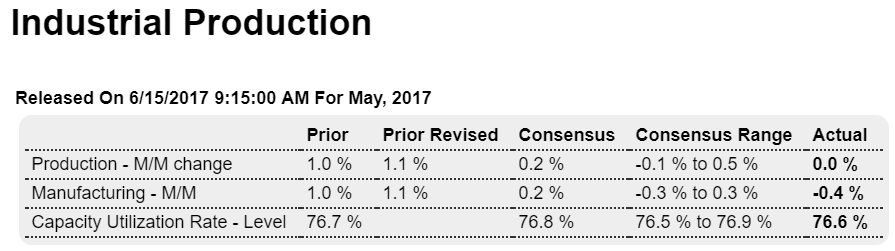

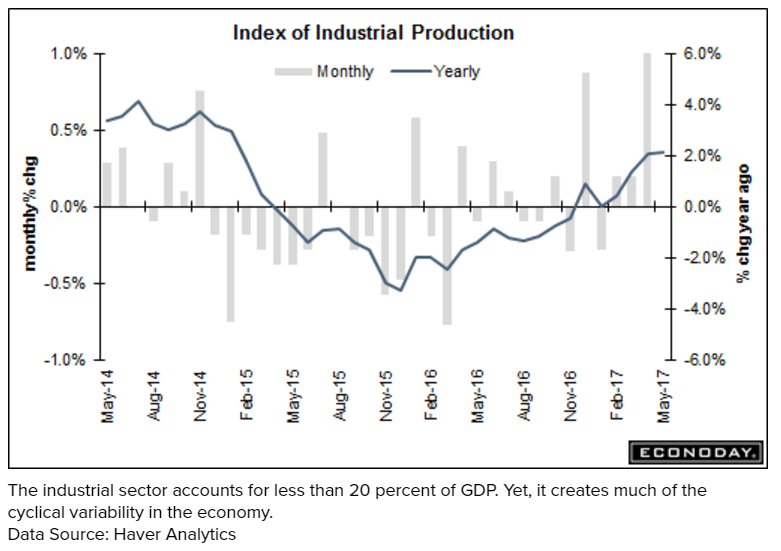

Highlights

Forget about all the strength in the low sample-sized regional reports. Government data are not pointing to strength at all as manufacturing readings in the May industrial production report are a matter of concern.

Industrial production could manage no better than an unchanged reading in May while the manufacturing component fell 0.4 percent. Both are lower than expected with manufacturing below Econoday’s low estimate.

Vehicle production fell sharply in the month, down 2.0 percent in a reminder that consumer spending on autos has been very weak this year. And in a reminder of how weak capital goods data have been, production of business equipment fell 0.7 percent. Hi-tech goods, in yet further confirmation of trouble, were unchanged in the month.

The mining component is a positive in this report, up 1.6 percent for a second straight strong gain, with the utilities component also positive, at plus 0.4 percent.

But manufacturing makes up the vast bulk of the nation’s industrial sector and today’s report makes April’s strength look very isolated. This report is bad news for durables data yet to be released not to mention factory payrolls.

Note that traditional non-NAICS numbers for industrial production may differ marginally from NAICS basis figures.

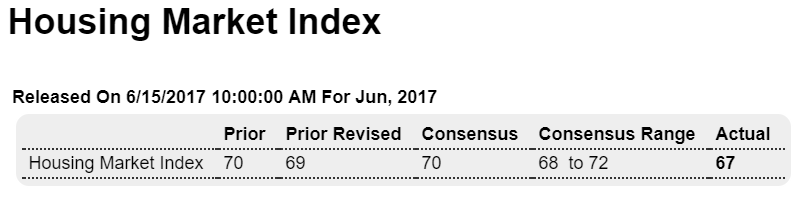

Housing is sagging in line with sagging bank real estate lending:

Highlights

Home builders have been very optimistic this year but are a little less upbeat this month. The housing market index slipped to 67 in June, down 2 points from a downward revised 69 in May and just below Econoday’s low estimate. But expectations for future sales, at 76, remain unusually strong with current sales also unusually strong at 73. The one component, however, that had been coming to life is back below 50 as traffic fell 2 points to 49. Lack of traffic, and here the emphasis is on first-time buyers, does not point to renewed strength for home sales data which started the year very strong but have since slowed. Regional data are very solid with the West, Midwest, and South all clumped near composite scores of 70 while the Northeast continues to lag in the distance at 46. Watch for housing starts on tomorrow’s calendar where snap-back strength is the call.

This is part of the reason the Fed hiked rates…

;)